Morning,

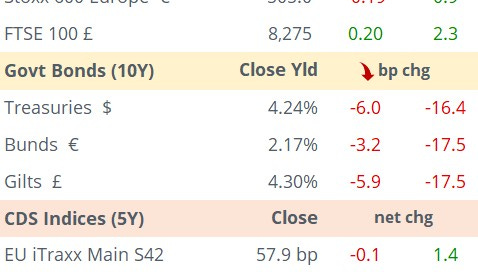

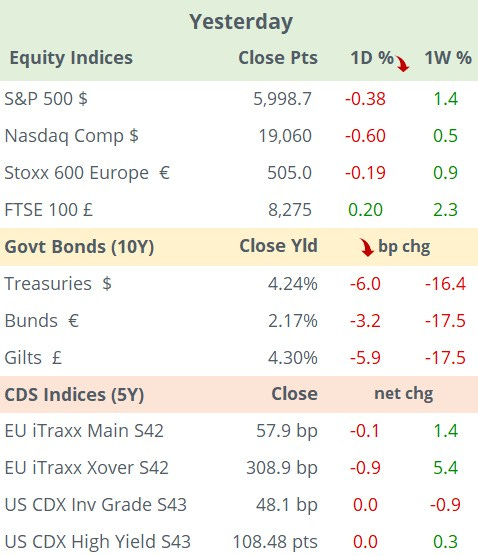

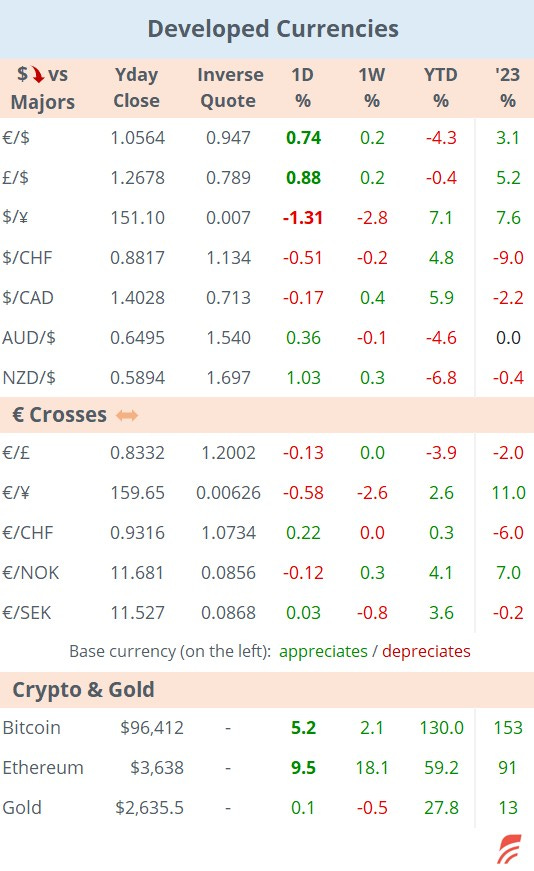

Stocks on Wall Street fell yesterday following an uptick in PCE (personal consumption expenditures) inflation which came in line with consensus at 2.3% YoY. Consumer spending rose reflecting a robust growth pace for the US economy impacting the disinflationary trend. Nasdaq-listed companies led the decline with a 0.8% drop ahead of today's Thanksgiving holiday on traders’ concerns about the Fed’s next move after the inflation update. Markets are pricing in a 25bp rate cut by the Fed in December but are now anticipating a pause at the first two meetings of 2025.

