Yesterday evening, the French parliament ousted PM Michel Barnier who failed the no-confidence motion (331 vs 246 votes) as the left and far-right (Le Pen) parties joined to oppose Macron’s minority government over the austerity budget. Facing a deepening crisis, Macron is expected to address the nation tonight.

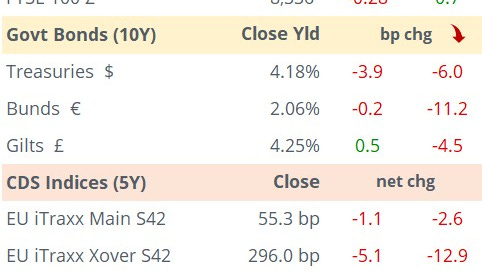

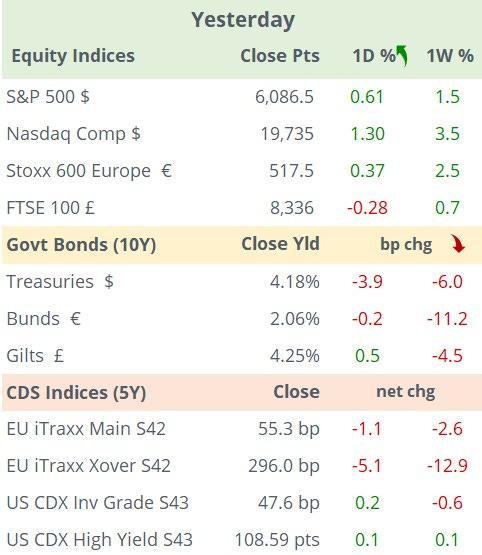

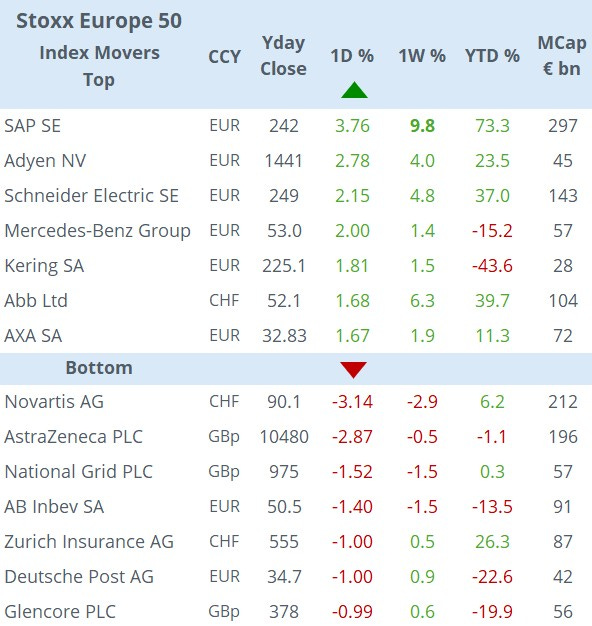

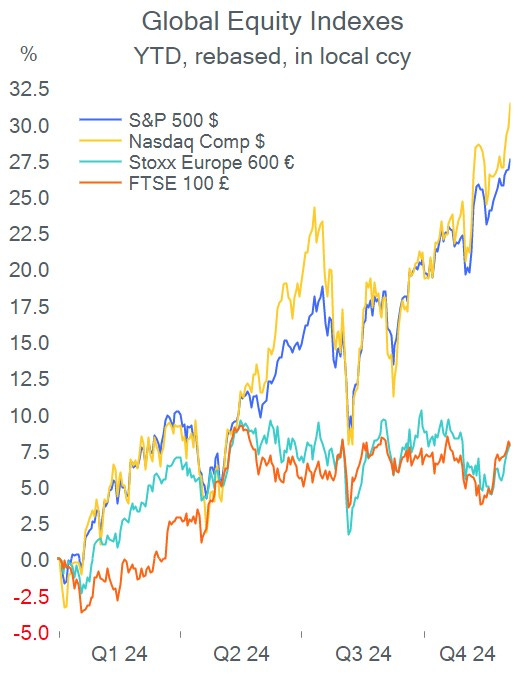

Wall Street closed at fresh records with the Dow Jones Industrials exceeding 45,000 points and the S&P 500 accumulating a 27% YTD rally. The catalysts were the strong earnings reports by software giant Salesforce (+11%) and chip-maker Marvell Technologies (+23%). Equities in the €-zone also posted solid returns despite the turmoil in France with the €-Stoxx 50 accumulating a ~4% gain in the past seven days.

