Morning,

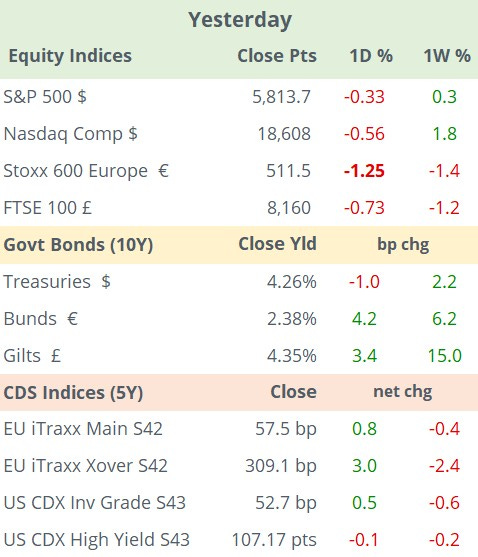

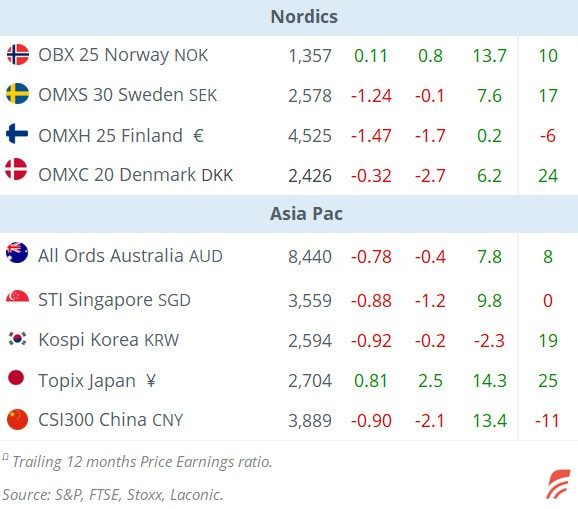

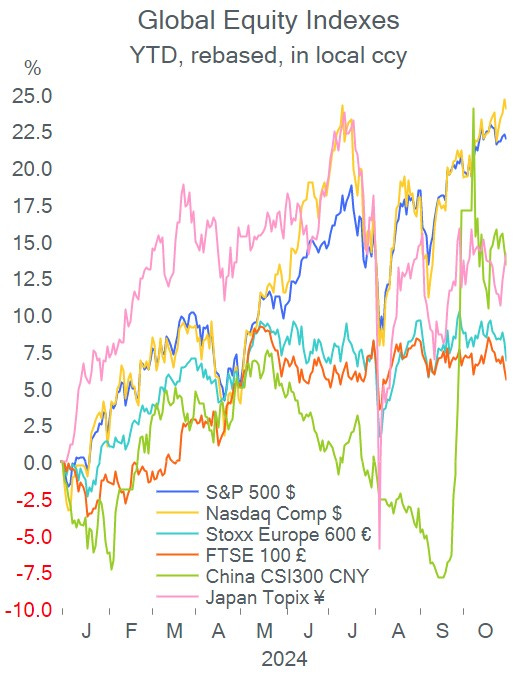

Market sentiment is being driven by corporate earnings and traders’ positioning ahead of Tuesday’s election. The busiest week for Q3 earnings reports continues today with several European and US blue chips following results by Microsoft and Meta after yesterday’s close. Wall Street ended lower with Nasdaq dropping 0.8% after another poor day for European markets where leading indices lost over 1%.

Microsoft beat revenue ($65.6bn, +16% YoY) and profits ($24.7bn, +11% YoY) estimates but shares traded 4% lower in after-hours on a disappointing cloud growth outlook. Meta Platforms also reported better than expected revenue ($40.6bn) and net income ($15.7bn) quarterly figures but warned of higher spending on AI and lower user numbers. Shares dropped 3% after the close.

Nasdaq futures are 0.7% lower overnight and European futures are down 0.5% in early morning trading. All Asian stock indices are in the red today, down between 0.5 and 1% with Singapore and Taiwan closed on holidays.

