Podcast script: Estimated reading time ⏲ ~5 mins

Morning,

Let’s begin with today’s big news in the mining sector. Australian giant BHP has approached London-listed miner Anglo American with an all-stock buyout. BHP has four weeks to make a formal bid. Anglo’s market cap was £29.5bn as of yesterday’s close or nearly $37bn compared to BHP’s $148bn. Sydney’s stock exchange is closed today on a national holiday. A combination would grant BHP access to Anglo’s copper, potash and coking coal mines and a transaction should trigger multiple deals in the sector as Anglo needs to divest its platinum and iron ore assets before the acquisition.

The other big story came in last night with Meta’s earnings report after the US market closed. Although Meta beat revenue ($36.5bn) and profit ($12.3bn) estimates, it disappointed with guidance as it raised its full-year expense forecast to continue developing its artificial intelligence platform. It also forecasts lower revenues for Q2, which would be the first quarterly sales drop since late 2022. Shares plunged 15% in after market hours.

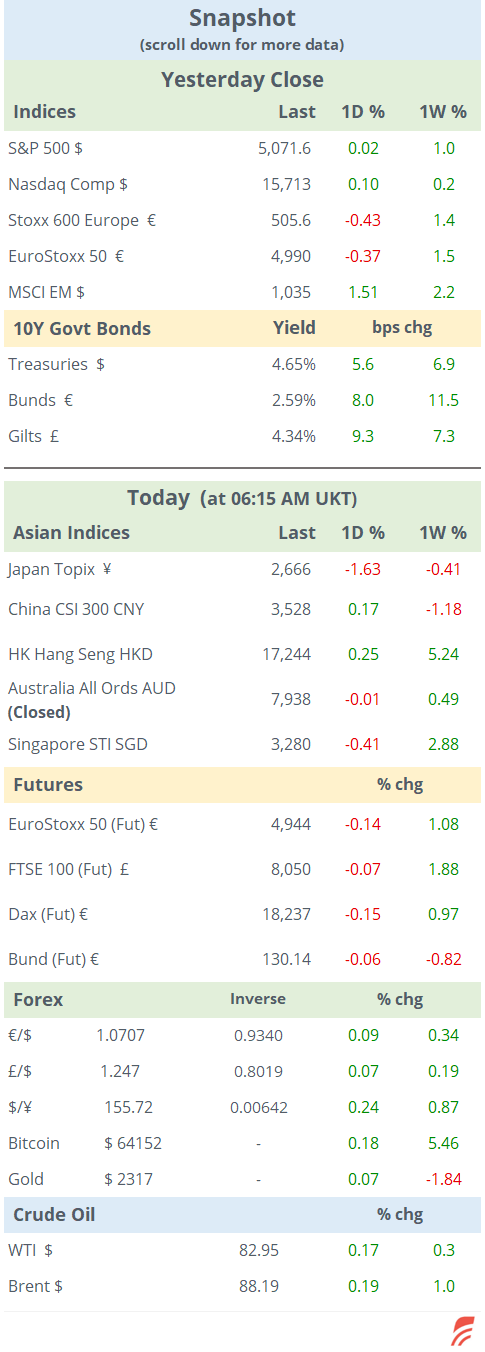

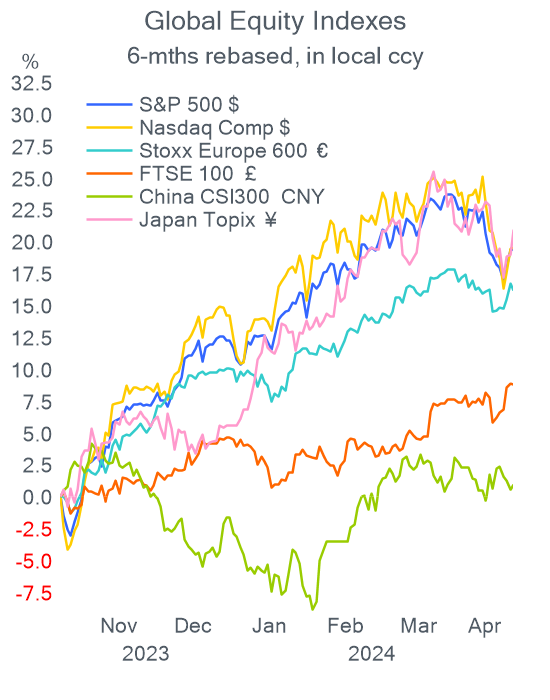

Stocks on Wall Street ended modestly firmer yesterday while European equities fell 0.4% on average. Tesla rallied 12% on the back of a plan for an affordable car despite its miss on earnings. Shares are 35% lower YTD for a total market value of $516bn. A few European movers worth highlighting are Dutch chip equipment maker ASM International with a 13% jump on strong guidance and Sweden’s Volvo and Svenska dropping 10 and 12% after reporting.

In data updates yesterday, Germany’s IFO surveys came in better than a month earlier and above estimates, reflecting an improvement in business sentiment. Sweden’s unemployment rate surprised with a jump to 8.6%. In central bank decisions, Indonesia surprised markets with a 25 bp rate hike to 6.25% against analysts’ expectations for no change.

Other headlines,

-Spanish Prime Minister Pedro Sanchez surprised with an announcement that may lead to his resignation, as he said he would suspend public duties for a week to “stop and reflect” on his interest in continuing in frontline politics following an investigation on his wife over corruption claims.

-The European Commission has raided the offices in Poland and The Netherlands of Chinese company Nuctech, a maker of security scanners used in airports and ports on national security grounds, raising tensions between Brussels and Beijing. Nuctech stands for nuclear technology and is partially state-owned.

The Japanese yen continues to depreciate and break fresh records against the dollar and the euro, with some politicians suggesting that a central bank intervention should materialize if it breaches 160 versus the dollar. The Bank of Japan may provide some colour at its two-day policy meeting starting today.

The UK Debt Management Office placed almost £7bn of 30-year Gilts at a record interest rate of 4.782%, a day after announcing an increase in debt issuance by £12bn to £278bn for this year.

In corporate deals, the oil & gas sector saw Israeli-owned Ithaca Energy, based and listed in Britain, acquiring nearly all of ENI’s operations in the UK for more than £750mn in stock, allowing Ithaca to expand exploration in the North Sea. The deal will result in ENI owning almost 40% of the combined entity. Ithaca’s current market value is £1.2bn.

Traders maintain their focus on earnings with Microsoft, Alphabet, Intel, and Comcast reporting today. The mega-caps will report after the market closes.

Today’s key data release will be GDP for Q1 in the US and core PCE price advances, ahead of tomorrow's PCE inflation update. In monetary policy meetings, the Central Bank of Turkey meets today with rates expected to remain steady at 50%.

That’s all for today, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. It is prohibited to copy and paste, forward, or set up auto email forwarding rules to give access to others. Please share the publication using the button below, as access is free to all.