Script: Estimated reading time ⏲ ~4 mins

Good morning,

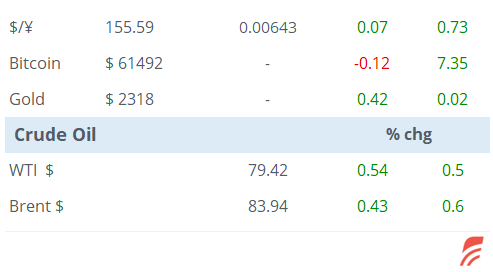

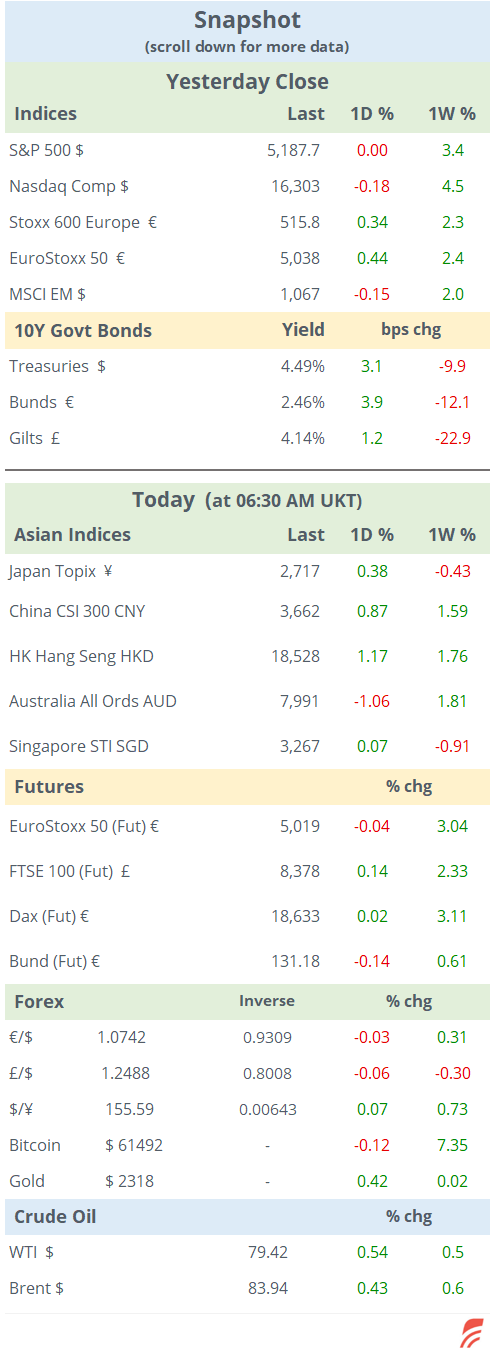

Asian markets are trading mixed today with Chinese stocks outperforming (+1.2%) after Beijing reported strong trade figures. Imports rose by 8.4% YoY, double what analysts expected while exports remained steady at +1.5% YoY, signalling a recovery in domestic and foreign demand. Korean and Australian stocks are declining by around 1%.

