Morning,

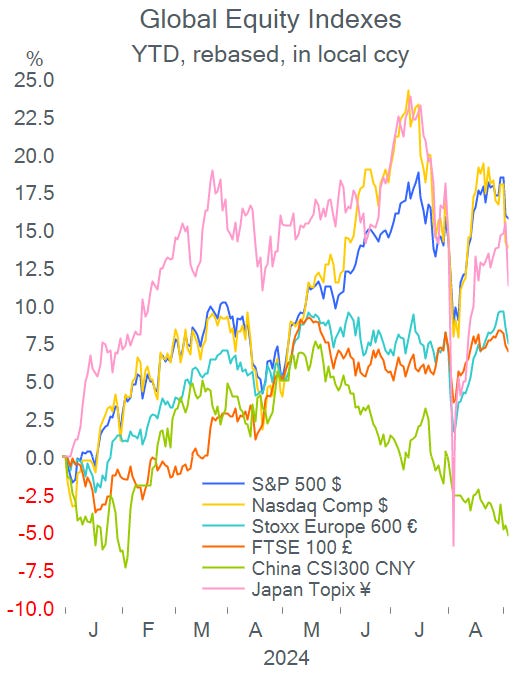

European stocks reacted to the selloff in Wall Street on Tuesday and benchmarks lost around 1% across the continent yesterday, mainly on fears of a slowdown in the U.S. economy. U.S. indices ended marginally lower last night on the back of dovish comments by Fed officials and a weak labour market update (job openings fell to the lowest in 3-yrs).

The Fed’s Beige Book survey showed a decline in economic activity in most regions during recent weeks. San Francisco Fed President Daly said that the central bank needs to cut rates to keep the labour market healthy.

Bonds rallied across developed countries with the yield on short-end Treasuries falling 12bp to 3.77%, an 18-month low and the curve steepened with 10-yr bonds also yielding 3.77%. Bond yields in Europe also fell as expectations for policy rate cuts increased. Traders are now pricing in a 45% probability of a “jumbo” 50bp rate cut by the Fed at its meeting in two weeks.

This morning, most Asian stock markets are posting a modest recovery from Wednesday’s steep declines while European equity futures are marginally lower and crude oil is a touch firmer at around $73 after losing 1.5% yesterday.

In economic data, Services PMIs in Germany, Italy and Spain came in below estimates but remain in expansionary territory while the update in France and the U.K. surprised on the upside. Producer prices in the €-zone accelerated by 0.8% in July and the annual PPI deflation eased to 2.1%.

In central bank action, the Bank of Canada eased its policy rate by 25bp as expected, to 4.25%, its third straight reduction and signalled bigger reductions ahead as it sees a slowdown in the economy. Canadian inflation fell to 2.5% YoY in July, still above the central bank’s 2% target. Also, the National Bank of Poland maintained its interest rate steady at 5.75%.

In corporate deals, British real estate co Segro Plc (mcap £11.7bn) will acquire smaller rival Tritax EuroBox Plc (mcap £550mn) in an all-share deal worth £1.1bn including debt.

Also, media reports suggest that the Biden administration will block the $15bn takeover of U.S. Steel (mcap $6.6bn) by Nippon Steel based on national security risks.

In secondary equity placements (follow-on), shareholders of Swiss personal products co Galderma Group AG (mcap $22bn) sold shares worth $1.2bn.

In new bond issues, the notable placements were $ and € senior bonds by Stryker (U.S., medical equipment, mcap $137bn) in 5, 8, 10 and 12-yr maturities. Uber (mcap $150bn) sold BBB rated senior bonds in 5, 10 and 30-yrs.

In credit ratings, Fitch u/g Greek banks Piraeus, Alpha, Eurobank and NBG.

In data releases today: €-zone’s retail sales, Ireland’s GDP, Germany’s industrial orders, U.S. non-mfg PMI (ISM) and initial jobless claims.

Broadcom is the only blue-chip to report earnings today.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.