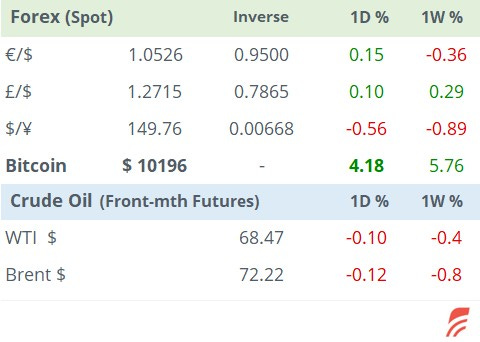

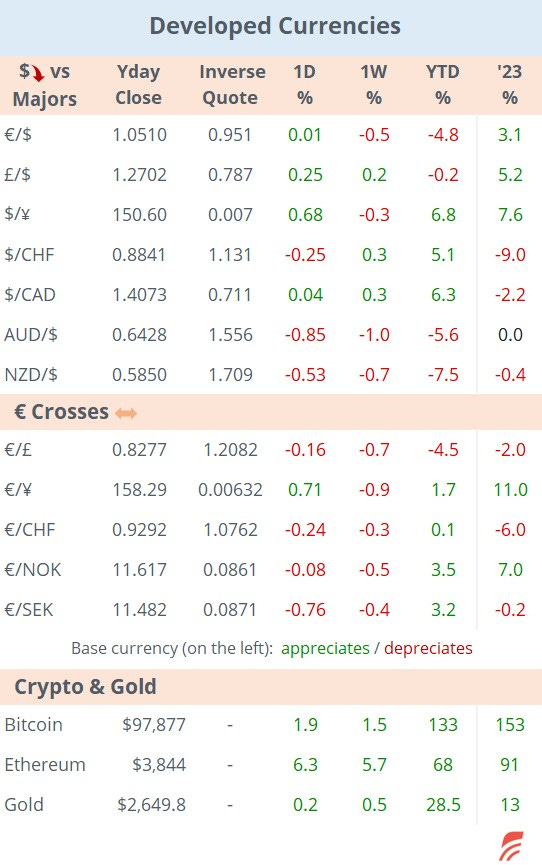

Bitcoin is rallying 5% today to $103k on the back of Trump’s plans for the crypto space, propelling the crypto’s total market value to $3.7tn, with Bitcoin representing 55%.

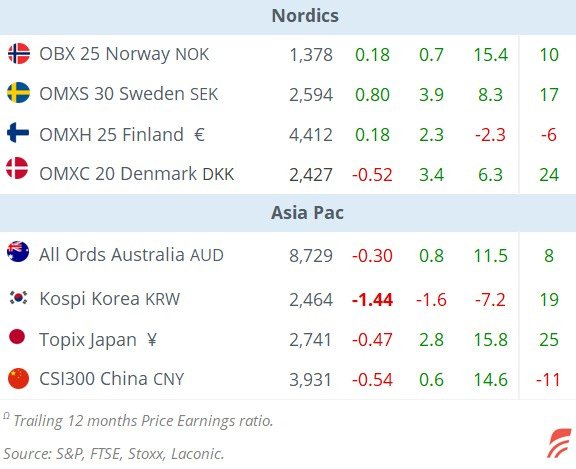

Asian equities are mixed today with Korea and HK falling >1% while other markets are marginally firmer. European futures are a touch lower in early trading. French OAT futures are little changed.

