Morning,

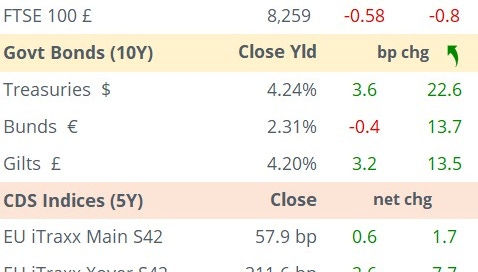

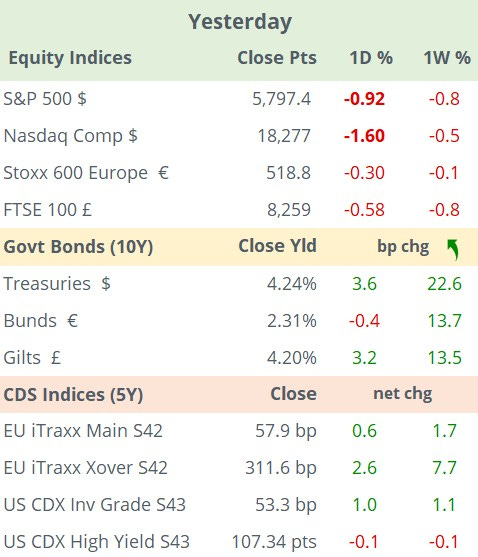

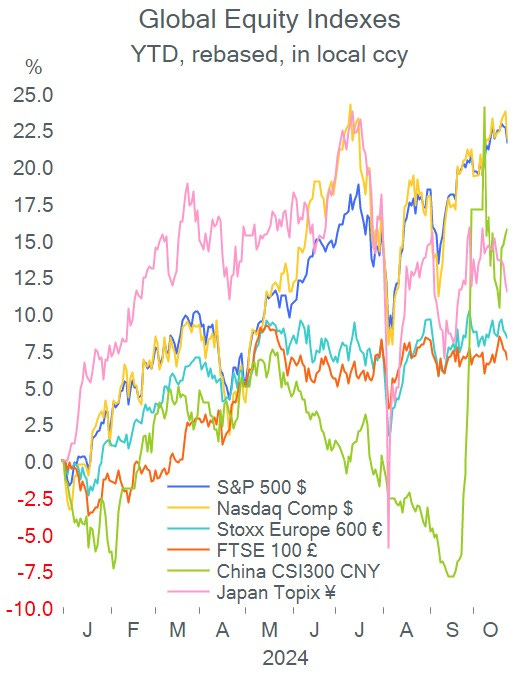

US stock indices ended between 1 and 1.6% lower yesterday with most mega-caps losing around 3% and poor updates from Coca-Cola (-2%) and McDonald’s (-5%) ahead of Tesla’s (mcap $764bn) earnings report after the close which surprised analysts with a bullish outlook that triggered an after-hours rally of 12% ($239).

Tesla reported revenues of $25bn and earnings of $2.5bn for the quarter, both up by 8% YoY. It raised its 2025 outlook, beat profit margin forecasts, and announced it was not considering a non-autonomous taxi model.

