Morning,

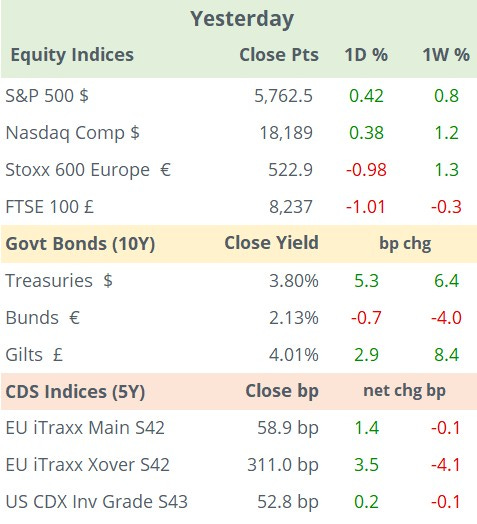

Monday’s highlight in global markets was China’s 8.5% equity rally, the best day in 16 yrs as Beijing’s large monetary and fiscal stimulus package triggered domestic and foreign demand. The CSI300 index went from being one of the worst performers this year to a 17% YTD gain in just a week, outperforming the broad European market and not far from the S&P 500’s 21% return, in local currency terms. The yuan is 1% stronger in 2024. It’s a holiday in China, Hong Kong and Korea today.

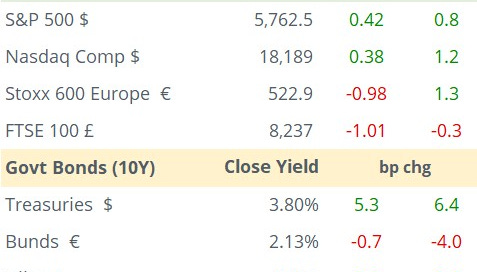

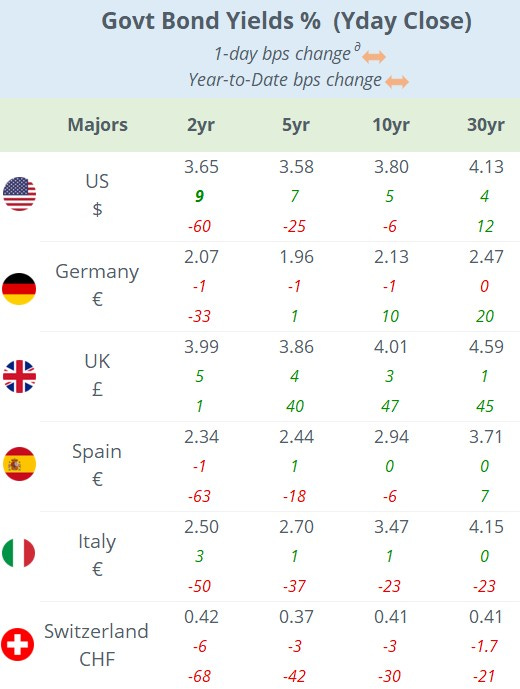

European equities fell more than 1% yesterday. The focus was on the weakness in the autos sector following a profit warning by Stellantis (mcap €36bn) which adds to the recent cautions issued by VW and BMW on slowing growth and competition from China. Stellantis shares plunged 15% yesterday and are 41% lower YTD. Aston Martin Lagonda (mcap £1bn) plummeted 25% on Monday after cutting its production outlook due to supply chain issues. Autos is the worst European sector this year with a 9% decline.

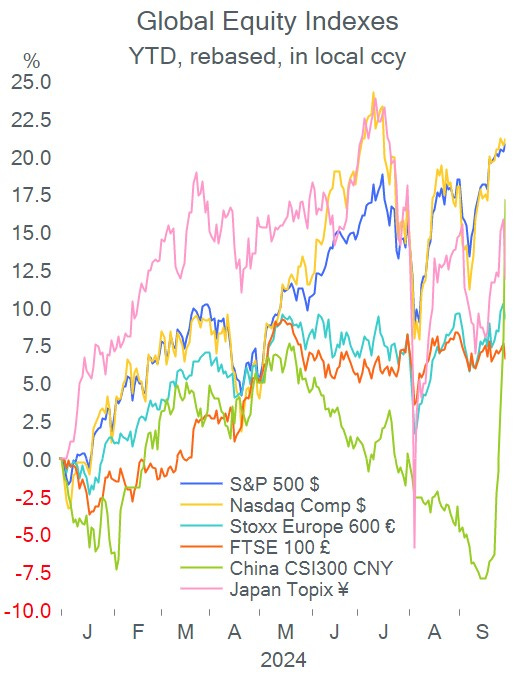

In September, the Stoxx 600 finished flat for the month vs a 2.2% gain for the S&P 500 (its fifth positive month), the DXY index lost 1% MTD and Brent oil plunged 9%. In rate markets, 10-yr US Treasury yields fell 11bp (fifth consecutive mth of decline), Bund yields dropped 16bp and Gilts ended the month unch.