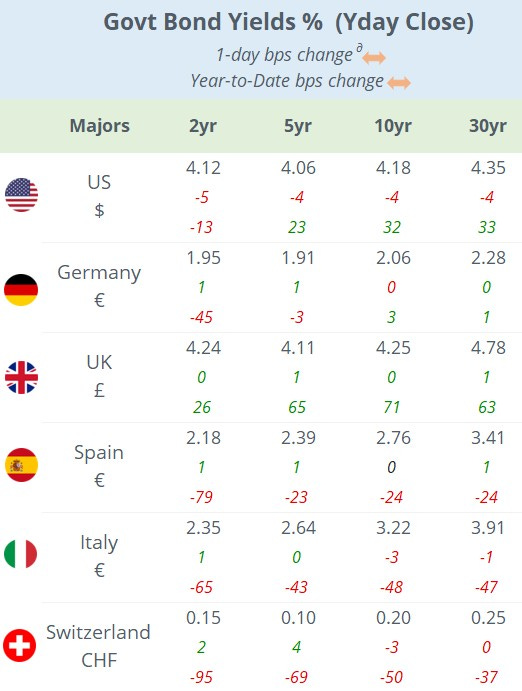

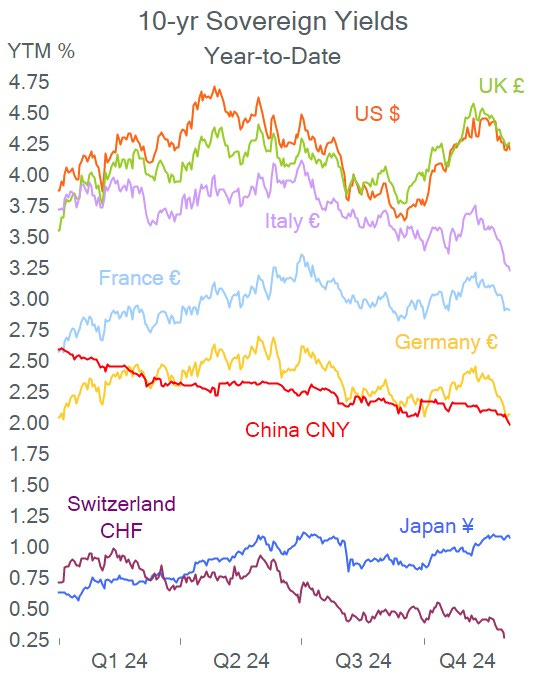

In central bank updates, the Bank of England projects four 25bp interest rate cuts for 2025 as inflation concerns ease. British headline inflation is running at 2.3%, marginally above the bank’s 2% target. The BoE meets on Dec 19 and futures are anticipating the base rate to remain steady at 4.75%.

In his last public appearance before the Fed’s meeting in two weeks, Jerome Powell said that the US economy had performed better than the central bank anticipated and inflation a touch higher than expected when it began easing rates, signalling that the Fed can afford to be a little more cautious. Traders maintained positions that imply a 73% probability of a 25bp rate cut.

ECB President Lagarde said she expected weak growth in the near term for the €-zone as indicated by the latest mfg and services PMIs followed by a recovery in the medium term.

In monetary policy decisions, the National Bank of Poland kept rates unch as expected at 5.75% for the 14th straight month.

Data released yday includes €-zone’s producer prices (Oct) falling 3.2% YoY in line with estimates (vs -3.4% in Sep). The Services PMI (Nov) updates came in on the weak side for the US with a sharp deceleration while the €-zone and UK readings showed a modest improvement.

In M&A, US private equity firm Insight Partners sold a 13% stake worth $2bn in Swiss cloud data co Veeam Software in a secondary offering valuing it at $15bn, trebling its value in four years.

In DCM deals in €, US electrical equipment co Johnson Controls (mcap $55bn) placed 9-yr senior bonds rated BBB+ at 117bp over Bunds for a 3.20% yield.

