Morning,

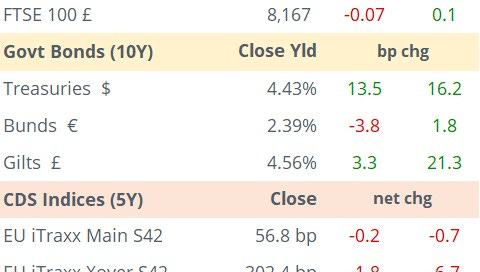

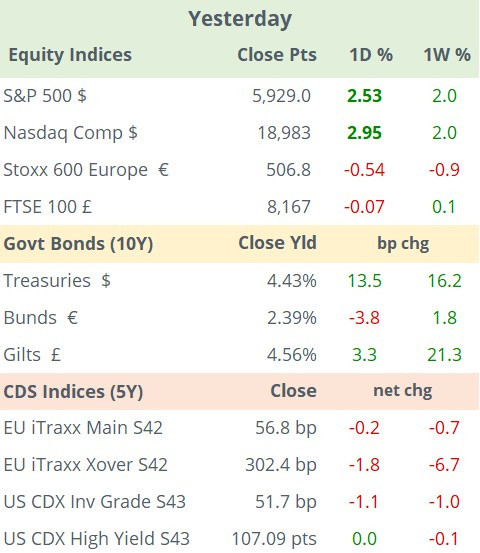

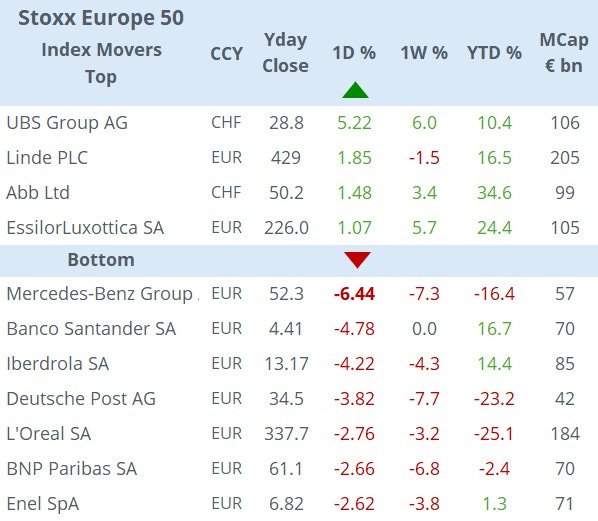

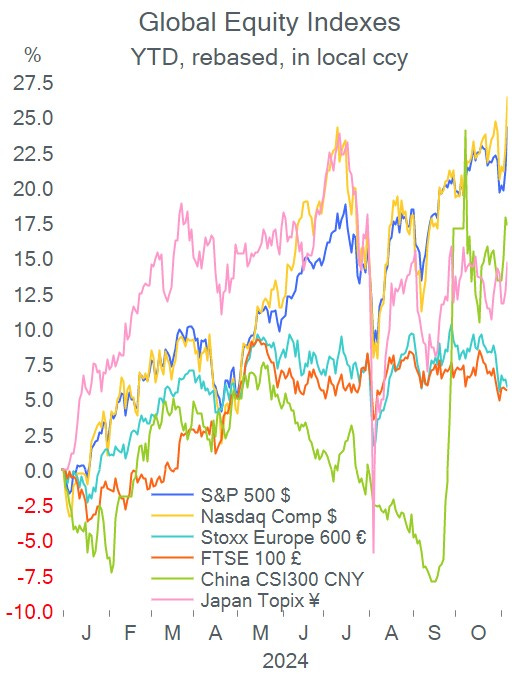

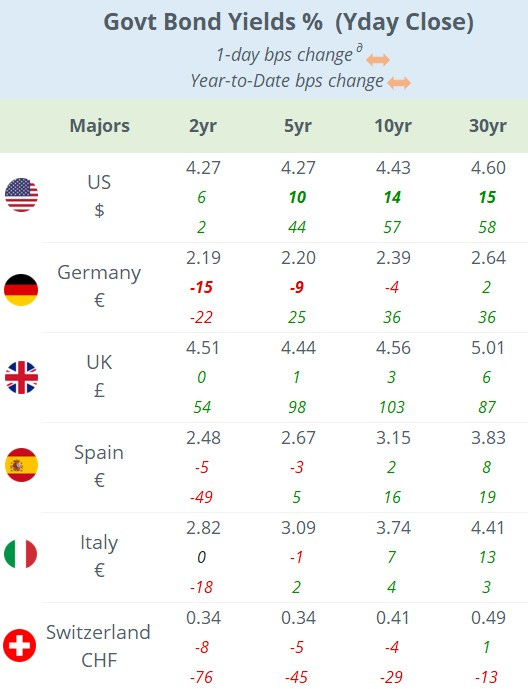

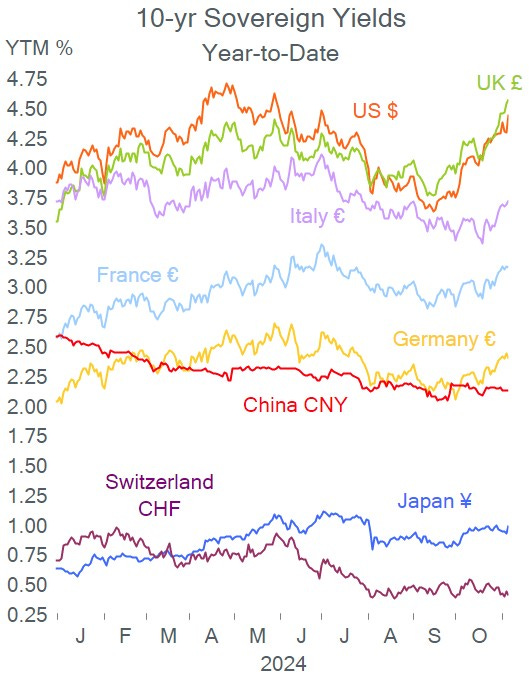

Global markets had a mixed reaction to the new US political landscape with the $ appreciating sharply, stocks on Wall Street rallying to a fresh all-time high while European equities struggled, and US bonds selling off while German bonds rallied.

Trump ended up winning on all seven swing states, gaining control of the Senate and becoming the first Republican to win the popular vote in 20 years, a powerful mandate that he will assume on January 20th.

Leading US stock benchmarks gained ~2.5% as the S&P 500 index nears 6,000 pts for the first time driven by a rally in Tesla which jumped 15% and the financials sector. A higher interest rate scenario helped JP Morgan advance 11%, Goldman and Wells Fargo 13% and Bank of America 8%. The VIX volatility index plunged 4 ppt to 16.3%, the lowest in five weeks.

In Europe, the €-Stoxx 50 ended 1.4% lower with Spanish stocks leading the fall on the back of Santander and Iberdrola’s 4% declines. On a year-to-date basis, US equities are significantly outperforming those in Europe.

