Morning,

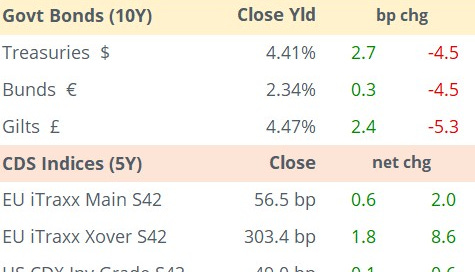

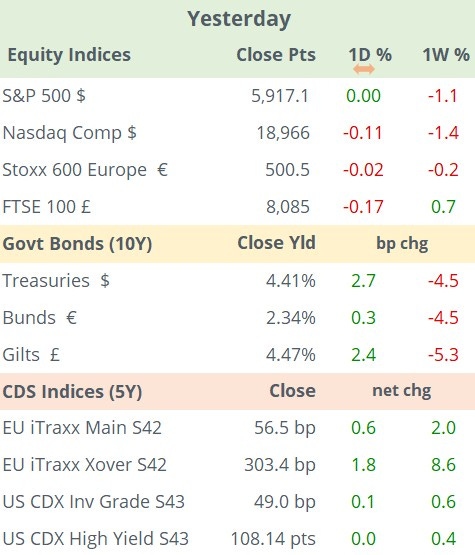

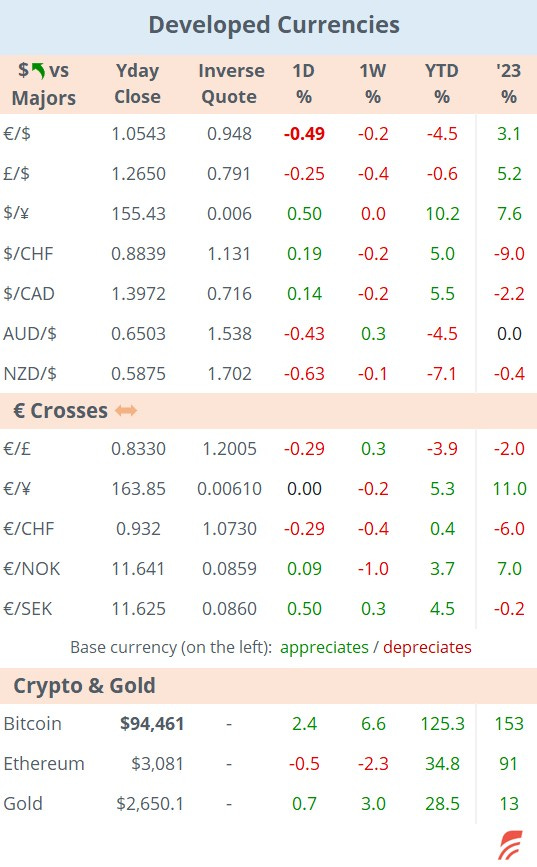

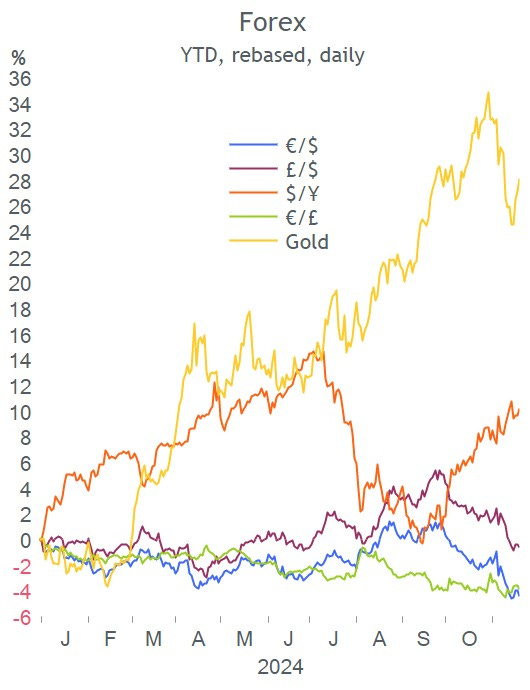

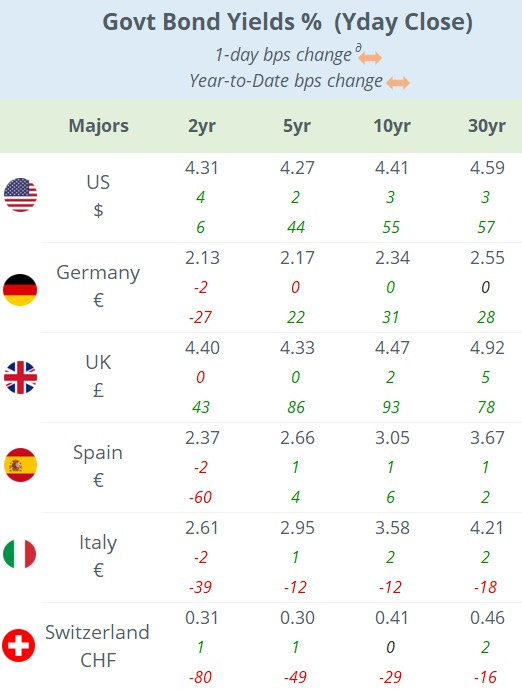

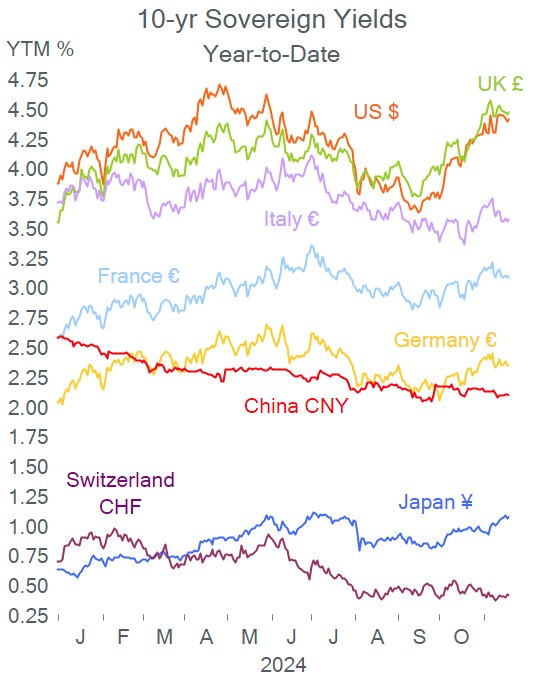

Wall Street ended flat last night ahead of Nvidia’s earnings report and European markets closed a touch lower on rising geopolitical tensions. Some of the so-called ‘Trump trades’ resumed their appreciation with the $ advancing and Bitcoin rapidly approaching $100k. Bond markets were little changed on both sides of the Atlantic.

Giant chip maker Nvidia Corp (mcap $3.6tn) beat quarterly revenue ($35bn, +94% YoY) and profit ($19.3bn, +109% YoY) estimates as these doubled from a year ago on strong AI demand but delivered the slowest sales growth outlook (+7% for the next quarter) in almost two years. Shares ended almost flat during the session, initially falling 5% in after-hours trading following the release but recovered partially. Nasdaq futures are marginally weaker in overnight trading.

The ECB warned about a bubble in A.I.-related stocks which could burst abruptly if the ambitious expectations are not met.

Yesterday’s notable mover among US single names was discount retailer Target which posted its biggest earnings ($854mn, -12% YoY) and revenue ($25.7bn, +1% YoY) miss in two years, cut its full-year guidance and shares fell 22%, the steepest daily drop in more than two years, to a total market value of $56bn, its lowest level in one year.