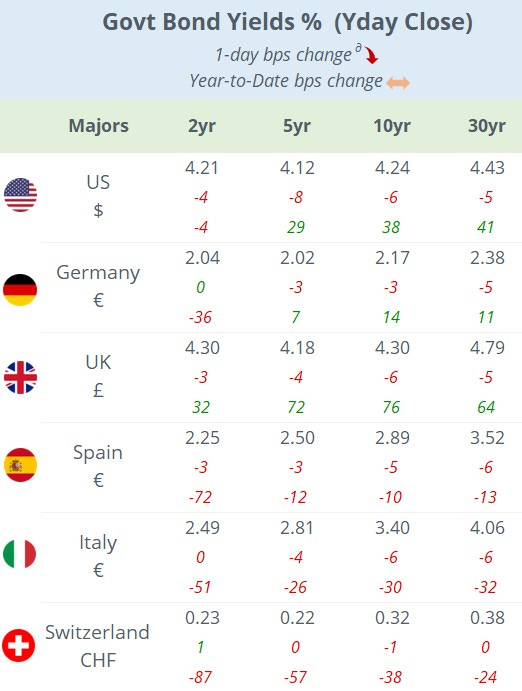

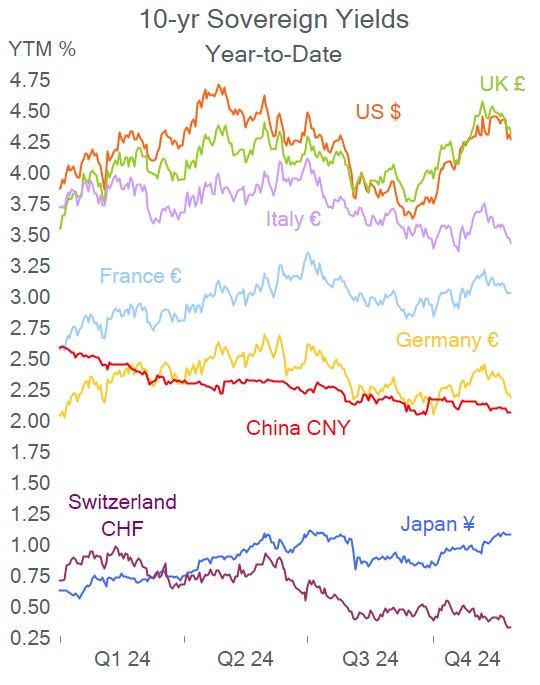

European equity indices also eased yesterday driven by the increasing instability in Paris. The political scenario in France has deteriorated following the recent snap election and Macron’s appointment of Michel Barnier as prime minister. Barnier is facing a confidence crisis as he battles to get his budget approved. The draft budget plans for €60bn of spending cuts and tax rises to cut the country’s 6% deficit but faces slim chances of being approved by parliament as far-right leader Marine Le Pen controls the lower house. French OAT bonds sold off yesterday to yield above 3% and a spread over Bunds of 85bp, the widest in 12 years, compared to +53bp at the end of 2023. French and Greek 10-yr sovereign bonds now yield the same return. In stocks, the CAC 40 index underperformed its neighbours with a 0.7% drop.

