Morning,

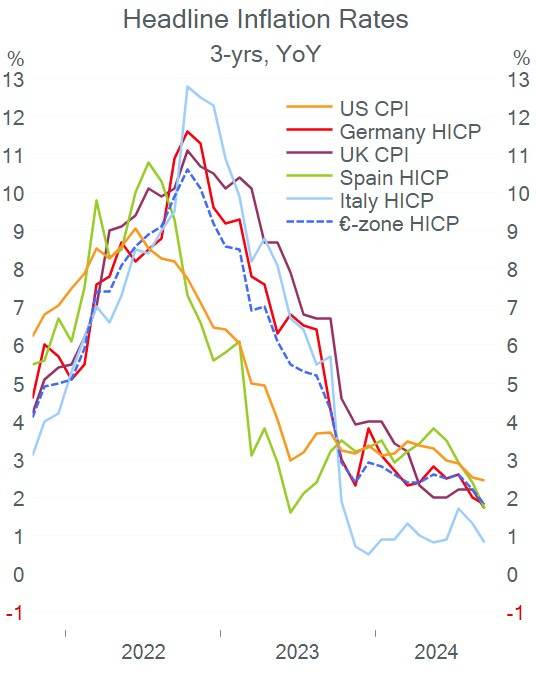

Yesterday’s key market update was the steep fall in UK inflation with headline CPI slowing to 1.7% and core CPI at 3.2% surprising analysts. Inflation was the lowest since April 2021 and below the central bank’s target rate. The RPI measure was also below estimates and lower than a month earlier at 2.7%. Also, services inflation, closely watched by policymakers, plunged to its lowest since May 2022 at 4.9%, significantly below August’s 5.6%.

The main catalysts for the disinflation trend were lower petrol prices and airfares. The news raised traders’ bets on a 25bp rate cut by the BoE at the Nov 7 meeting to an 87% probability.

