Morning,

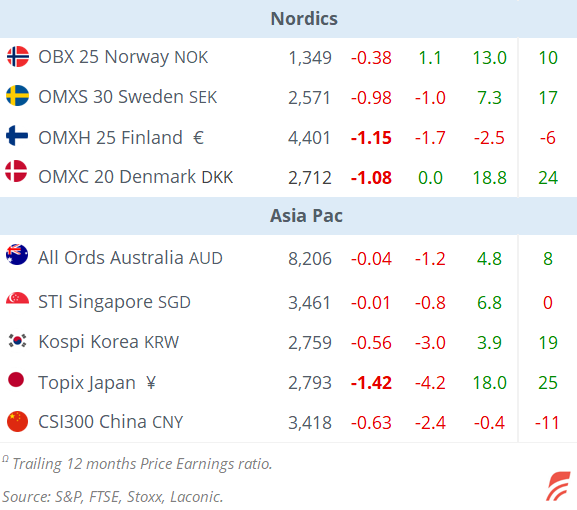

Asian markets are falling sharply with stocks in Tokyo leading the decline with a nearly 3% plunge while Seoul, Hong Kong and Sydney lose more than 1%. European futures are 0.5% lower in early morning trading while US equity futures are modestly firmer overnight. Brent crude is giving up yesterday’s gains and is back at $81. Bitcoin is down by 3% and Ethereum is losing 6% today.

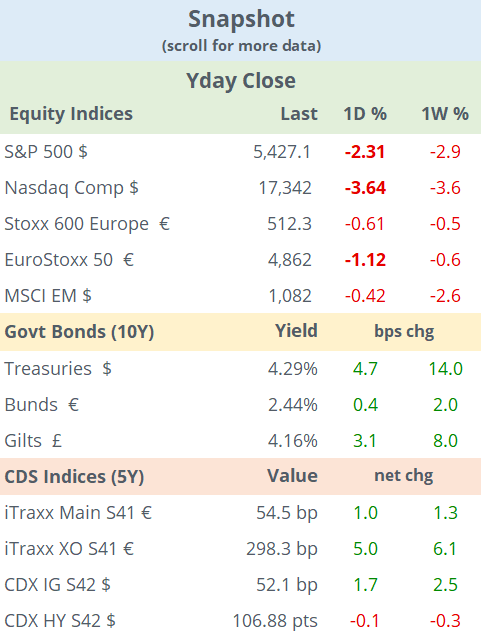

The recent technology sector sell-off accentuated by Tesla’s weak quarterly earnings report and the negative sentiment for risk assets led indices to post their worst day since late 2022. The S&P 500 lost 2.3%, the Nasdaq 100 fell 3.7% and even the small-cap Russell 2000, which has been benefiting from the rotation out of mega-caps, declined 2.1%. Artificial intelligence-related stocks were the most affected following the record gains year-to-date. Nvidia fell 7%, Broadcom 8%, Alphabet and Meta 5%. The broad Nasdaq Composite is down 7% from its all-time high two weeks ago.

We covered Tesla’s overnight earnings report in yesterday’s episode and shares closed 12.3% lower, their worst day in four years, for a total market value of $689bn. Ford (mcap $54bn) had a significant profit miss while beating revenue ($47.8bn) estimates and shares were indicating an 11% drop in extended trading. Visa (mcap $504bn) missed revenue estimates and shares lost 4%.

