The Fed’s easing cycle has finally begun with a jumbo 50bp interest rate cut, to a 4.75 to 5.0% range, larger than most analysts expected but in line with what futures markets were pricing in. The FOMC signalled more easing ahead and only one voting member opted for a 25bp reduction. The recent weakness in job creation increased concerns that the U.S. economy is cooling rapidly. Fed officials said they had gained more confidence that inflation was decelerating although it remains somewhat elevated.

It was the Fed’s first rate cut since March 2020 when it eased by 100bp during the pandemic outbreak. The FOMC’s “dot plot” now shows that policymakers expect the target rate to drop by another 50bp by year-end, an additional full percentage point by the end of next year. Futures markets are implying a 33% probability of another 50bp rate cut at the next meeting in November.

The DXY $ index finished unchanged and bond yields shifted upwards by just a few basis points except for the Gilts curve which rose by 8bp across tenors following the inflation update. U.S. equities reacted positively to the Fed announcement propelling the S&P 500 to a new record but later reversed and closed a touch lower on the day. European markets closed before the announcement with indices down by ~0.5%.

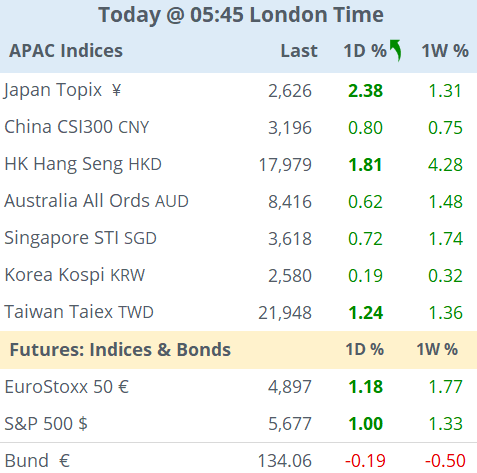

Asian markets are rallying today with stocks in Japan gaining >2%, and by 1% in Hong Kong and Taiwan. European index futures are pointing to a strong open of >1%, in line with U.S. futures overnight. Bitcoin is 3% higher at $62k.

In other monetary policy updates yesterday, and contrary to the global trend, Brazil raised rates by 25 basis points to 10.75% while Indonesia surprised with a 25bp cut to 6%.

In economic data, €-zone headline inflation in August was confirmed at 2.2%, much lower than in July and the lowest since mid-2021. U.K. CPI inflation also came in steady at 2.2% but the services component rose to 5.6% YoY. Also, the core CPI reading rose to 3.6%, exceeding estimates, a day ahead of the Bank of England’s policy meeting, sending the pound above 1.32 against the $.

In M&A, British life insurer Legal & General Group (mcap £13bn) sold its U.K. housebuilder Cala Group in a £1.35bn deal. In business news, Microsoft and Blackrock are teaming up to create a $30bn fund to invest in energy and infrastructure to support the demand for AI.

Thursday will also be active for central banks with the Bank of England (unch at 5% exp; futures: a 19% prob of a 25bp cut), Norges Bank of Norway (unch at 4.5% exp) and Turkey (unch at 50% exp) holding policy meetings.

It will be a light day on the data front with U.S. weekly jobless claims and existing home sales. U.S. logistics group FedEx will be the only blue-chip reporting earnings today.

September Treasury bond futures expire today, leading equity futures expire tomorrow and a new series of CDS indices will be launched tomorrow.

That’s all for this week, Markets Dawn Europe will return on Monday.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.