Morning,

Asian equities are rallying today with leading indices in Japan, China and Korea advancing more than 2% despite the lacklustre performance on Wall Street yesterday. The semiconductor sector is the driver of positive momentum after Micron’s update last night. Japanese chip-related companies, Tokyo Electron and Advantest are gaining up to 7%. European and U.S. stock futures are trading between 0.5 and 1% firmer overnight.

Chip maker Micron Technology (mcap $104bn) reported quarterly earnings after the close and beat revenue ($7.75bn) and profit ($887mn) estimates on the back of strong demand for its memory chips from the A.I. sector. Shares rallied 14% in extended hours.

European and U.S. equity markets ended a touch weaker driven by concerns about whether China’s new stimulus plan can revive domestic consumer spending. Also, Morgan Stanley downgraded some auto companies with Ford and GM falling more than 4%. In Germany, news reports suggest that software giant SAP AG (mcap €236bn) is under U.S. investigation over a potential price-fixing incident. Shares fell 2.5%.

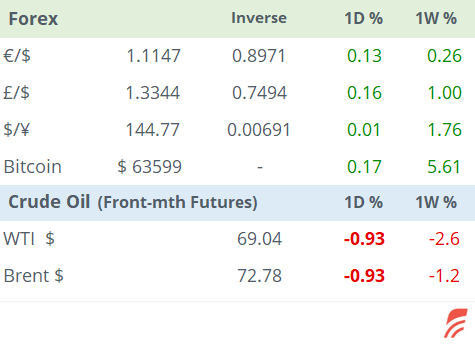

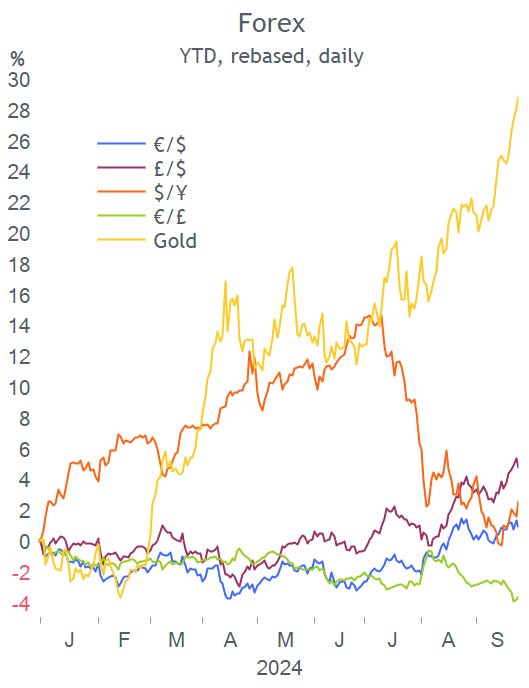

The $ appreciated and benchmark yields shifted upwards by a few basis points across tenors on Wednesday. Oil dropped more than 2% despite crude stockpiles hitting their lowest level in nearly 2.5 years.

Headlines:

-Hurricane Helene is expected to intensify to Cat 4 in its path through the Gulf of Mexico before it makes landfall in northern Florida on Friday and weather models predict severe floods. (NBC)

-Israel does not rule out a ground offensive in Lebanon to fight Hizbollah as the conflict intensifies and Washington tries to avoid an all-out war with a 3-week ceasefire request. (FT)

-The OECD forecasts global inflation to continue to ease and economic growth to stabilise at 3.2% this year but warned of widening fiscal deficits for large nations and urged them to cut spending and raise taxes. (OECD)

-Some Commerzbank (mcap €18bn) shareholders suggested management hold constructive talks with Unicredit after Berlin said it could not block a takeover and ruled out increasing the government’s stake. The Italian bank already controls ~21%. Commerzbank’s stock remains near its 12-year high following this year’s 42% rally. (CNBC)

- ChatGPT parent OpenAI plans to restructure its core business into a for-profit corporation that will no longer be controlled by its non-profit board and co-founder Sam Altam may receive ~7% of the shares. (CNN)

In central bank action on Wednesday, Sweden’s Riksbank cut rates by 25bp as anticipated to 3.25% and signalled further easing measures ahead which could include a 50bp cut. Inflation is running at 1.2% YoY, below the official target.

In new bond placements, the notable corporate issuer yesterday was Oracle, placing senior debt in $ rated BBB with 5, 10 (at T+95bp), 30 and 40-yrs maturities for a total of >$6bn.

Data to be released today: Spain’s retail sales; U.S. GDP (Final Q2), durable goods and weekly initial jobless claims.

Monetary policy meetings today: Switzerland is expected to cut rates by 25bp again to 1%, although futures are pricing in a 50% chance of a larger reduction. Mexico is expected to ease by 25bp to 10.5%.

Large-caps reporting earnings today: Costco Wholesale (mcap $400bn) and Accenture Plc (mcap $213bn).

That’s all for today, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.