Script: Estimated reading time ⏲ ~4 mins

Good morning,

The Fed kept rates steady as widely expected at a 5.25-5.5% range, a 23-year high, and Governor Powell offered a somewhat dovish tone to markets by saying that although there’s a lack of further progress on inflation, he leans towards eventual rate cuts. He also said that it was unlikely that the next move would be a rate hike.

Traders confirmed that the Fed is delaying the decision to begin easing its monetary policy as inflation is still too high. The dollar fell, bonds rallied and stocks ended slightly weaker yesterday.

Let’s have a listen from Powell himself (audio).

"The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably towards 2%,"

"In recent months, there has been a lack of further progress towards the Committee's 2% inflation objective".

The Fed will also reduce the pace at which it is cutting its balance sheet from next month by selling $35bn less in Treasuries per month.

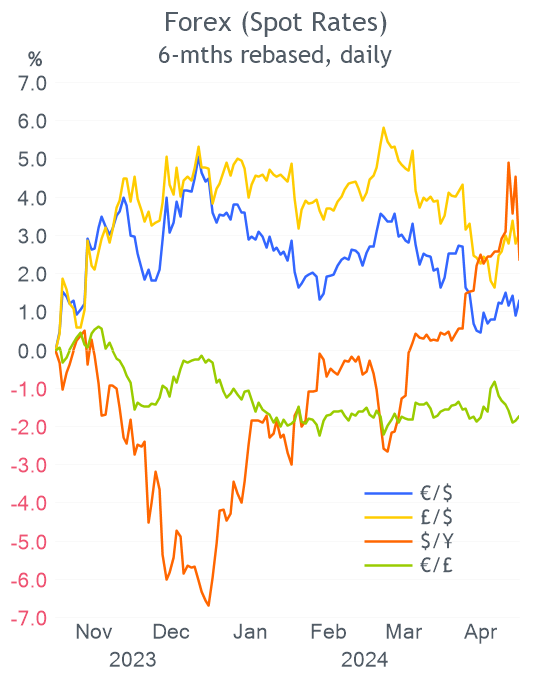

The US Treasury curve shifted sharply lower by around 10 basis points with 2-year Notes now yielding 4.94% and 10-year Bonds at 4.59%. The dollar index reversed and declined mostly against a recovering ¥, the € and the Swiss franc.

Moving on to other markets that were open yesterday, the notable mover was crude oil. Brent futures plunged 5% to a 7-week low, their worst day since October on the back of increased US inventory level (+7.3mn barrels reported for last week) and easing tensions in the Middle East. Brent was trading at 83.40 late yesterday and is now closer to $84.

Asian stock markets are mixed this morning with the Hang Seng as the highlight with a 2% gain to a 6-month high. European futures are mixed, the FTSE is pointing to a firmer open while the Eurostoxx 50 is marginally weaker and the S&P is recovering yesterday’s loss. Bitcoin is dealing around $57,000.

Pfizer beat Q1 revenue ($14.9bn, -20% YoY) and net profit ($3.1bn, -43% YoY) estimates and raised its full-year profit outlook, as it tries to replace the business generated by its Covid vaccine. Shares added 6% for a market cap of $154bn.

Several significant earnings misses led to steep share price drops. Disappointing updates from AMD (-9%), Super Micro Computer (-14%), CVS Health (-17%) and Starbucks (-16%).

Spain’s BBVA confirmed its intention to acquire smaller rival Banco Sabadell for €12bn, offering shareholders a 30% premium to Sabadell’s close on Monday. A combined entity would control 23% of the country’s deposits and 21% of the mortgage market.

In IPOs yesterday, travel and cruising operator Viking Holding had its debut on the NYSE after being priced at $24. Shares gained 9% to a total market value of $8bn.

In credit ratings, Nvidia was upgraded one notch to AA- by S&P, and Japanese banks Sumitomo and Mitsubishi UFJ Trust were upgraded one notch to A by Fitch.

Today we’ll learn about manufacturing PMIs in the €-zone, inflation in Switzerland, international trade and factory orders in the US. On the earnings front, we’ll hear from Apple, Amgen, Moderna, Novo Nordisk, Shell, ING, and Swisscom among others.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. It is prohibited to copy and paste, forward, or set up auto email forwarding rules to give access to others. Please share the publication using the button below, as access is free to all.