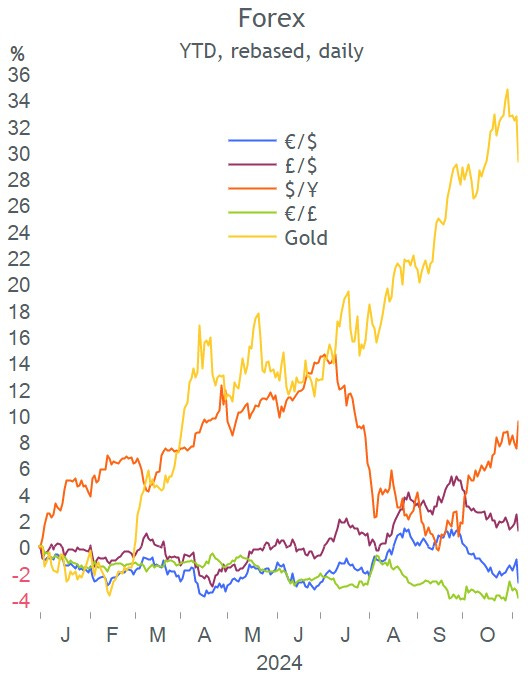

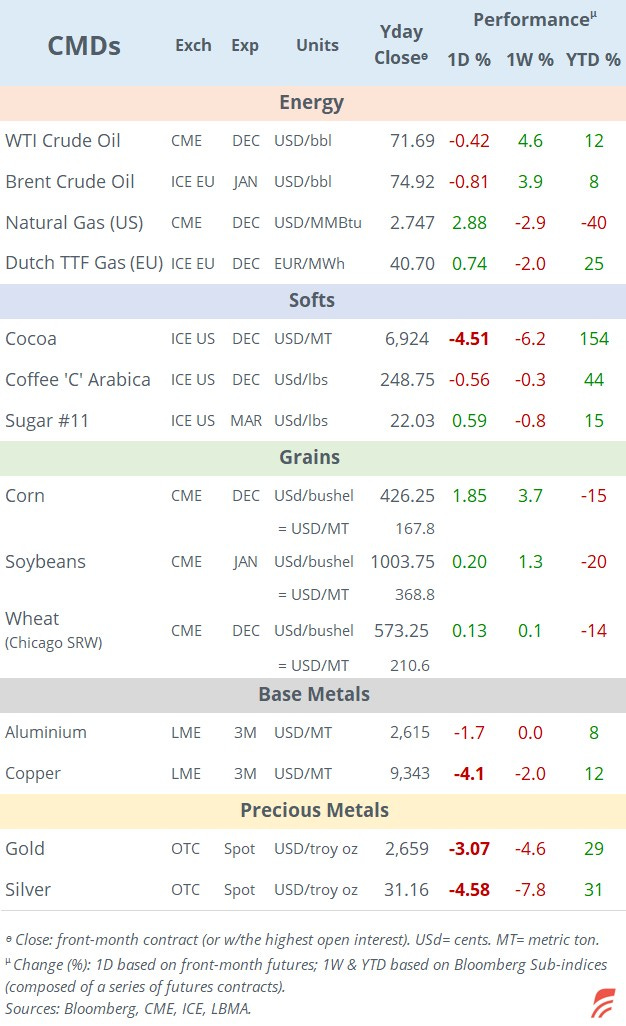

The $ index had its best day in two years, advancing 1.6% to 105 pts as the €, £ and ¥ fell sharply. The € is 3% lower against the $ and 4% weaker versus the £ this year. A stronger $ and higher yields pulled gold down by 3% while cryptos rallied with Bitcoin touching a record high of $76k before easing to $74.8k this morning.

In earnings reports, Danish pharma giant Novo Nordisk (mcap €341bn) met revenue and profit (€3.6bn) estimates on the back of strong sales for its weight-loss drug Wegovy which jumped nearly 80% YoY. Shares are 7% higher YTD.

In economic data, the decline in €-zone producer prices accelerated in September, down 0.6% MoM and down 3.4% YoY. Also, October’s final reading for Services PMIs showed an improvement in the €-zone and its biggest members.

In credit ratings, Peru’s outlook was u/g to stable by Fitch and Barbados was u/g to B by S&P.

In corporate deals, Italy’s third-largest bank Banco BPM (mcap €9.7bn) will take full control of asset manager Anima Holding (mcap €1.8bn) in which it already controls 22%. Anima shares are 46% higher this year.

It will be an active day for central banks, with the Fed announcing at 19:00 London time and widely expected to cut its target rate by 25bp to a 4.5-4.75% range. Futures are pricing in one more 25bp rate cut by the Fed before year-end.

The Bank of England should announce at midday and is also expected to ease by 25bp to 4.75% although futures implied a 17% chance of a larger cut as of yesterday’s close. Sweden’s Riksbank also meets today and analysts expect a 50bp rate cut to 2.75% while Norway’s Norges Bank should keep its rate unch at 4.5%. Finally, the Czech Rep’s central bank also meets and analysts anticipate a 25bp reduction to 4%.

Data to be released today: €-zone retail sales, Germany industrial production, Ireland inflation and US jobless claims.

Earnings reports today: Telefonica, BT Group, Amadeus IT, Airbnb and Arista Networks.

Thanks for your time, “Markets Dawn Europe” will be back next week.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.