Good morning,

Markets Dawn Europe will be shorter than usual today.

Global markets experienced one of the most volatile days this year with a steep risk off sentiment triggered by renewed trade tensions between the US and China, mainly on the semiconductors´space. Also, Trump´s doubts on defending Taiwan added to traders´concerns.

The potential escalation of trade conflicts with China pulled chip stocks sharply lower and the Nasdaq Composite fell 2.8%, its worst day since late 2022. The S&P 500 ended 1.4% lower, its steepest decline in 2.5 months. The S&P 500´s equal weighted version outperformed with a small 0.3% drop, as the sell-off was concentrated on the best perfominng large-cap stocks this year. The Dow Jones Industrials, which is a price weighted index, advanced 0.60% to a new record of 41,200 points. The VIX volatility index jumped to 14.5%, the highest level in six weeks.

The Philly Semiconductors´index plummeted 7%, its worst day since the early days of the Covid pandemic, with Nvidia losing 6.6%, Broadcom 8% and ASML 11%. The technology sector was by far the worst on both sides of the Atlantic, with Communication Services and Consumer Discretionary also falling sharply in the US.

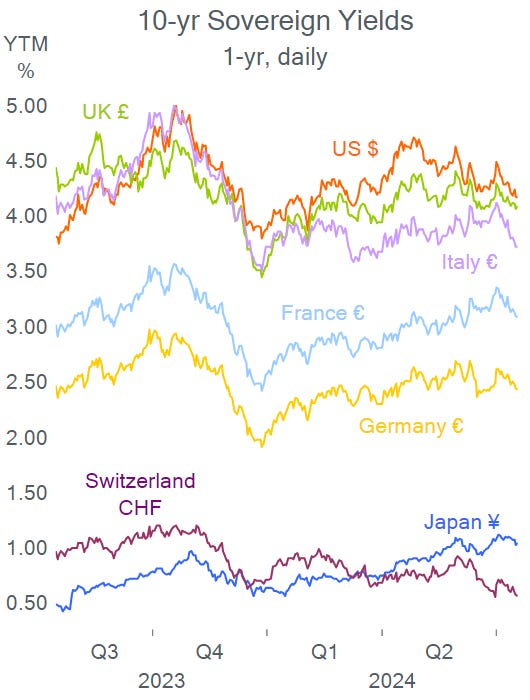

Interest rates were little changed and the DXY $ index accelerated its downward trend with a 0.5% decline.

Investors´focus turns to the ECB´s policy meeting today which is widely expected to maintain its deposit rate steady at 3.75%. The attention will be on the press conference language at 14:45 CET, in search for hints regarding a potential cut in September.

Asian markets are following on the negative trend in the US and are declining sharply with Taiwanese stocks down more than 2% with TSMC as the main drag (-3.5%) but Japan and Korea are also weaker by 1%. The ¥ appreciated sharply yesterday and is now at 156.50.

Headlines:

-Biden tested positive for Covid, is suffering only mild symptoms and will self-isolate. Nearly 40% of Democratic registered voters said he should drop his reelection effort, according to an Ipsos poll.

-Fed officials, Waller and Williams, made dovish remarks supporting a rate cut in the coming months and ahead of November´s election.

In corporate deals, French eyewear giant Essilor Luxottica (mcap €88bn) agreed to acquire streetwear brand Supreme for $1.5bn from VF Corporation which also owns North Face and Vans. Essilor shares fell 4.5%.

In debt capital markets, Britain´s Nationwide Building Society €1bn 8-year senior bond, rated A+, was the notable bond placement. (at Bunds +115bp)

Key data to be released today include: UK´s employment and earnings figures and weekly jobless claims in the US. South Africa´s central bank holds its monetary policy meeting with rates expected to stay unchanged at 8.25%.

Large-caps reporting earnings today include: Netflix, TSMC, Novartis, Abbot labs, ABB, Volvo, Blackstone and Atlas Copco.

That’s all for today.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.