Script: Estimated reading time ⏲ ~5 mins

Good morning,

Risk markets rallied sharply with lower US inflation as the key catalyst. April headline CPI inflation rose by 0.3% MoM and 3.4% YoY, lower than expected and resuming its downward trend. The core reading came in at 0.3% and 3.6%, also in descent. Cooling domestic demand was the reason for the lower pressure on consumer prices. It is unclear why the data was accidentally released half an hour before the scheduled time by the Bureau of Labor Statistics, confusing those who noticed it. It is the first time this year that inflation was lower than analysts’ forecast. In other US data releases, retail sales came in flat, well below estimates.

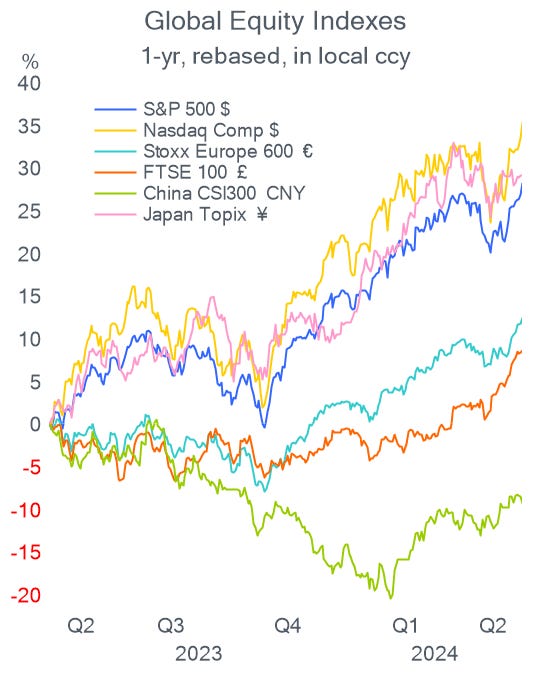

The dollar fell sharply (DXY index -0.6% yday) and equities hit a fresh record high as the S&P 500 closed above 5,300 points (+1.2%). The best-performing equity sector was information technology, followed by the defensive sectors of real estate, utilities and healthcare, which benefit from lower interest rates. The Treasury yield curve fell 9bp with 2-yr yields at 4.74% and 10-yr at 4.36%, their lowest in five weeks.

In Fed comments, Minneapolis Fed President Kashkari said that rates should stay on hold for a while longer as he is unsure how restrictive the current level is at the moment. Rate traders are now pricing in two Fed rate cuts for 2024, with Fed Funds futures implying nearly 50bp of cuts with the first one in September.

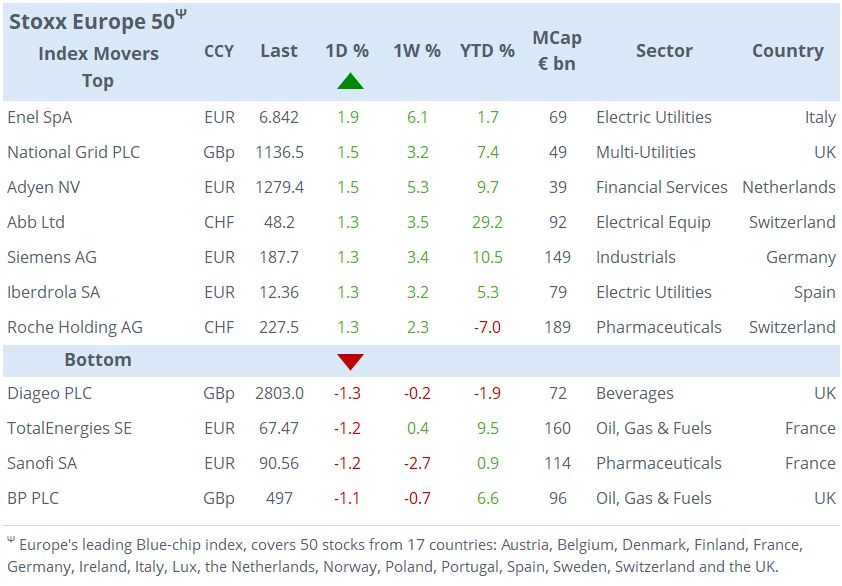

European stocks also reached a new record high with the Stoxx 600 adding 0.6% and accumulating a 9.5% gain YTD, on upbeat corporate earnings from Experian and Commerzbank. The €-zone’s real estate sector index was the best performer and rose to a 15-month high.

Asian markets are trading firmer today with Australia and Hong Kong benchmarks rallying more than 1.5%, mainland China, Korea and Taiwan up nearly 1% while Japan is marginally weaker. European stock futures are positive (€Stoxx 50 +0.2%) but not as strong as Asian indices.

10-yr UST yields continue to shift lower, the $ is a touch weaker again this morning, Bitcoin is dealing around $66k and Brent oil is above $83.

Headlines,

- Slovakia Prime Minister Robert Fico is said to have survived an emergency surgery after receiving multiple shots in an assassination attempt yesterday.

- In Dutch politics, election winner Wilders said he agreed to form a right-wing coalition government following months of negotiations.

- In US politics, Biden and Trump agreed to live debates scheduled for June 27 and September 10, ahead of November’s presidential election.

In other economic updates, €-zone’s first estimate for GDP growth in Q1 was confirmed at 0.3% QoQ, following Q4’s flat reading and industrial production in March grew 0.6% MoM, better than anticipated. French EU-harmonized inflation was confirmed at 2.4% YoY (in line w/ estimates) while Sweden’s CPIF inflation measure rose by 2.3% YoY (below estimates).

In corporate deals, Britain’s IDS, the parent of the postal company Royal Mail, received an improved takeover bid from a Czech investment group for £3.5bn of total equity value. IDS is prepared to back the 370 pence bid per share which is still 17% above yesterday’s close after rallying 16% to 315. The bidder has two weeks to make a formal offer.

Siemens is selling its large motors and drive unit Innomotics for €3bn to KPW Capital Partners, according to media reports and is expected to be announced today during the earnings call.

Economics updates expected today include housing data, industrial production and weekly jobless claims in the US and GDP in Norway.

European blue-chip companies going ex-dividend today include Shell, BP, Tesco, Unilever, SAP and GSK. Those reporting earnings include Siemens, Deutsche Tel, Zurich Insurance, Walmart, Applied Materials and Deere.

That’s all for today, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Please share using the button below, as access is free to all.