Morning,

The unwinding of the yen carry trade, one of the most widely replicated strategies in the past decade, continues to impact market dynamics as only a portion of the trades has been closed. The enormous amount of Japanese currency used to finance positions in higher-yielding currencies as well as equities and even real estate, has placed the Bank of Japan in the spotlight as any hawkish signal could trigger further volatility. The central bank said today that it is monitoring the situation but had no planned action and traders are anticipating a pause at the next meeting.

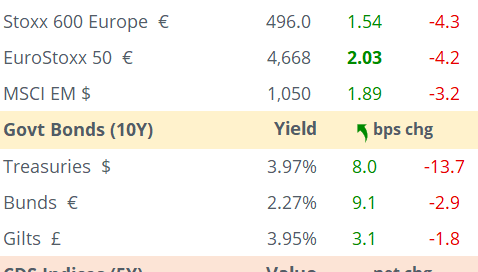

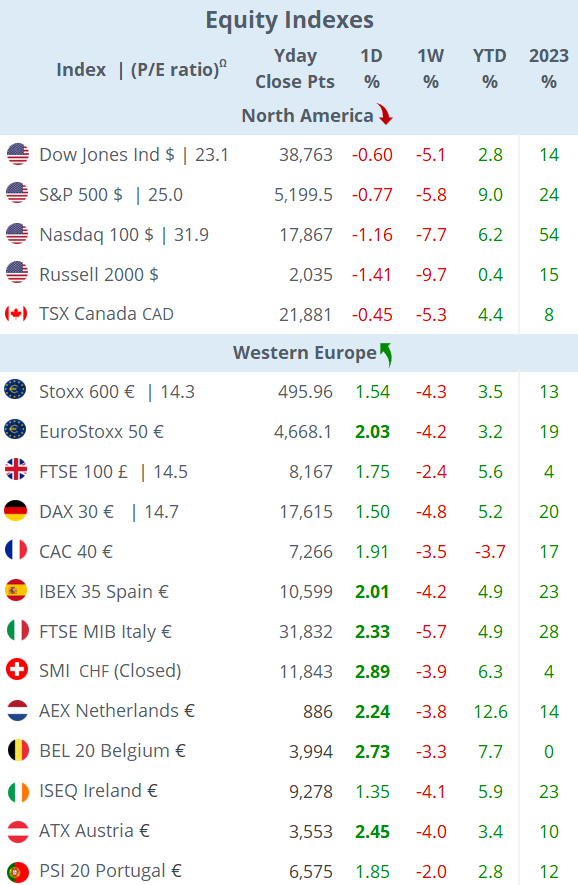

In European markets, oil & gas and bank stocks helped benchmarks finish 2% higher despite a nearly 7% plunge for the region’s largest company. Every country index gained except for Denmark’s which fell 3.8%. Pharma giant Novo Nordisk (mcap €377bn) had its worst day in two years and fell to its lowest level in six months after missing earnings (€2.7bn) estimates and cutting its profit outlook. Novo reported lower sales for its popular weight-loss drug Wegovy as it faces increasing competition.