In economics, British inflation rose for the first time in three months in October with headline CPI gaining 2.3% YoY, well above September’s 1.7% mostly on higher housing and energy prices. The update marginally exceeded the Bank of England’s estimate and its 2% target, confirming why the central bank is cautious regarding interest rate decisions. Core CPI also shifted upwards to 3.3%, RPI or retail price index jumped from 2.7% to 3.4% and the Services component of the CPI reading rose to 5%. Traders reduced their bets on lower interest rates and futures are now implying an 83% chance for no rate change at the BoE meeting in four weeks.

Asian equities are mostly weaker today following Nvidia’s report last night and TSMC is just 1.5% lower. In India, the stocks of the Adani Group of companies are falling between 10 and 20% today following a $265mn bribery charge against the group Chairman in the US. Adani Green Energy pulled a planned bond placement as the group’s bond prices dropped. The Nifty 50 Index is down ~1% today.

In monetary policy decisions, Bank Indonesia left rates steady at 6% as expected as the central bank focuses on currency stability following Trump’s victory. The rupiah (IDR) is 3% weaker YTD.

In new corporate bond issues in €, Deutsche Tel placed 10-yr BBB+ rated notes at 3.30% and Ireland's SmurfitKappa sold 8 and 12-yr BBB bonds.

The central banks of Turkey (unch at 50% exp) and South Africa (-25bp to 7.75% exp) hold policy meetings today.

Economic data to be released include €-zone consumer confidence, Norway GDP, Canada PPI and US existing home sales and weekly jobless claims.

Large-caps reporting today include Baidu, Intuit, Deere & Co, Copart and Ross Stores.

Thanks for your time.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.