Est reading time: 4 min

Morning,

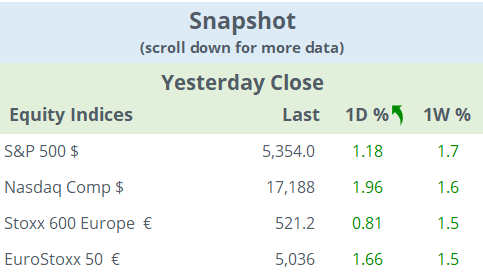

Risk assets rallied yesterday across European markets and on Wall Street as interest rate cut expectations gain momentum on softer US labour data. The ADP national employment (private companies) reading came in below estimates and the previous month was revised lower ahead of tomorrow’s non-farm payrolls report (+185k exp).

Treasury and Bund yields shifted down by 4 to 5bp across tenors, with 10-yr UST closing at a two-month low (4.29%). Markets are now pricing in a 57% chance that the Fed cuts rates in September and 42% it cuts again before year-end.

Today’s ECB meeting (14:15 CET) is widely expected to result in a 25bp rate cut of the deposit rate to 3.75%. However, the focus will be on signals regarding future decisions. In economic data, €-zone producer prices dropped 1% in April and 5.7% YoY, significantly more than expected.

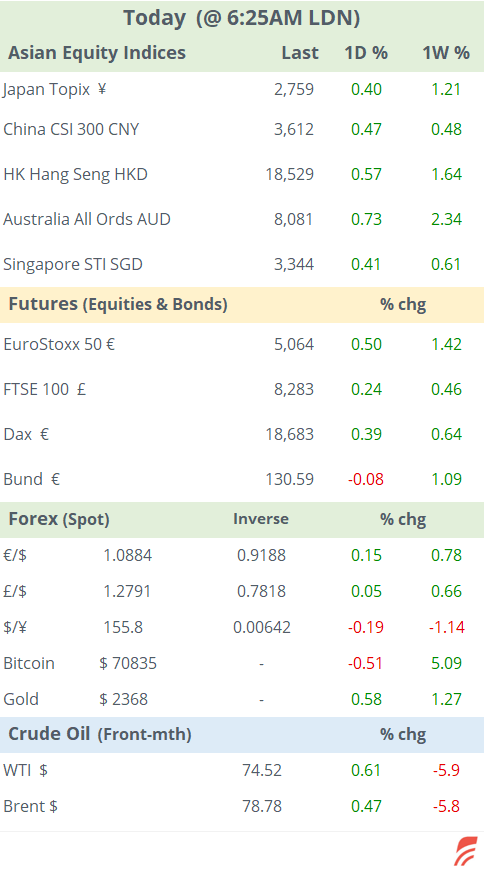

Information technology was the leading sector on both sides of the Atlantic with sharp gains for semiconductors stocks. The Nasdaq 100 added 2% and accumulated a 13% gain YTD and the S&P 500 gained 1.2% (+12% YTD). Both are trading at record highs. The Eurostoxx 50 rallied 1.7% yday (+11% YTD).

Nvidia shares advanced 5% to a fresh record, hitting a $3tn valuation (P/E 104x) to overtake Apple as the world's second-biggest company behind Microsoft ($3.15tn). This helped TSMC of Taiwan to also rally 5% today to a record valuation of $720bn. Dutch ASML gained 8% to match LVMH’s €377bn market cap. The Philly SOX Semiconductors index is trading at an all-time high, +28% YTD.

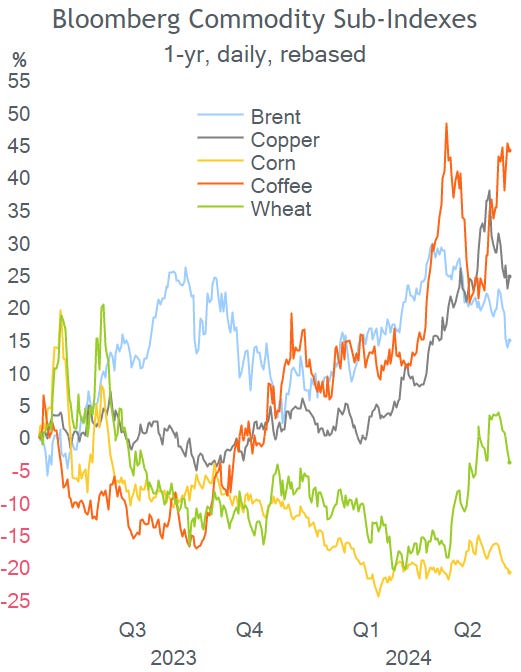

Stocks in Asia are also rallying today with Taiwan up 2%, Korea 1% and all other markets are around 0.5% firmer. The $ is a touch weaker this morning, mainly against the yen (-0.2%) and the Swiss franc (-0.3%). Brent oil is also firmer at $78.80. Eurostoxx 50 futures are dealing 0.5% higher in early trading.

On the earnings front, Zara-owned Inditex advanced 3.7% to €45.57, after reporting strong Q1 results with current trading conditions better than analysts predicted, net profits of €1.29bn on €8.15bn of net sales. Inditex is valued at €142bn (P/E 26x).

In central bank updates, Canada became the first G7 nation to loosen monetary policy. As expected, the BoC cut rates by 25bp to 4.75% as policymakers gained confidence that inflation (2.7% YoY) is on a downward trend towards their 2% target. The economy has felt the impact of the restrictive level of interest rates as it has softened in recent months (Q1 GDP +1.7% annualized). Also, Poland’s central bank maintained rates unchanged at 5.75%, as anticipated.

Headlines:

-Israeli troops have taken operational control over towns in central Gaza, expanding their ground presence in the Palestinian region, while ceasefire and hostage release negotiations take place in Doha and Cairo.

-Sustainable investment funds are falling out of favour for investors, according to research by Barclays. The underperformance in recent years is the main reason for large redemptions from funds under the ESG label.

In corporate deals, SAP AG (Germany, software, mcap €200bn), has agreed to acquire Walkme (Israel, Nasdaq-listed, software, mcap $1.2bn) for $14/share or $1.3bn in total equity value. The bid represents a 45% premium to Walkme’s previous close. Shares jumped 42% yday.

Apollo Global Mgt will invest $11bn for a 49% stake in Fab 34, a joint venture with Intel to build a high-capacity chip facility in Ireland. Intel shares gained 2.6%.

In IPOs, Tempus A.I., a genetics-testing company that runs genomics diagnostics tests across oncology and other areas, including neuropsychiatry, and radiology plans to raise ~$410mn in a Nasdaq listing for an estimated $6bn valuation. It is backed by a Groupon co-founder, Google, Softbank, and Franklin Templeton. Last year revenues rose by 66% to $532mn.

In data today we’ll get retail sales in the €-zone and Italy; GDP data in Ireland; international trade figures and weekly jobless claims in the US. The 2024 European Parliament election begins today and will run until Sunday, in the first EU election since Brexit became effective. It’s a holiday in Sweden today.

That’s all for today, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Please share using the button below, as access is free to all.