Morning,

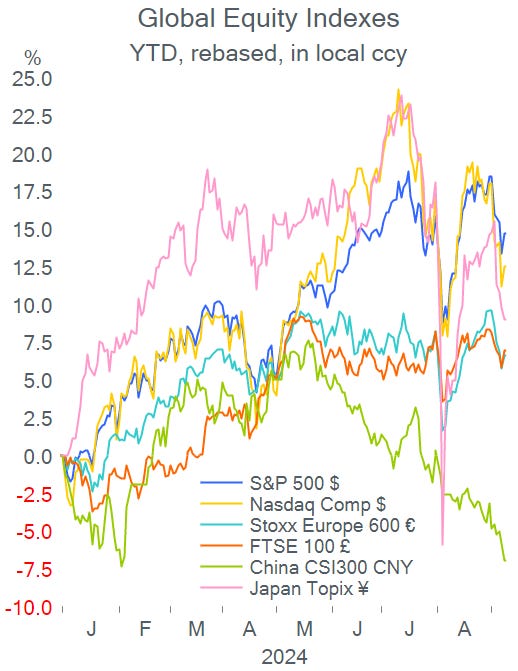

There were no clear catalysts for Wall Street’s partial recovery on Monday from last week’s selloff as indices finished firmer by more than 1%, in line with European benchmarks, ahead of tomorrow's key U.S. inflation report.

There were no significant single stock movers in the U.S. besides Palantir Technologies (mcap $77bn) with a 14% rally on the back of its inclusion in the S&P 500 index. Dell Technologies (mcap $75bn) will also be added to the benchmark and shares gained nearly 4%.

In earnings reports, software giant Oracle (mcap $385bn, P/E 38x) beat sales ($13.3bn, +8% YoY) and profit ($2.93bn, +22% YoY) estimates after the close and shares rallied 9% in extended trading. Oracle is trading near its all-time high following this year’s 34% gain.

In corporate news, Apple held its annual product launch with a focus on the iPhone 16, a new smartwatch and earphone and their “not so ready” artificial intelligence features. Shares barely moved ($220.9).

Interest rate markets had a quiet day with benchmark yields closing little changed. 10-yr Treasuries yield 3.70%, Bunds 2.17% and Gilts 3.86%.

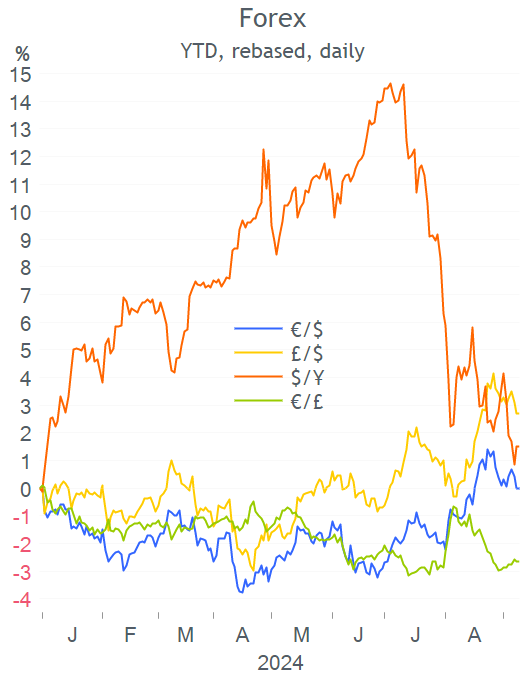

The $ appreciated and is now flat against the € year-to-date. Sterling became the best performer in 2024 with a 2.7% gain against the $, following cable’s rally during August. Bitcoin and Ethereum advanced 8%, reducing last week’s steep decline.

Mario Draghi, the former ECB President and Italian prime minister presented his research on the EU’s competitive outlook and the warning was alarming. Either the €-bloc invests heavily (5% of GDP per year) or it faces a slow agony as it loses against the U.S. and China.

In M&A, Canadian methanol producer Methanex (mcap $2.6bn) plans to acquire the methanol division of OCI Global of The Netherlands for €1.8bn in a share and cash deal.

In IPOs, U.S. private equity firm Lone Star is considering a sale or listing of its Novo Banco in Portugal with an estimated valuation of €5bn.

Privately-held Swedish battery maker Northvolt AB announced layoffs and divestments as it faces serious financial deterioration.

In credit ratings, Turkey’s sovereign rating was u/g one notch by Fitch to BB- last Friday.

Monday was an active day for new corporate bond issues in € with British Petroleum (7-yr), Portugal’s EDP (30-yr) and Compass Group (9-yr) placing senior bonds.

In data today, we’ll get employment figures in the U.K. and inflation updates in Germany, The Netherlands, Norway, Denmark and Greece.

Asian markets are trading mixed overnight while European equity futures are marginally down and the FTSE and Nasdaq 100 pointing to a weaker open. Chinese trade figures for August were released this morning with exports advancing 8.7% YoY, faster than expected while imports decelerated sharply to +0.5% YoY. Mainland stocks are dropping ~ 0.5%. The biotech sector is underperforming after the U.S. passed a bill aimed at limiting their funding and operations in the country.

Finally, the first debate between Kamala Harris and Donald Trump will take place tonight in Philadelphia.

See you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.