Scroll down for Podcast script.

Good morning,

Risk markets in the US ended marginally higher last night, following mixed signals from a positive PMI reading to a somewhat hawkish tone by the Fed Governor. All leading US stock indexes closed between 0.1 and 0.6% higher, after a similar session in European markets, where the Stoxx 600 added 0.3%. The notable mover was the Irish stock index which gained 1.7% to an all-time high and is Europe’s best-performing country this year with a 15% gain.

Markets in China and Taiwan will be closed today and tomorrow, for holidays unrelated to the earthquake. Hong Kong is closed today but opens tomorrow. Asian markets are trading notably firmer today with Japan and Korea up more than 1%.

A few single stock movers yesterday worth highlighting. In the US, Dell Technologies and Spotify gained more than 8%, and General Electric added 7%. Intel fell 8%, on its second-worst day this year, after disclosing large losses at its foundry unit, where chips are manufactured for third-party semiconductor designers. Intel reports earnings on April 25th, shares are down 20% in 2024.

In European markets, German utility EnBW dropped by 7% and Austrian utility Verbund declined by almost 5%, after US investment bank Stifel, downgraded Verbund to sell and slashed its target price. Shares are down by 22% year-to-date.

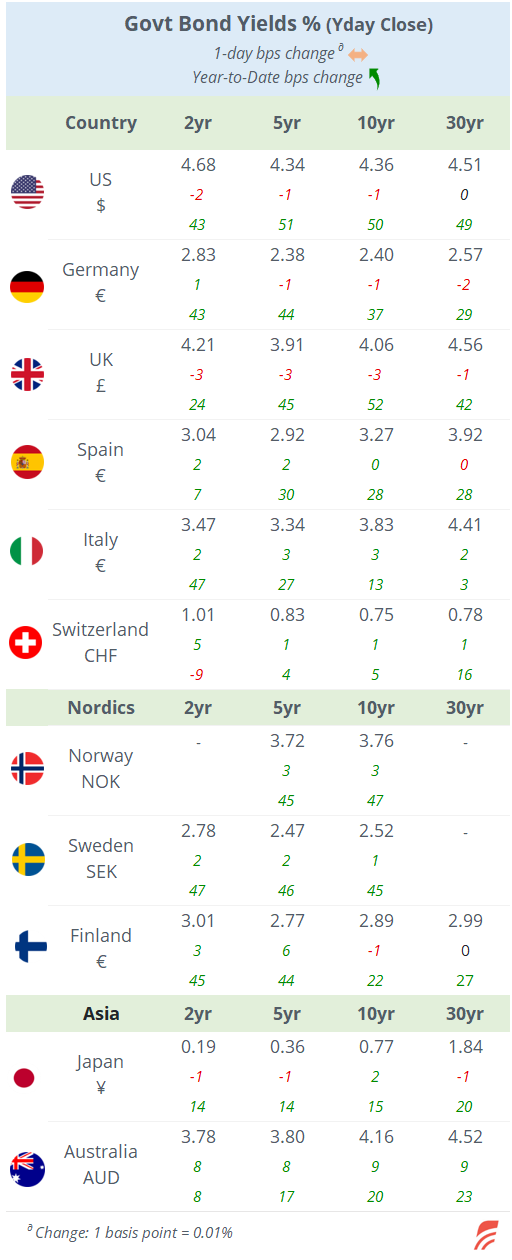

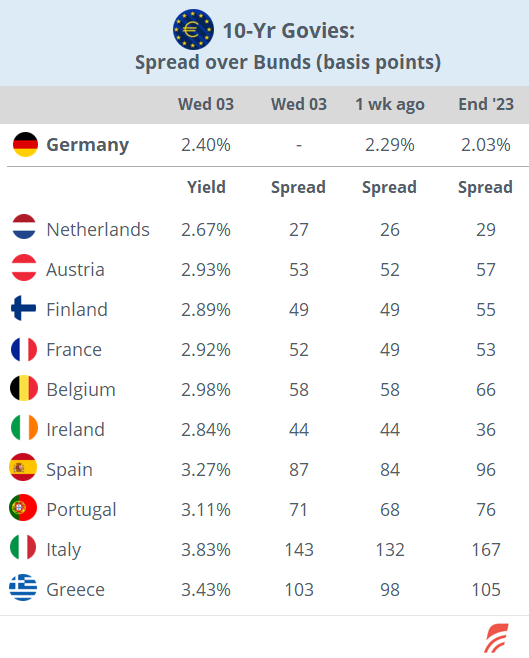

In currencies, the dollar fell yesterday, as the euro and sterling appreciated 0.6%, although both remain almost unchanged in the past 7 days. Gold hit yet another record of 2,300, and silver gained 4% to a 3-year high at 27 dollars. Bond markets were little changed, Bund yields are steady at 2.40% and Gilts at 4.06%.

Fed Governor Powell made some cautious remarks, stating that recent job gains and inflation data have come higher than expected. And, although Fed policymakers agree that interest rates can fall later this year, it will only happen once they have more confidence that inflation is on a sustainable path to the central bank’s 2% target. Atlanta Fed Bostic said that he believes rates should be cut but in Q4, and only projects one quarter-point reduction this year.

Yesterday, we got the latest on Eurozone inflation, with headline at 2.4% and core at 2.9%, both reading below expectations and confirming the downward trend. The update increases the chances that the ECB will begin easing policy rates from their record highs. The central bank meets next Thursday and futures are pricing in an 82% probability of rates remaining steady.

Inflation in Austria remained unchanged at 4.2% in March.

The Services PMI in the US showed a deceleration of activity, weaker than a month ago, worse than expected, but still expanding. The ADP employment update showed a strong increase in private jobs created in March, although the key figure will be non-farm payrolls tomorrow.

In corporate deals, Danish biotech Genmab agreed to buy cancer drug maker ProfoundBio, a US privately held biotech, for $1.8bn in cash. Genmab’s market value is 10 times that of its target.

Swedish private equity firm, EQT agreed to buy compliance software developer Avetta of the US, for an enterprise value of $3bn.

In business news, the success of ChatGPT is forcing Google’s parent Alphabet to consider new options for its online search division, which generated $175bn in Ad sales last year. It evaluates offering a paid search service with generative artificial intelligence features. Alphabet shares were unchanged yesterday, are 11% higher this year and ranks top 4 by market cap at $1.9tn.

Economic updates for today include inflation in Switzerland, producer prices in the Eurozone, international trade in the US, and service PMIs for European countries. Also, Poland’s central bank holds its policy meeting, with markets anticipating rates to remain unchanged at 5.75%.

That’s all for today, see you tomorrow.