In economics, inflation (HICP) in Germany for September eased to 1.8%, slightly better than estimates and the lowest in three years, and Italian inflation also fell to 0.8%.

Headlines:

- Israel has begun "targeted ground raids" against Hizbollah in Lebanon. (BBG)

-Austrian politicians begin coalition talks following the far-right’s win on Sunday. (FT)

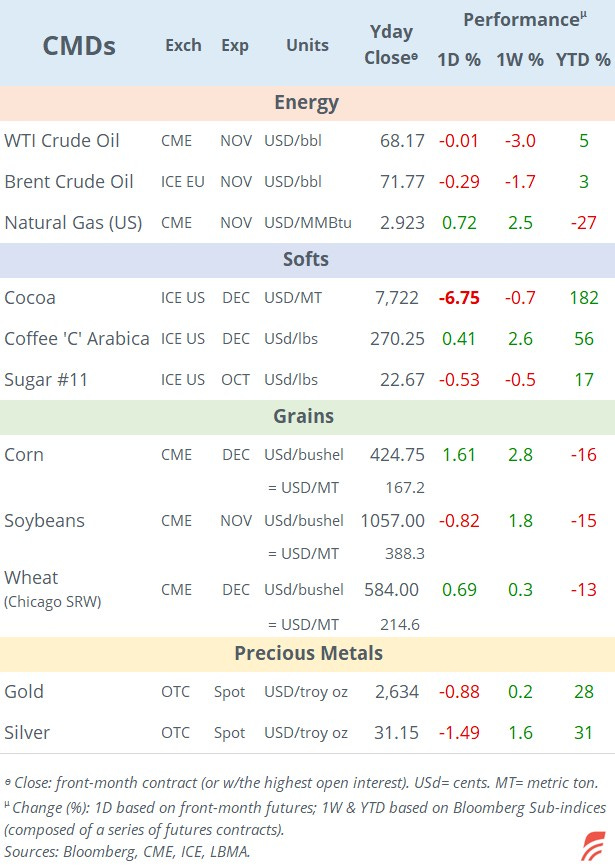

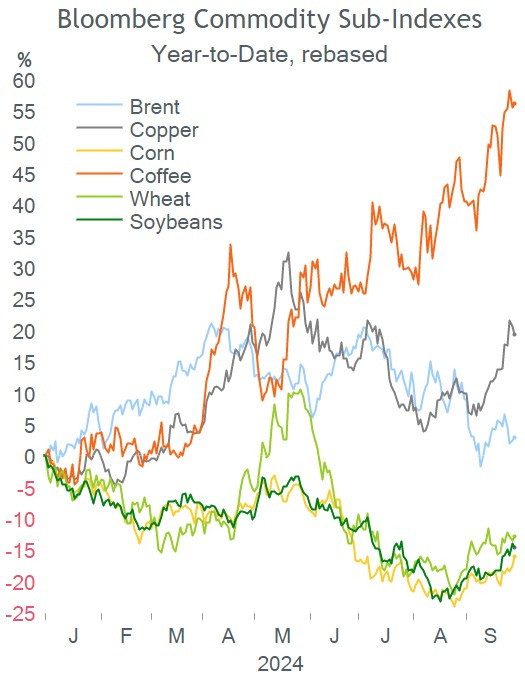

-Iron ore prices jumped 11% yesterday, driven by China’s stimulus measures. Copper miners warned of price volatility risks on the back of supply shortages. Copper rallied 10% in September to $9,830.

In central bank action, Colombia cut its policy rate by 50bp to 10.25% on Monday, as expected. Headline inflation is running at 6.12%, the lowest since March 2022. The currency (COP) depreciated 8% YTD.

Corporate deals: AT&T (mcap $158bn) is selling its entire 70% stake in DirecTV to TPG for $7.6bn. TPG already owns 30% of the satellite TV provider. AT&T will focus on its core wireless and fibre connectivity businesses. (Reuters)

In private markets, start-up OpenAI is targeting a $150bn valuation in its latest funding round that includes interest from Softbank for $500mn. (FT)

In debt primary markets, the notable corporate issuer was Dutch private electric utility Alliander placing €750mn of senior bonds, rated Aa3/A+, at 98bp over Bunds or a 3.11% yield.

Credit rating changes yesterday: Estee Lauder Companies (mcap $36bn) was d/g one notch by Moody’s to A2.

Economic data today: €-zone inflation (a drop to 1.8% exp); Mfg PMIs in developed countries; retail sales in Switzerland and the Netherlands; unemployment in Austria, Portugal and Greece.

Earnings reports today: Nike (mcap $132bn) after the market close.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.