Hi, Markets Dawn Europe is ads-free. To survive, it needs to grow its audience, more feedback and support. 🙏 share it, like it and email us with suggestions so we can improve.

Morning,

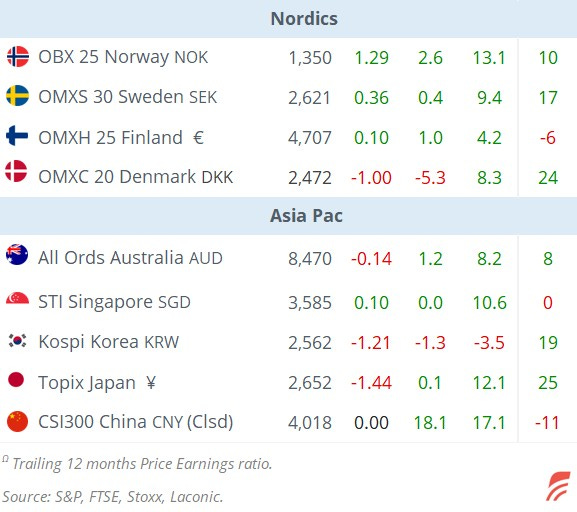

Equity indices on Wall Street and in European markets ended little changed on Wednesday as the action this week continues to be in Asia despite China’s week-long holiday. The Hang Seng is losing >3% today with the property sector plunging ~10% on profit-taking following the sharp recovery driven by Beijing’s stimulus measures.

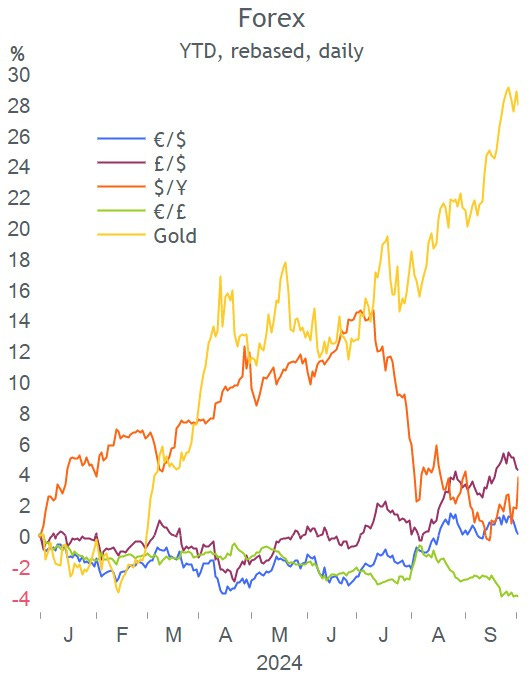

Stocks in Tokyo are advancing >1% after Prime Minister Ishiba’s dovish rate comments reduced the chances for further monetary policy tightening and the ¥ fell towards the 147 level. European equity futures are trading ~0.5% lower in early morning trading, in line with S&P 500 futures overnight.