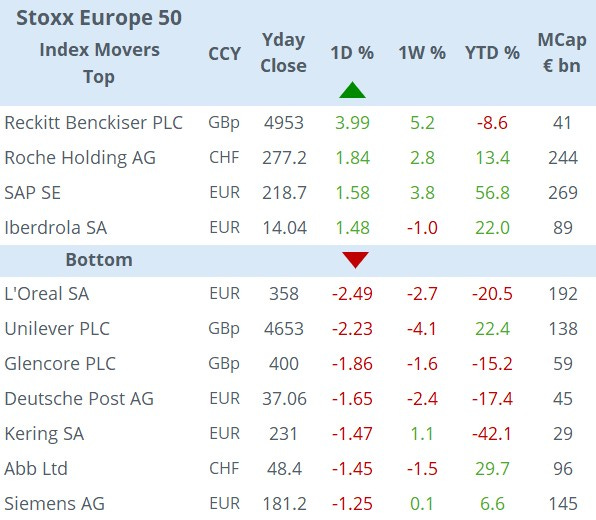

European equities finished a touch lower for a 3rd straight session with L’Oreal (-2.5%) and Unilever (-2.2%) as the biggest losers among blue-chip names. Deutsche Bank (mcap €31bn) posted a record pre-tax profit in Q3 (€2.3bn) on the back of stronger revenues at the investment bank but warned of rising bad loans ahead and shares ended 1% lower.

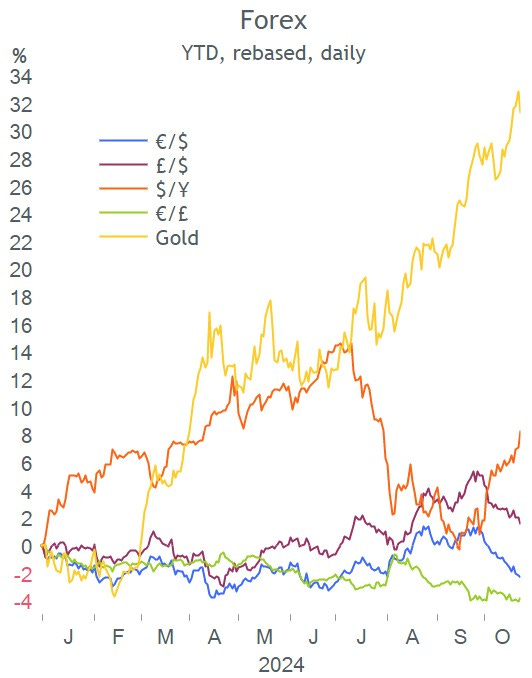

In forex markets, the $ continues its recovery trend driven by strong figures for the US economy leading to a less dovish Fed and the so-called ‘Trump trades’ ahead of the election. The DXY index is 4% higher in October at its strongest level in two months. The ¥ accelerated its depreciation trend and is once again above 152.

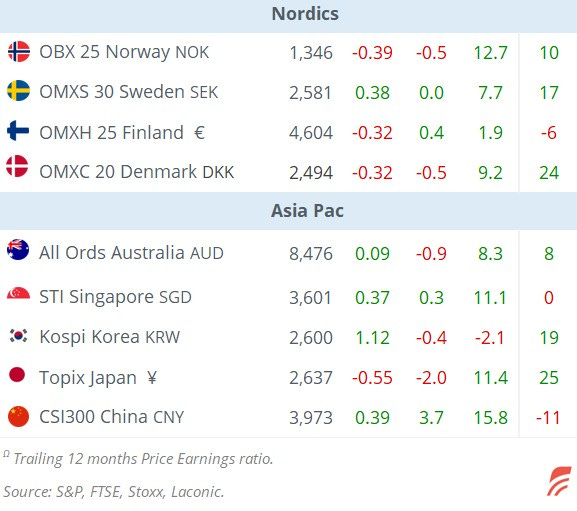

Markets in Asia are mostly weaker this morning with Hong Kong and mainland indices losing 1%. European futures are mixed while US futures are a touch firmer following Tesla’s results. Brent oil is recovering from yesterday’s losses and trades around $75.80 this morning.

The Bank of Canada cut its policy rate by 50bp to 3.75% as anticipated to boost a weakening economy and signalled further easing measures as inflation, at 1.6%, is already well below the 2% official target.

In credit ratings, Toronto Dominion Bank was d/g one notch by Moody’s to A2.

Today’s earnings reports will come from Barclays, Dassault Systemes, Honeywell and UPS.

In economics, October’s (Flash) Services and Mfg PMIs for the €-zone, UK, US, Germany and France; and US weekly jobless claims.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.