UBS’s revenue ($12.3bn) and profit ($1.4bn) came in well above estimates but shares lost 4.5%, the most among Stoxx 50 members, due to an uncertain regulatory environment and the bank’s capital requirements in the near term.

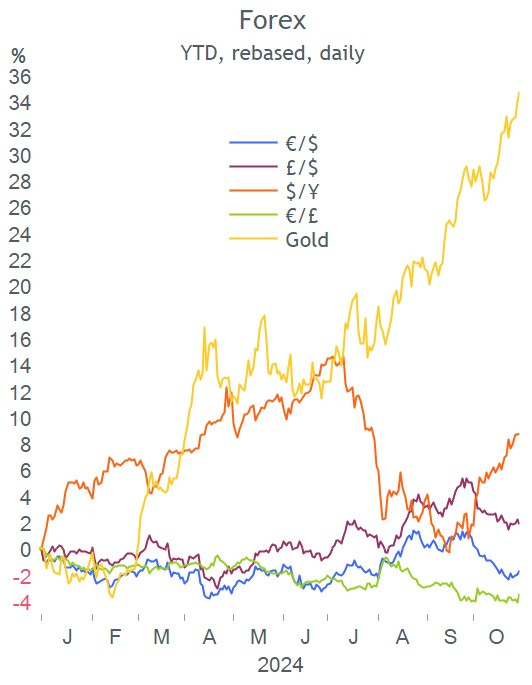

The Bank of Japan kept its benchmark rate unch at 0.25% as widely anticipated, maintaining its ultra-low monetary policy but signalled plans to hike if inflation reaches its 2% forecast in the coming years. The central bank highlighted global risks as its main focus, particularly the US election. The ¥ is trading firmer today below 153, near its three-month low while stocks are a touch lower.

In data yesterday, the US economy expanded by 2.8% annualised in Q3, a solid pace slightly below the 3% recorded in Q3.

GDP in the €-zone expanded by 0.4% QoQ in Q3, still weak as Germany’s economy remains stagnated but much better than expected.

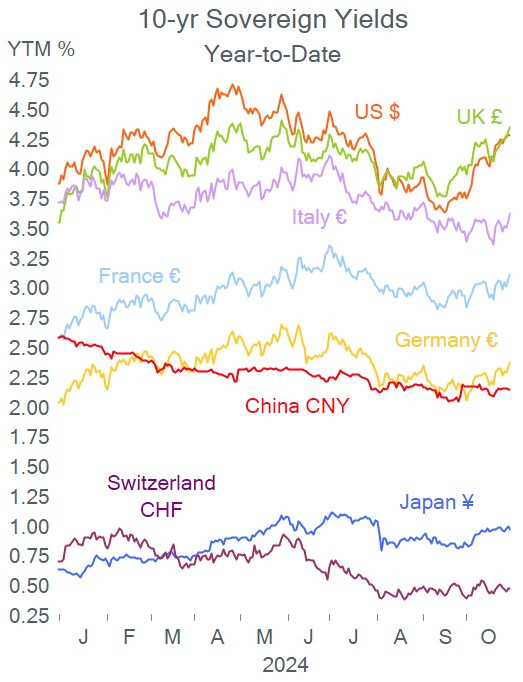

Germany’s inflation (HICP) in October surprised with a 2.4% YoY print, above estimates and higher than September’s 1.8%. The yield on 2-yr German bonds (Schatz) rose by 12bp to 2.28%, the highest closing level in two months.

In the UK, the Gilts yield curve shifted 4-5bp higher and the £ fell sharply (-0.7%) against the € after the budget announcement which anticipates a fiscal expansion with higher public borrowing, spending and a £40bn hike in taxes.

Data today: €-zone inflation; Germany retail sales; US personal consumption, PCE inflation index and jobless claims.

Earnings reports: Total, Shell, Inbev, BNP, BBVA and Intesa in Europe. Apple & Amazon (AMC); Intel, Mastercard & Uber (BMO).

The central banks of Colombia (-75bp to 9.5% exp) and Ukraine meet today.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.