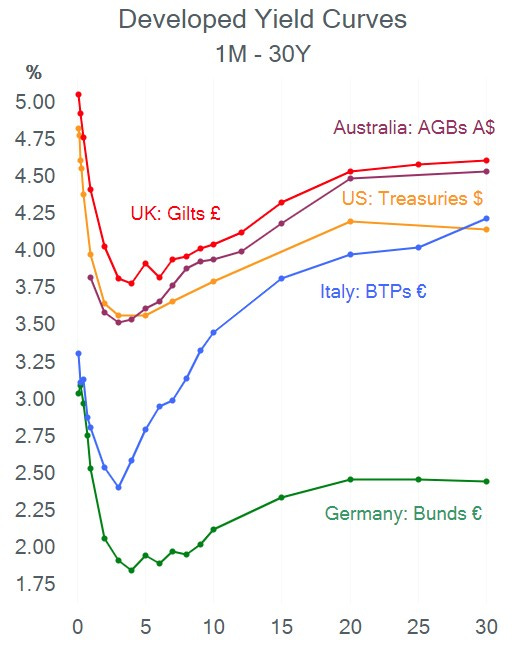

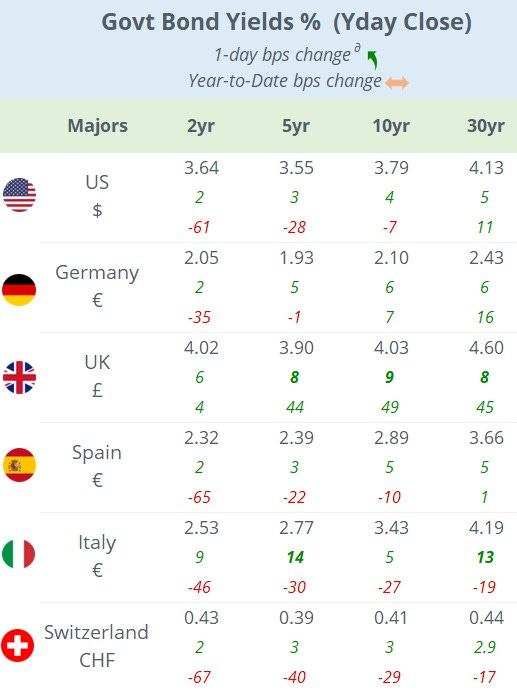

Bond yields in developed countries shifted higher yesterday. British Gilts and Italian BTP yields added between 8 and 14bp across the curve. 10-year Gilt yields closed above 4% as the attention turns to the budget update at the end of the month, with new bond supply on the horizon.

In economics, the U.S. private sector ADP employment update for September beat consensus estimates with a solid 143k jobs creation ahead of tomorrow's non-farm payrolls report. The $ appreciated for a fourth straight session and the DXY index nears 102 pts while Treasury yields continue to shift higher following the somewhat hawkish remarks by Powell at the start of the week. Futures markets are now pricing in a 64% chance for a small 25bp rate cut at the Fed’s next meeting on November 7.

Tesla (mcap $794bn) shares dropped 3.5% after releasing a disappointing delivery update with 462,890 vehicles delivered worldwide in Q3, up 6.4% YoY. The EV giant needs record-breaking deliveries in Q4 to avoid an annual decline. Its largest global competitor, China’s BYD delivered 443,426 cars in the same quarter (+2.7% YoY). Tesla shares are flat YTD.

Poland’s central bank kept its benchmark interest rate steady at 5.75% as expected, the same level for the past twelve months.

In M&A, U.S. real estate investment trust Crown Castle (mcap $50bn) is exploring the sale of its fibre and wireless assets, including 40k cellular towers across the U.S., to private equity firms in a deal valued at ~$10bn. Also, Toyota invested $500mn in Joby Aviation (mcap $4.4bn) the drone-taxi company. Joby shares rallied 28% on Wednesday.

In private markets, OpenA.I. raised $6.6bn at a $157bn valuation from Microsoft, Nvidia, Thrive Capital and Fidelity among others and demanded backers not to invest in rival start-ups.

In new corporate debt issues, yesterday’s notable placements in the € high-yield space were Italian business support Sammontana Italia Spa (7-yr) and British chemicals giant Ineos Quattro (5-yr).

In credit rating updates, Moody’s u/p Brasil’s sovereign by one notch to Ba1 and several blue-chip companies, including Vale (Baa2), Itau (Ba2), B3 Bolsa (Baa3), NU Holdings (Ba2) and BNDES (Ba1).

Economic data today: Services PMIs in developed countries; producer inflation in the €-zone; consumer inflation in Switzerland; factory orders, durable goods and weekly jobless claims in the U.S.

Earnings reports today: Tesco Plc (mcap £24bn) and Constellation Brands (mcap $46bn).

Markets will be closed in China, Taiwan, Korea and Israel today.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.