In ratings: Spain’s Caixabank SA (mcap €37bn) was u/g one notch by Fitch to A-, stable outlook.

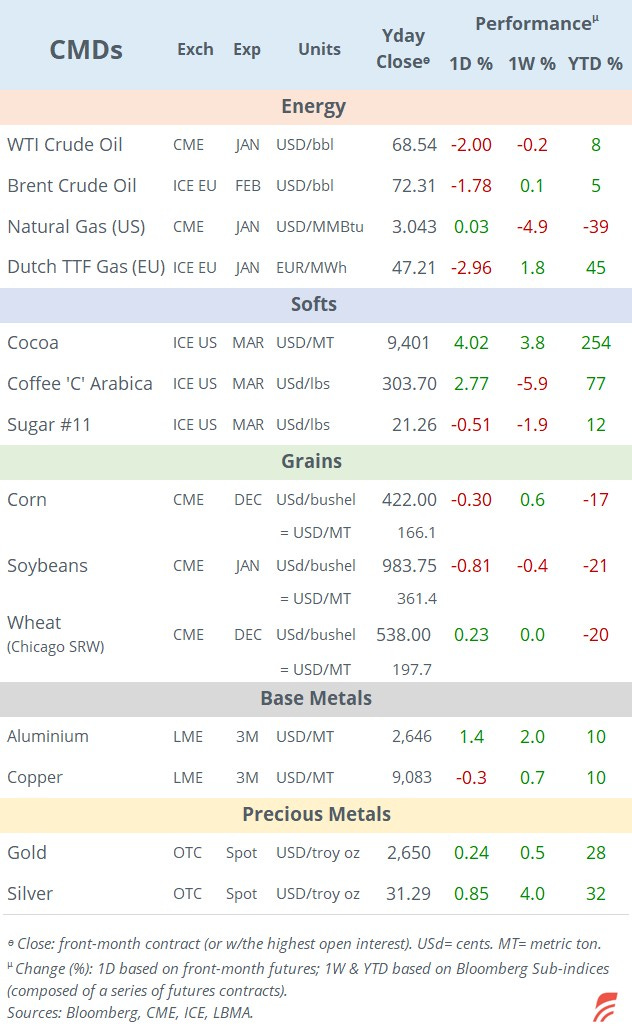

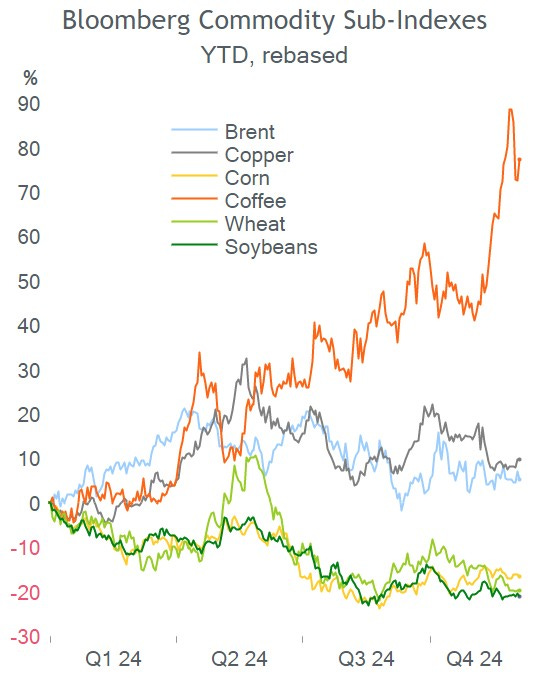

OPEC meets today to discuss output policy for 2025 with analysts expecting the cartel to maintain the crude oil production cuts of 6mbpd, or roughly 6% of global daily demand. Brent fell nearly 2% on Wednesday and is flat for the week.

Earnings today: more Canadian banks including TD, CIBC, Bank of Montreal, HP Entreprise and Lululemon.

Data updates: €-zone’s retail sales, Ireland’s GDP, US international trade and jobless claims, and industrial output in Germany, France and Spain.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.