Podcast 🎙 ↑↑↑↑ Scroll down for the script.

Morning,

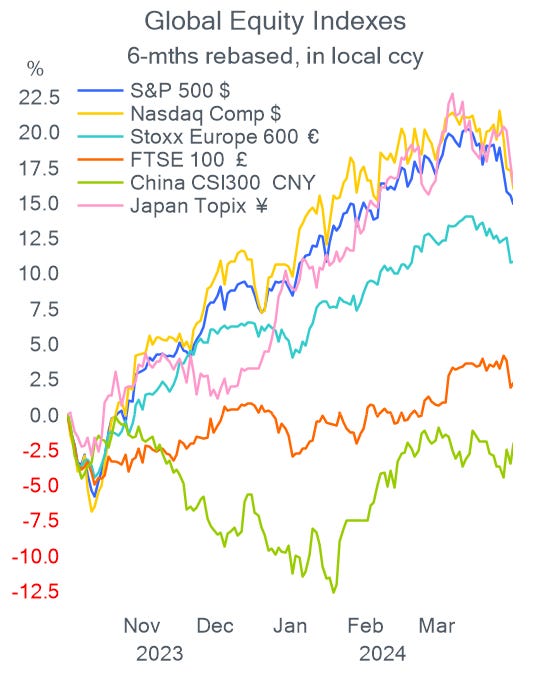

Wall Street stocks sold off again yesterday, with earnings reports disappointing and the chip sector falling sharply. The S&P 500 ended 0.6% and Nasdaq more than 1% lower last night, with information technology as the weakest sector. Companies that reported either poor Q1 results or delivered weak guidance for the quarters ahead include insurer Travelers and real estate trust Prologis, both falling more than 7% and Abbot Laboratories, losing 3%.

Equity indices in Europe ended mostly unchanged with the broad Stoxx 600 and Eurostoxx 50 barely changing on the day. Madrid’s Ibex index added 1% while Amsterdam’s AEX fell 1%.

ASML, the Dutch semiconductor equipment maker, reported weak Q1 results with sales dropping by 21% YoY to €5.3bn and net income by 37% to €1.2bn, reflecting a slowdown in the sector following a long period of strong performance. Shares lost 6.7%, their worst day in 22 months, triggering a sell-off in the chip sector and sending the Philadelphia Semiconductor Index to the lowest level in two months. ARM Holdings plunged 12% while Nvidia and Micron lost around 4%. Taiwan’s TSMC is trading unchanged today.

Airline stocks in the US rallied yesterday driven by the strong Q1 results by United Airlines which saw shares climb 17%, its best single day in more than one year, despite reporting a quarterly loss. United delivered an upbeat guidance for the current quarter. Rival American Airlines rallied more than 6%.

Asian equities are trading firmer today with Korea, Singapore and Hong Kong advancing by at least 1.5%.

Crude oil lost 3% yesterday on the back of higher US inventories and concerns over Chinese demand, despite the tensions in the Middle East. Brent is now at $87.50. In soft commodity markets, coffee futures continue to trade higher, adding nearly 5% and accumulating a 34% gain year-to-date.

Headlines,

-A severe and unprecedented storm hit the United Arab Emirates with the heaviest rains in 75 years causing extreme floods that led to disruptions in Dubai, one of the world's busiest travel hubs. 18 months of rainfall fell within 24 hours bringing the country to a standstill.

-The IMF released more economic forecasts and raised concerns about four countries for their high fiscal deficit. The US deficit is expected to climb to 7.1% next year, well exceeding the 2% estimated for all developed countries. China is also seen widening its fiscal deficit to 7.6%. The UK and Italy are also on the watchlist for increased macro imbalances.

-Preliminary results of yesterday's snap election in Croatia suggest that no majority has been formed as neither the ruling party nor its biggest opposition has claimed enough seats to govern.

-Germany’s finance minister described the country’s current economic situation as miserable and urged for structural reforms, including cutting taxes and red tape, to regain competitiveness.

Britain’s inflation rate rose by 3.2% in March, down from 3.4% a month earlier but cooled by less than analysts expected. Core inflation also printed above estimates at 4.2% but below February’s reading. The update led traders to reduce their expectations for a policy rate cut by the Bank of England and are now pricing in one cut this year. Headline inflation in the €-zone was confirmed at 2.4% in March and core inflation at 3.1% as the disinflation trend supports the scenario of a rate cut by the ECB in June.

A curious event took place in New Zealand yesterday when the statistics agency alerted it had released an incorrect inflation figure, replicated by media sources. Headline inflation rose by 4% YoY and non-tradeable inflation was 5.8%.

In corporate deals, Vinci, the French infrastructure group, acquired a controlling stake (50.01%) in Edinburgh Airport for £1.27bn. The existing shareholders, Global Infrastructure Partners, will maintain the other half.

In new bond issues, Swiss biotech and pharma Lonza Group raised €1bn with a 12-year senior bond rated BBB+, priced at Bunds + 150 bp or a 4% yield.

In credit ratings, Allegion Plc, the US-listed security products company, was upgraded one notch by Fitch to BBB.

Today’s data releases will be US-focused with the Philly Fed Business index, existing home sales and weekly jobless claims. It will be an active day for Fed speakers with Bostic, Williams and Bowman participating in conferences.

That’s all for today, see you tomorrow.