Good morning,

Asian markets are trading weaker today with the Hang Seng leading the decline with a 2% drop and Sydney shares down by 0.7%. European futures are pointing to a weaker open by 0.25% and US equity futures are also trading lower overnight. The ¥ has broken the 160 resistance level. Brent oil is at $85 and Bitcoin at $61,000, both little changed.

Market sentiment is being driven by inflation updates and politics. This week’s inflation readings in Australia and Canada came in above estimates and higher than a month ago ahead of the key PCE update in the US tomorrow. Also, traders will pay close attention to today’s US Presidential debate following yday’s debate by UK candidates and the recent French TV debate for Sunday’s legislative election.

Yesterday was a strong day for the $ mainly against a weakening ¥ which ended at a 38-year low as it nears 161 but £ also dropped 0.5% to 1.2620, a six-week low. The higher-for-longer rate scenario in the US is keeping the differential with Japanese interest rates at a high level, impacting the ¥ and creating concerns at the Bank of Japan. The central bank warned of potential action if the currency continues to depreciate and 160 is perceived as the level where intervention occurs. In data today, retail sales in Japan rose by 3% YoY, above estimates and higher than a month ago.

Bond prices fell yday following some hawkish remarks by Fed officials but the latest inflation prints also impacted other markets as most European yield curves shifted higher. US Treasury yields added 8bp to 4.32%, Bunds 4bp to 2.45% and Gilts ended 6bp higher at 4.14%.

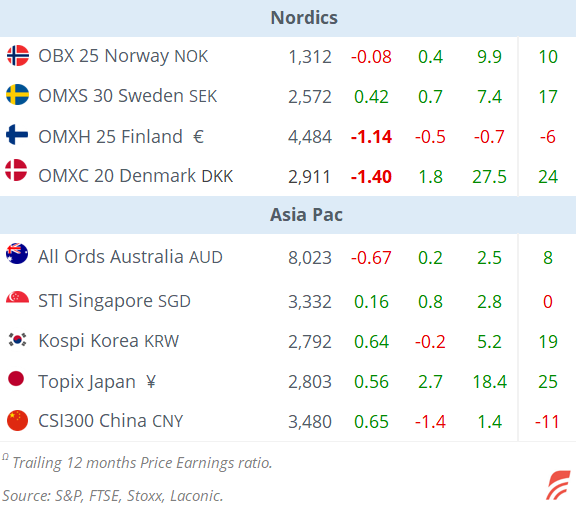

Wall Street finished little changed while European benchmarks fell again with the Stoxx 600 losing nearly 0.6% with stocks in Paris, Madrid and Brussels as the underperformers. Airbus accentuated its weakness with another 3% drop.

In US markets, Amazon added 4% to a record high and joined the $2tn market cap club with Microsoft, Apple, Nvidia and Alphabet.

Micron Tech (US, semiconductors, mcap $157bn) beat revenue ($6.8bn) and earnings ($332mn) estimates on solid demand for AI products but disappointed on its outlook guidance and shares dropped nearly 7% on after-hours trading. The news also hit Nvidia shares which are indicating a 2% fall.

Headlines:

-In French politics, the latest Ifop poll shows Le Pen’s National Rally party leading with a 36% voting intention, followed by the left-wing alliance, which is struggling to maintain unity, with 28.5% and Macron’s centrist party with 21%. The 10-year OAT yield spread over Bunds remains at 74bp for a 3.19% yield, in line with Portugal.

-EU country members Romania and Bulgaria will not be adopting the € after failing to meet economic requirements. High inflation, weak institutions and money laundering risks are the main reasons why these two nations are not following Croatia’s path to joining the €-zone.

It was a calm day for corporate deals. Blackstone is acquiring Village Hotels which runs more than 30 mid-market hotels in Britain for ~£850mn from KSL Capital Partners.

In IPOs, Webtoon Entertainment (WBTN), the Korean online comics platform, was priced at $21 the top of the guidance range for a $2.7bn valuation and will raise $315mn. Trading begins on the Nasdaq exchange today.

On the data front today we’ll get the final Q1 GDP and PCE inflation readings in the US as well as durable goods and weekly jobless claims. Also inflation in Belgium, PPI in Italy, retail sales in Spain and sentiment indicators for the €-zone.

Sweden’s Riksbank announces its policy decision at 08:30 London time (exp unch at 3.75%). In emerging markets, central banks in Mexico (unch at 11% exp), the Philippines (unch at 6.5% exp), Turkey (unch at 50% exp) and the Czech Republic (-25bp to 5% exp) will hold monetary policy meetings today.

That’s all for today, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.