Podcast script: Estimated reading time ⏲ ~6 mins

Good morning,

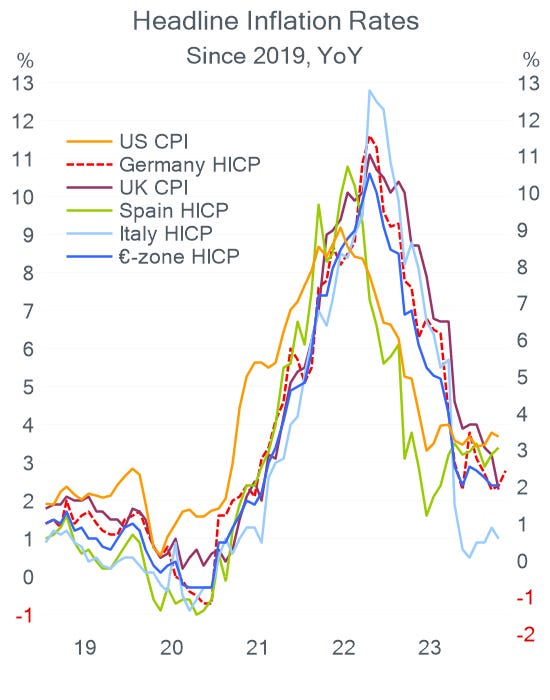

Risk assets sold off yesterday driven by a higher inflation reading in Germany (2.8%) that led to a steep jump in bond yields as traders reconsider the timing and speed at which monetary policy rates will be cut. With equities trading near record highs, inflation updates get considerable attention to test valuations as traders anticipate central bank action.

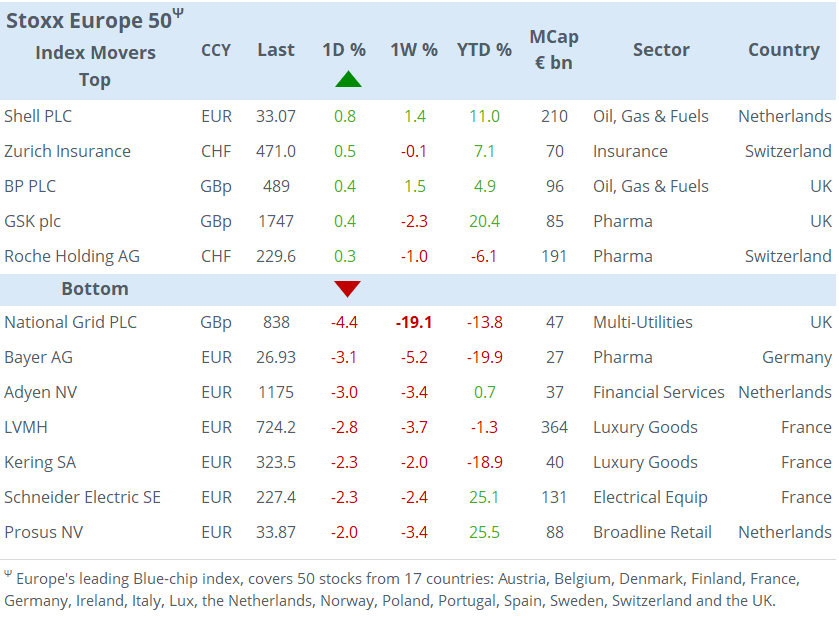

European leading indices declined well over 1% with the French CAC and Italian MIB as the biggest losers, down 1.5%. The notable faller among Europe’s large-caps was National Grid of Britain which lost more than 4% and accumulated a 19% decline in the past week following last week’s launch of the country’s largest rights issue since 2009, worth £6.8bn and priced at GBp645, 23% below yday’s close.

In Wall Street, every sector finished lower with Energy, Materials and Utilities as the underperformers and the Dow Jones losing 1%, the S&P 500 and the Nasdaq down by 0.7%. The VIX index jumped to 14.3%, its highest level in four weeks.

