Podcast script: Estimated reading time ⏲ ~4 mins

Good morning,

Wednesday was a risk-off day for developed markets with equities dropping from record highs ahead of a highly awaited earnings report by chip giant Nvidia after the market close. Leading indices on Wall Street and Europe finished lower by 0.25% to 0.5% on average. Basic resources and the Auto sectors pulled the FTSE and CAC indices down by more than 0.5%.

Nvidia shares jumped 6% to more than $1,000 in after-hours trading when it beat quarterly revenue ($26bn, +260% YoY) and earnings ($14.9bn, 7x YoY) estimates, as demand for A.I. chips remains strong. It also beat expected sales for Q2 with a forecast of $28bn. At the close, before reporting, shares were up by 92% YTD and have increased 25-fold in the last five years to become the third-largest US company with a market cap of $2.3tn. It more than doubled its cash dividend and announced a 10-for-1 stock split for June 10th.

Asian markets are trading mixed today with mainland China and Hong Kong stocks down by around 1% while Japan, Singapore, Taiwan and Korea are a touch firmer.

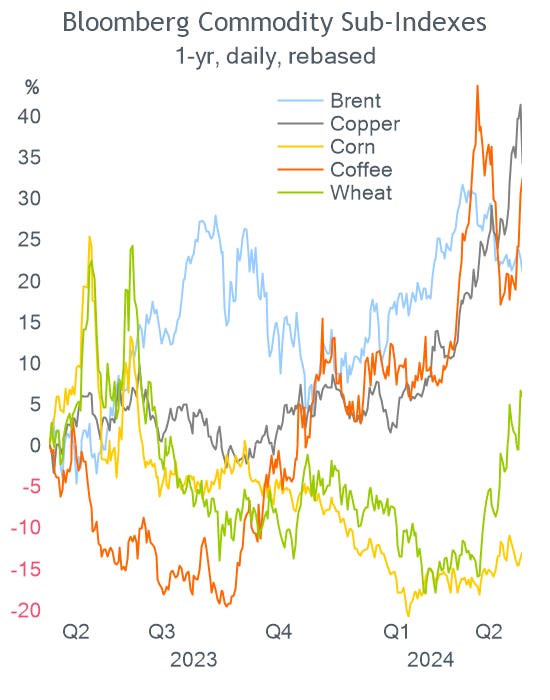

Japanese 10-year government bond yields rose to over 1% for the first time in more than a decade. Crude oil fell 1% yesterday after US inventories rose unexpectedly and is weaker this morning with Brent trading around $81.50. Stock futures in Europe are indicating a firmer opening this morning.

Headlines,

-In politics, Prime Minister Rishi Sunak surprised analysts by calling an early national election for July 4th, when polls indicate a clear advantage for the Labour Party.

-China launched military exercises around Taiwan as a strong punishment for the new leader who assumed only three days ago.

-Goldman Sachs CEO said he expects no interest rate cuts by the Fed this year.

Headline inflation in Britain rose by 2.3% YoY, the lowest level in 3 years and much lower than a month earlier. However, it eased by less than analysts anticipated, leading traders to scale back bets on an imminent policy rate cut. Futures markets are now pricing in a 90% chance of no rate change in June. The core CPI reading also slowed down from March to 3.9% but was above expectations. The RPI reading came in at 3.3%, in line with estimates. Services inflation (5.9%) was much higher than expected (5.5%). The Bank of England forecasts headline inflation to end 2024 at 2.6%. The Gilts curve jumped upwards with 2-year yields adding 14bp to 4.45%, the highest since early May.

Korea’s central bank left its policy rate unchanged today as expected at 3.5% as upside risks to inflation have increased.

In corporate deals, Anglo American rejected yet another improved takeover bid by BHP worth £29.34 per share, an 8.5% premium to yesterday’s close or $50bn of total equity value. Anglo shares ended little changed while BHP is dropping almost 3% today. Anglo agreed to a one-week extension to continue negotiations.

Also, US private equity firm Oaktree Capital took control of the Italian football club Inter Milan after its Chinese owner Suning defaulted on a loan.

Portugal placed 30-year sovereign bonds, rated A3/A-, at 99bp over Bunds or a 3.68% yield. On the corporate front, the notable issuer was Swisscom (Telco) which placed 7.5, 12.5 (at 3.74%) and 20 years senior notes rated A1/A. Other corporates issuing in € include American Tower Corp (REIT/US), Molson Coors (Beer/US), Nexans (Cables/France), Aker (Energy/Norway) and Sagax (Real Estate/Sweden).

Today’s data release highlight will be May’s preliminary PMIs, Mfg and Services, for the US, UK, the €-zone and Japan. Turkey’s central bank will hold its policy meeting with rates expected to remain unchanged at 50%.

Companies reporting today: Intuit, Medtronic, Workday, National Grid, Xiaomi, Lenovo and Meituan.

See you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Please share using the button below, as access is free to all.