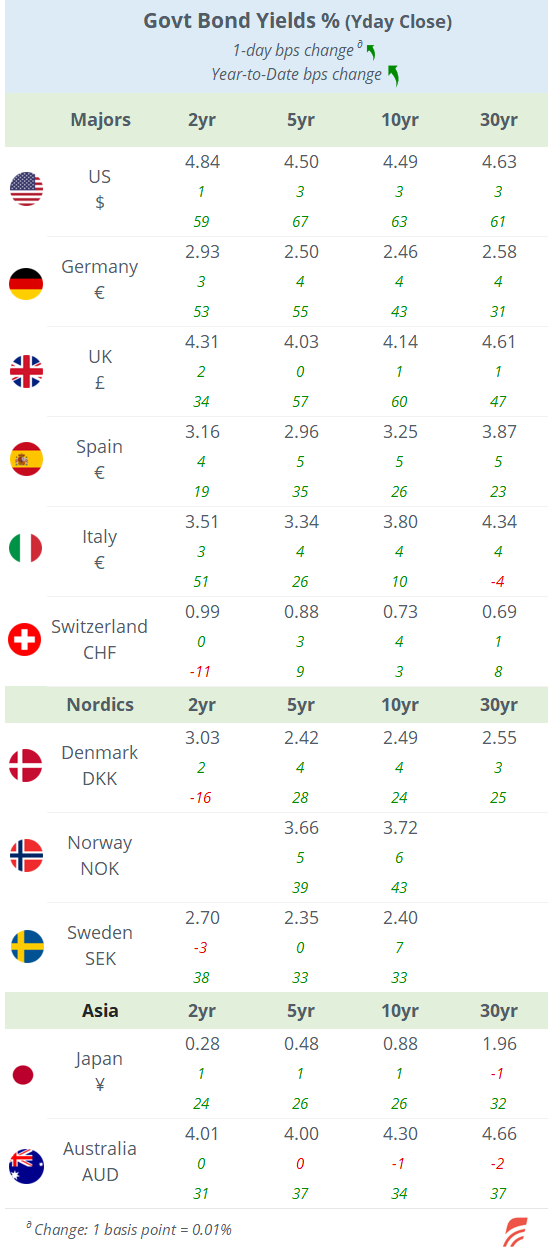

Wall Street ended flat last night with the blue-chip Dow Jones Industrials as the only notable index mover, accumulating six sessions of gains. Interest rate and currency markets had a relatively quiet day with yields moving higher by a few basis points across regions.

Biden warned Netanyahu that the US would stop supplying certain types of weapons if Israel proceeded with a large-scale invasion of Rafah in the south of Gaza. Washington is Israel's largest supplier of weapons and has already delayed the shipment of bombs in an attempt to de-escalate the conflict.

It was a positive day for European companies reporting with Inbev, Siemens Energy, Puma, Ahold and Leonardo all showing solid results. On the other hand, BMW disappointed on margin estimates and shares dropped 3%.

Shares of French train manufacturer Alstom jumped 9% yesterday to the highest level since its cash flow warning last October. It beat revenue but missed profit estimates and announced plans for a €1bn rights issue to reduce debt and avoid a credit downgrade. Its two largest shareholders said they will participate. The stock is +41% YTD to a market cap of €6.6bn.

In the US, Airbnb reported after the market close, beating estimates on higher travel demand but missed revenue guidance for Q2, sending shares down by 6% in after-hours trading. It made $264mn (+125% YoY) on $2.1bn in sales (+18% YoY) in Q1. The company is valued at $100bn.

Sweden’s central bank cut its policy rate by 25bp to 3.75%, its first easing measure since 2016 and signalled two more cuts by year-end subject to inflation data. Also, Brazil cut its benchmark Selic interest rate by 25 bp as expected to 10.5%, the lowest level since early 2022. The central bank sees inflation at 3.8% this year.

There were two Fed policymakers, Barkin and Collins, who made similar remarks regarding a needed slowdown in the US economy for inflation to reach the Fed’s 2% target.

In corporate deals, Brazilian pulp and paper company Suzano made an approach to International Paper of the US for a potential acquisition worth $15bn. International Paper is in the process of acquiring British packaging company DS Smith for $7.2bn.

In debt markets, Moody’s upgraded UBS’s credit rating by one notch to Aa2 and updated all the Credit Suisse entities absorbed by UBS to the same level.

In the new issue market, Coca-Cola continued raising funds via Euro-denominated senior bonds, rated A+. A 2032 priced at 85bp over Bunds or a 3.21% yield and a 2044 at 97bp over or 3.56%. Also, Italian oil & gas ENI issued 10 and 30-year dollar bonds rated A-.

Today’s key data will come at 1 PM London time with the Bank of England monetary policy announcement, with consensus expecting the base rate to remain steady at 5.25%. We’ll also get inflation in Ireland. Finally, Italian utility Enel reports today.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Please share the publication using the button below, as access is free to all.