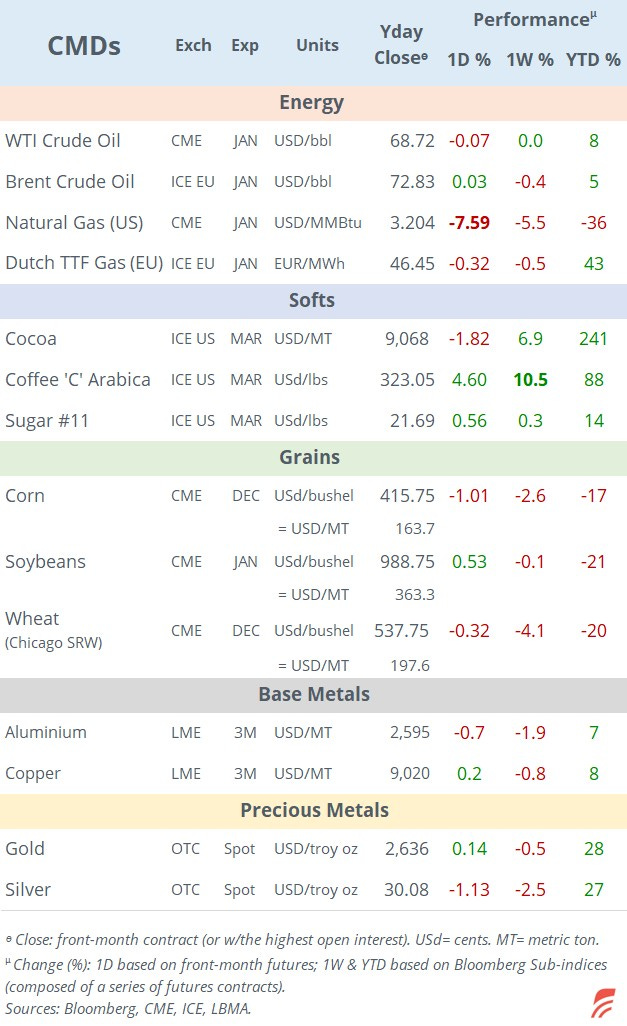

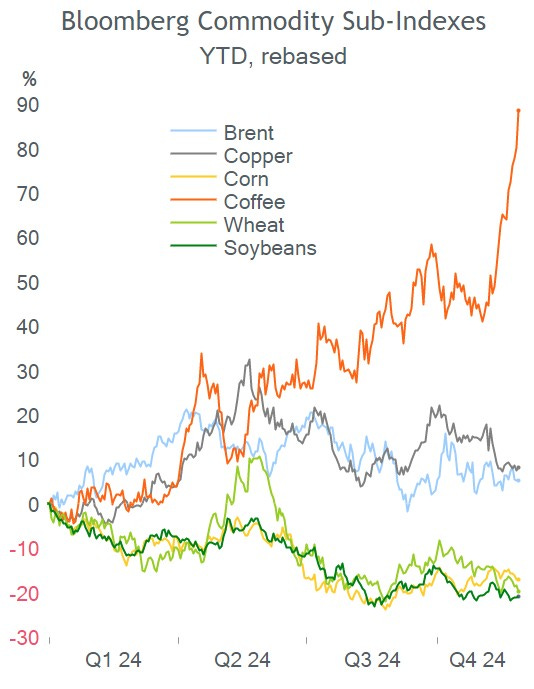

In commodity markets, the notable mover was coffee which rallied 5% on Wednesday to accumulate a 10% gain in the past week and ~90% this year to a 47-yr high. The catalyst is global supply concerns due to Brussels’ new laws on deforestation as well as dry weather conditions in Brazil, the largest bean grower. Arabica coffee front-futures contract in New York closed at $3.23 per pound.

In the energy sector, volatile US natural gas contracts plunged nearly 8% yesterday on lower expected heating demand for the coming weeks as temperatures failed to drop as low as anticipated and increasing output.

Korea’s central bank surprised markets today with a 25bp rate cut to 3%, for a second consecutive meeting as inflation eased faster than the bank anticipated. The Korean on is falling 0.5% this morning.

Asian equities are mixed today with China and Hong Kong down ~1% while others are a touch firmer. European futures are pointing to a positive opening in early trading.

In EM, the Russian rouble (RUB) plunged 7% yesterday to accumulate a 21% depreciation this year to a 32-month low, after the US implemented fresh sanctions on Russian banks last week. The rouble is partially recovering today at 109.

In business news, Elon Musk has rewarded the financial backers of his Twitter acquisition with a 25% stake in his artificial intelligence start-up xAI which reached a $50bn valuation in this week’s funding round.

In credit ratings, Moody’s u/g several Saudi companies including Aramco to Aa3.

In new corporate bond issues, Italian high yield food producer Irca Spa (private) placed €1.1bn of senior secured FRNs at a +375bp margin.

In economics today: German inflation and import prices; Swedish GDP; €-zone sentiment indicators; and inflation in Spain and Belgium.

Tomorrow: the latest €-zone inflation update and Japan’s inflation, retail sales, unemployment and industrial output.

MDE will take a break tomorrow and return on Monday.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.