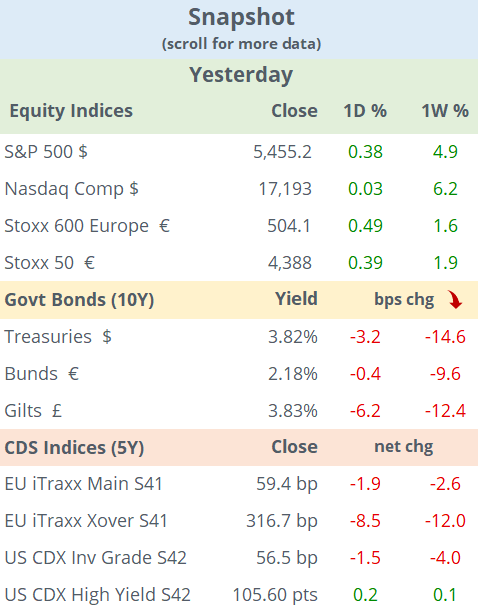

U.S. markets ended somewhat firmer last night to accumulate five straight positive sessions, driven by an encouraging inflation reading that increases the chances of the Fed cutting rates. The S&P 500 added 0.4% with the financials sector as the main gainer, Nasdaq finished flat and the small-cap Russell 2000 lost 0.5%.

U.S. headline CPI for July came in at 2.9% YoY, marginally better than estimates and lower than in June while the core CPI print was 3.2%, in line with expectations. Headline CPI was the lowest since March 2021 to confirm the disinflationary trend from the 9% peak in mid-2022.

European equities also traded firmer with the Swiss (+1.2%) and Italian (+1%) benchmarks as the outperformers. The FTSE 100 added 0.5% while Gilt yields dropped 6bp across tenors following Britain’s inflation report. Britain’s consumer prices rose 2.2% YoY in July, slightly below estimates but still higher than the 2.0% recorded a month earlier. It was the first increase on an annual basis since December. Core inflation, which excludes food, energy, alcohol and tobacco, rose by 3.3%, down from 3.5% in June. 2-yr Gilt yields fell to 3.55%, their lowest level since April last year.

In earnings reports, UBS Group (mcap €96bn) beat quarterly revenue ($12bn, +25% YoY) and profit ($1.1bn) estimates driven by solid figures at the investment bank and successful integration and divestments of some units of Credit Suisse. Shares rallied 5%, the best performer among Stoxx 50 members yesterday and have fully recovered from the recent global equity selloff.

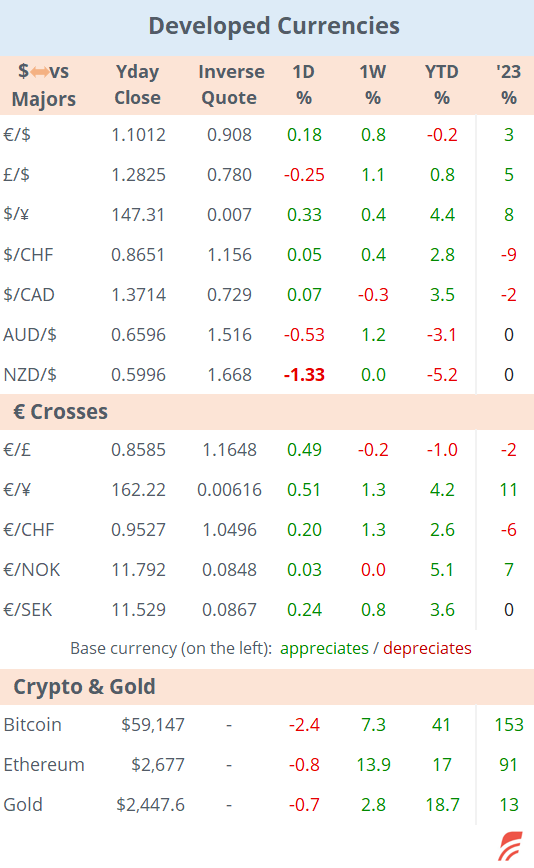

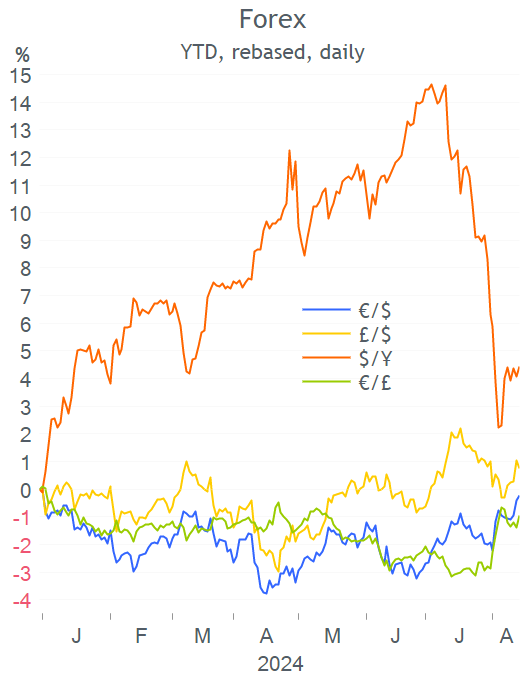

In forex markets, Wednesday’s notable mover was the Kiwi dollar with a 1.3% depreciation following the central bank’s surprise rate cut to 5.25% (see yesterday’s Ep).

In M&A: American candy giant Mars (unlisted & family-owned) is acquiring Kellanova, formerly known as Kellogg & Co ( mcap $27.5bn, P/E 38x) for $36bn in cash, this year’s biggest corporate deal. Mars is paying $83.5/share equivalent to a 33% premium and Kellanova shares gained 8% to close at $80.3, an all-time high.

Also, media reports suggest that Flutter Entertainment (Ireland, gambling, mcap £29bn) is in talks with smaller rival Playtech (mcap £1.9bn) to acquire its Italian unit Snaitech in an estimated £2bn deal. Playtech shares rallied 14%.

Headlines:

-The World Health Organization declared Mpox, the highly contagious disease formerly known as monkeypox that is quickly spreading across Africa, a global health emergency.

-Japan’s economy expanded much faster than anticipated, +3.1% QoQ annualised, in a sharp rebound to the previous quarter, supporting the case for more policy rate hikes.

-China’s retail sales advanced 2.7% YoY, higher than expected, but factory output disappointed modestly, up 5.1% YoY. Urban investment was just 3.6% higher in the past year, well below estimates and house prices fell 5% YoY.

Asian stock indices are all trading in green today with China, Japan and Korea up by 1%. European futures are firmer overnight and point to a positive open, in line with the S&P 500 and Nasdaq 100. Bond futures are a touch lower. Most currencies, gold and Bitcoin are little changed, except for the Aussie dollar which is ~0.5% higher.

Credit ratings: British banking group Close Brothers (mcap £730mn) was d/g one notch to A3 by Moody’s.

At 9 A.M. Ldn time, Norway’s central bank will announce its monetary policy decision, with analysts expecting the benchmark rate to remain steady at 4.5% while futures imply a 30% probability of a hike.

In economic data: retail sales, industrial production and jobless claims in the US; GDP, industrial and manufacturing output in the UK.

Companies reporting today: Walmart, Alibaba, Applied Materials and Deere & Co.

It’s a holiday in Italy, Greece, Poland, India and South Korea.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.