Salesforce (software, mcap $263bn) plunged 16% in after-hours trading following weak results that thinly missed revenue estimates, beat profit expectations but provided poor guidance on lower customer demand for its soft cloud services.

Despite all the action in the stock market, yesterday’s focus was on the bond market with global yields selling off sharply. The Bund yield curve is at the highest level since November after a 9bp gain for 10-year yields to 2.68%. Italian BTPs added 12bp to 4.02%. British yields added 11bp from the 5-year to 30-year tenors and US Treasuries are at the highest in four weeks, with 10-yr yields at 4.62%.

The dollar appreciated almost 0.5% against all majors. The € is a its lowest level in 21 months against £, and 2% weaker YTD at 0.8503 on policy rates timing expectations.

The preliminary German HICP inflation print was 2.8% YoY in May (0.2% MoM), compared to 2.7% expected and 2.4% in April. Core inflation was unchanged at 3.0%. The government forecasts a 2.4% inflation rate for this year. The event did not change the probability of a rate cut to 3.75% by the ECB next Thursday implied by futures markets, which remains at 90%.

The Fed’s Beige Book, which surveys businesses’ sentiment, showed increased pessimism in the economic outlook, highlighting greater downside risks.

Overnight markets in Asia maintained the negative sentiment with all leading stock indices trading lower across the board, between 0.5% and 1.2%. European futures and S&P 500 futures are also pointing down this morning. Bitcoin is around $68k and Brent is little changed at $83.50.

It was an active day for corporate deals with ConocoPhillips (US, oil & gas, mcap $139bn) agreeing to takeover smaller rival Marathon Oil Corp (US, independent exploration, mcap $16bn) in an all-share deal worth $17bn in equity value and $22.5bn of enterprise value. Conoco’s bid equates to $30.33 per Marathon share, a premium of 14% to the closing price on Tuesday. Marathon gained 8.4% to $28.70.

The transaction adds to the consolidation of the oil & gas sector in the US and follows Hess Corp’s approval of the takeover by Chevron and Exxon completing its acquisition of Pioneer.

In the mining sector, BHP’s (Australia, mcap $152bn) attempt to swallow Anglo American Plc (UK, mcap $42bn) for nearly $50bn came to an end after the bidder walked away following several rejections. Anglo shares fell 3% to £24.8 compared to BHP’s last bid worth £29.34/share.

In the British postal sector, International Distributions Services (mcap £3.3bn) has accepted a £3.57bn takeover bid by Czech businessman Kretinsky. IDS owns the Royal Mail and international courrier GLS. The takeout price is £3.7/share compared to the government privatisation price of £3.3/share ten years ago. IDS shares gained 4.3%.

Saudi Arabia is planning to launch a $10bn Aramco (oil & gas, mcap $1.8tn) share sale on Sunday.

GSAM raised $20bn (under Wall Street Loan Partners V vehicle) to invest in private credit as more companies rely on loans granted by non-banking firms and the asset class becomes mainstream for insurers, pensions and SWF.

On the credit ratings front, Fitch upgraded Banco Sabadell by one notch to BBB. Also, S&P upgraded India’s sovereign outlook to positive. In debt capital markets, LVMH placed 6 (Bunds+75bp, 3.42% yield ) and 10-yr (+89bp, 3.56%) senior notes rated AA-.

It will be an active day for economic data, with GDP and Q1 PCE prices in the US, inflation in Spain and Belgium, GDP updates in Switzerland and Sweden, and sentiment indicators and consumer confidence in the €-zone.

The Central Bank of South Africa holds a policy meeting today with the repo rate expected to remain unchanged at 8.25%, as markets await yesterday's general election result.

The Presidents of the Atlanta, New York and Dallas Fed will participate in conferences today.

Companies reporting earnings include Auto Trader in the UK, Costco and Best Buy in the US. Exchanges will be closed on holidays in Poland, Croatia and Brazil today.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Please share using the button below, as access is free to all.