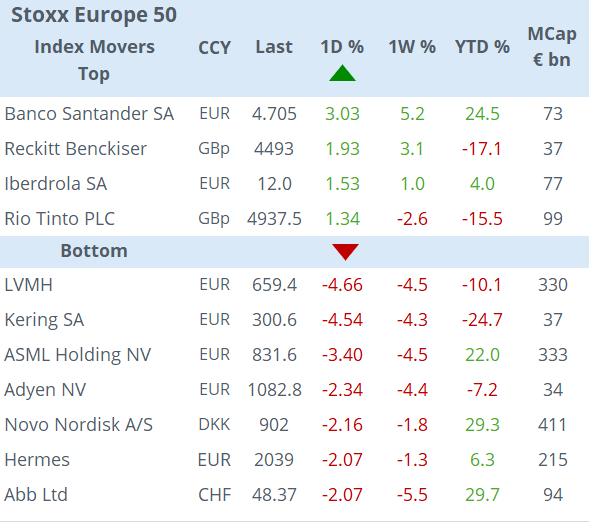

In Europe, luxury names continue to disappoint mainly on lower demand in China, with Kering and LVMH stocks losing almost 5%. The broad Stoxx 600 managed to fall just 0.6% while the blue-chip €-Stoxx 50 index ended more than 1% lower, still outperforming US indices. Another notable mover was Deutsche Bank’s (mcap €29bn) 8% fall after pausing a share buyback and increasing lawsuit provisions that led to its first loss in four years.

Moving on to currencies, the notable mover continues to be the ¥, shifting higher with no official confirmation of market intervention ahead of next week’s Bank of Japan meeting. Traders are pricing in a 71% chance for a rate hike from the actual 0.10%, in stark contrast to all other developed countries.

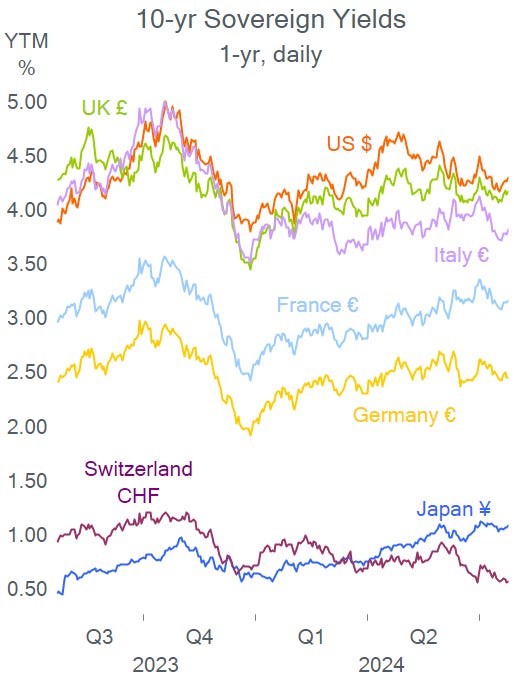

In fixed income markets, short-end yields continue to drift lower with 2-yr yields in the US (4.42%) and Germany (2.71%) hitting a six-month low as yield curve inversions ease.

In economics, the €-zone flash composite PMI for July came in lower than estimated on the back of weaker figures for German and French manufacturing activity. The UK showed solid numbers both in the services and the manufacturing sectors while the US surprised with positive updates in services and a weaker manufacturing reading. All in all, the US and the UK outperformed the €-zone on business activity in July.

The Bank of Canada cut its policy rate by 25bp to 4.5% as expected and lowered its GDP growth forecast for this year from 1.5% to 1.2%. Inflation is running at 2.7%, slightly above the central bank’s target.

In IPOs, OneStream Inc, a financial software platform backed by KKR, raised $490mn on its Nasdaq listing and was priced at $20, above guidance. Shares rallied 34% for a market value of $4.2bn.

In credit ratings, Deutsche Post AG (mcap €48bn) was u/g one notch to A- by Fitch.

Key economic data today will be the US GDP advance for Q2 and durable goods ahead of tomorrow’s US PCE inflation update and Germany’s Ifo sentiment indicators. Ukraine’s central bank meets today, following Fitch’s one-notch credit d/g to C.

Swiss giants Nestle and Roche report earnings today together with Astra Zeneca, Unilever, Sanofi, Essilor and TotalEnergies.

Finally, Netanyahu will visit Biden at the White House as he urges Washington to continue to support Israel in its fight against Hamas.

See you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.