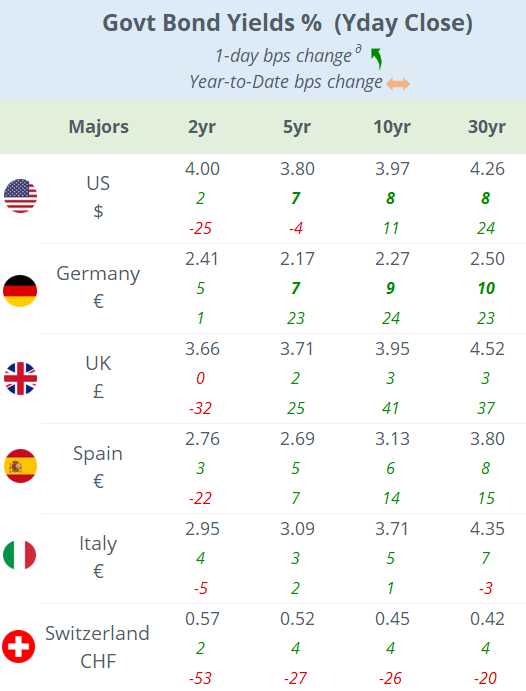

Stocks in Wall Street declined towards the end of the session driven by weakness in the tech sector with giant chip makers Nvidia and Broadcom as well as Tesla and Disney, losing around 5%. Every leading index ended lower with the Nasdaq 100 and small-cap Russell 2000 dropping >1%. Poor investor demand on a 10-year US Treasury auction also weighed on sentiment as yields rose across tenors with 10-year yields adding 8bp to 3.97% as demand for safe assets decelerated. Additionally, JP Morgan increased its probability of a recession by year-end to 35% from 25% only five weeks ago.

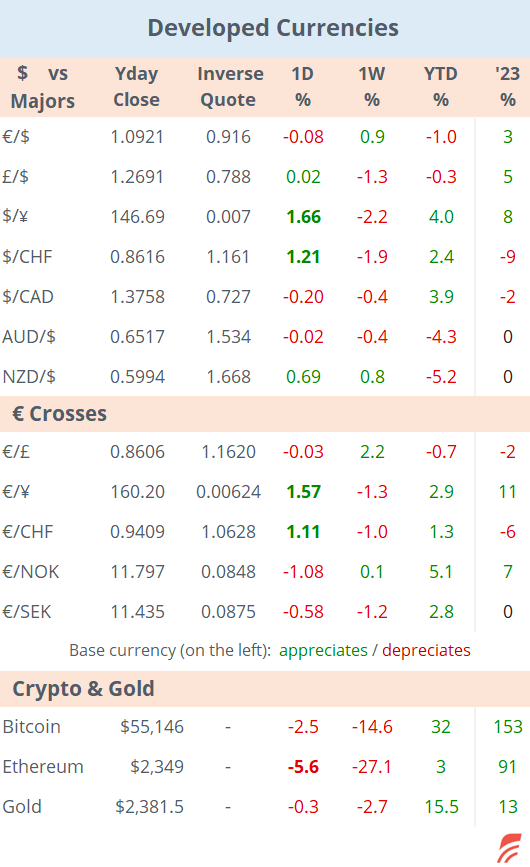

In forex markets, the notable movers were the Swiss franc and the ¥, which reversed recent gains and depreciated >1% against the $. Another mover was the Norwegian krone (NOK) which gained 1% against the € yesterday.

Crude oil prices recovered partially after a sharp fall in US inventories. WTI gained almost 3%. In Europe, natural gas prices rose to the highest this year following intense fighting at a pipeline hub in Ukraine. The Dutch TTF front-month contract gained 5% to €38.75.

Onto markets today, Asian stocks are trading mixed with no major surprises. Japan, Korea and Taiwan are lower between 0.6% and 1.2% while Hong Kong and mainland China are a touch firmer. The ¥ is stronger at 143.15, Brent oil is 0.4% higher at $78.60 and European stock futures are dropping sharply (~1%) in early morning trading, following Wall Street’s decline.

In private markets, Swedish PE firm EQT said it will acquire a majority stake in Swiss cybersecurity and data protection co Acronis which is estimated to be valued at $4bn.

Also, WPP (UK, advertising, mcap £7.6bn) is selling its controlling stake (~50%) in FGS Global, its financial PR agency, to KKR for almost $800mn.

In debt capital markets, it was an active day for $ corporate issues with VW, BMW, Meta Platforms, Coca-Cola, GE and HCA as the highlights. Facebook’s parent placed 5, 7, 10 (at T+80bp), 30, and 40-year senior notes, rated AA-, for a total of $10bn.

In credit ratings, Commerzbank AG (mcap €16bn) was u/g by S&P to ‘A’. It is rated ‘A2’ by Moody’s. The bank reported a steeper-than-expected quarterly loss, announced plans for a stock buyback and shares fell 4%.

It will be another light day for data releases with inflation in Ireland and weekly jobless claims in the US. In monetary policy, the central banks of India (unch at 6.5% exp) and Mexico (unch at 11% exp) meet today. Large-caps reporting today include Eli Lilly, Siemens, Allianz, Zurich, Munich Re, and Deutsche Telekom.

That’s all for today, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.