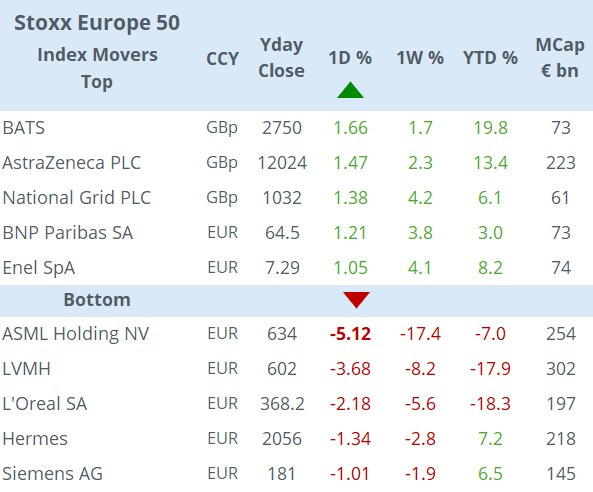

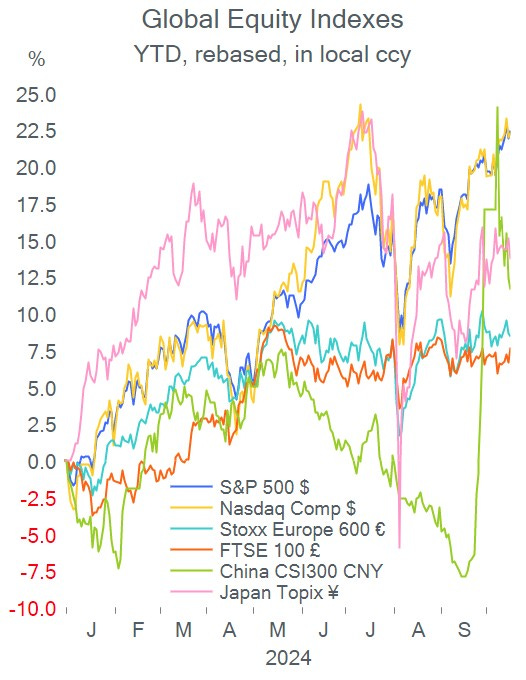

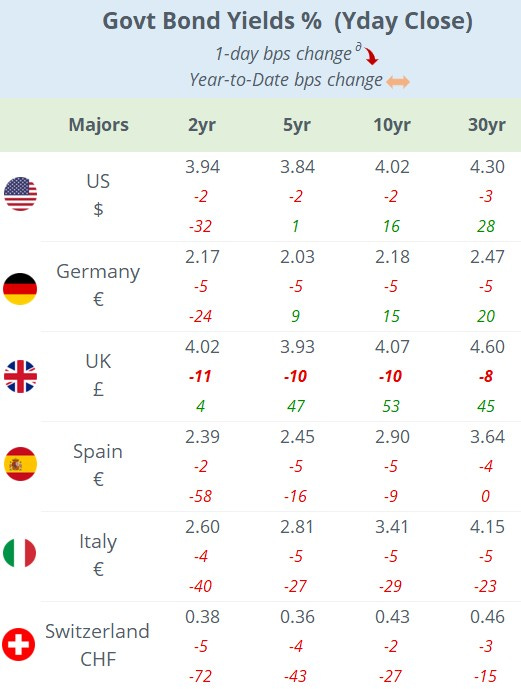

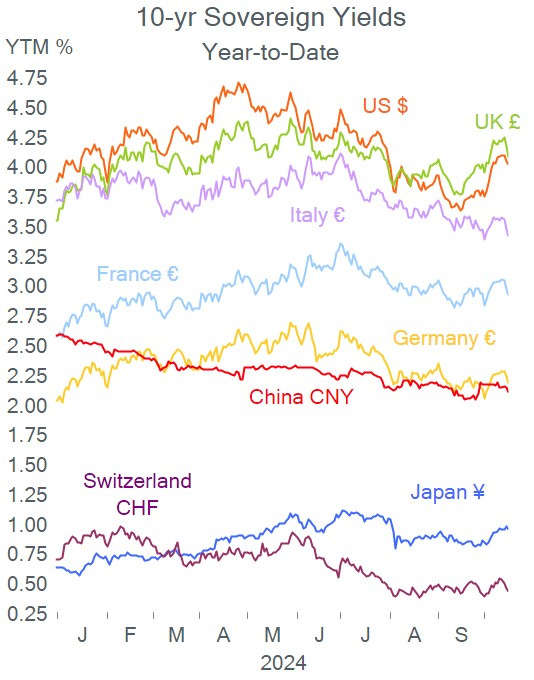

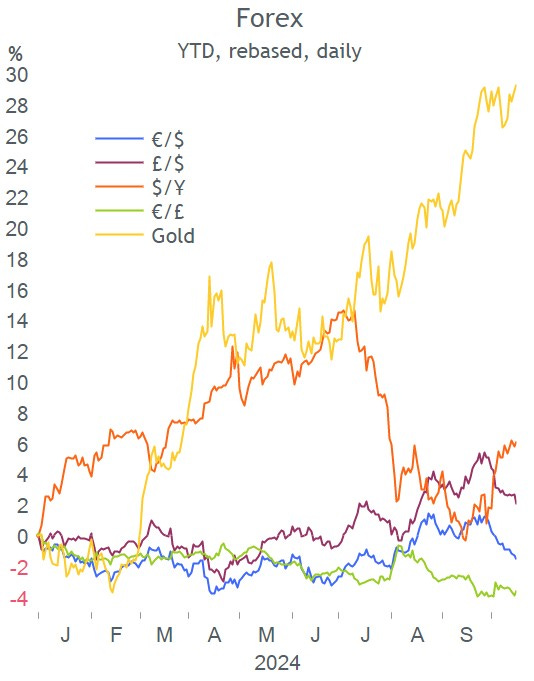

The update led to a depreciation of sterling against the $ and the € with cable trading below 1.30 for the first time in two months. Gilt yields fell by 10bp across tenors with 10-yr yields back at almost 4% while the FTSE 100 was the best-performing benchmark in Europe, up by 1%.

In earnings announcements, Morgan Stanley’s (mcap $193bn) results exceeded estimates on the back of strong dealmaking and shares jumped 6.5% to a record high (+28% YTD). Investment banking revenues rose by 56% in Q3, better than at Goldman and JP Morgan.

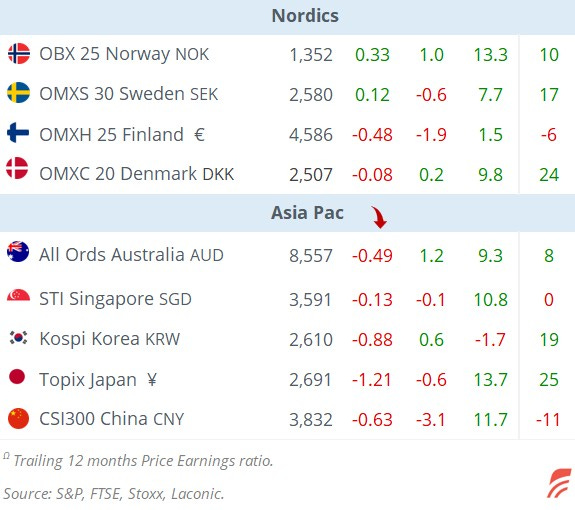

In monetary policy decisions on Wednesday, Indonesia left rates steady at 6%, the Philippines cut by 25bp to 6% as expected and Thailand surprised with a 25bp cut to 2.25%.

In DCM, British business support company Informa Plc (mcap £11bn) placed 6 (at 3.33%) and 10-yr (at 3.67%) senior bonds in € rated BBB.

In deals, media reports suggest that private equity firm Advent is preparing a takeover of British food processor Tate & Lyle (mcap £3.1bn). Shares jumped 8%.

In IPOs, Hong Kong is seeing signs of increased activity with two large deals, Horizon Robotics and China Resources Beverage aiming to raise nearly $700mn each.

Headlines:

-The US military strikes terrorist group Houthi in Yemen. (ABC)

-Elon Musk donated $75mn to Trump’s presidential campaign. (CNN)

-Mega-cap technology companies consider nuclear as an energy source to power data centres and A.I. infrastructure. Amazon invested in X-energy a US private company developing small nuclear reactors. (FT)

Asian markets are mostly firmer today with stocks in Hong Kong taking the lead while US futures are weaker overnight (-0.25%).

The ECB meets today with the announcement expected at 14:15 Frankfurt time and a 25bp rate cut is expected by analysts and fully priced by markets to a deposit rate of 3.25% and a refi rate of 3.40%. Turkey’s (unch at 50% exp) and Chile’s (-25bp to 5.25% exp) central banks also meet today.

In economics, we’ll get the final inflation reading in the €-zone; retail sales, industrial production and jobless claims in the US; and inflation in Austria.

On the earnings front, we’ll hear from TSMC, Nestle, ABB, Nordea, Netflix (AMC), Blackstone and Travelers.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.