Morning,

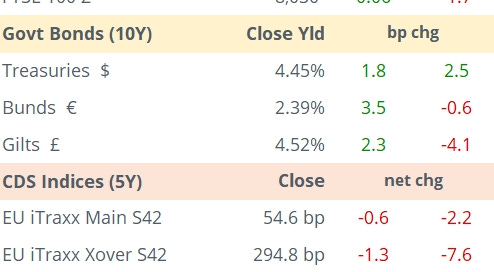

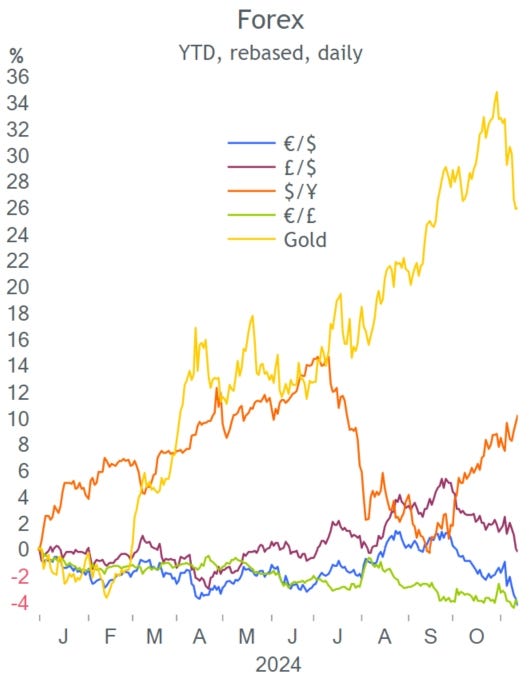

Stock and bond markets were little changed on both sides of the Atlantic on Wednesday with the focus on US inflation figures and the latest election vote count. In politics, the Republicans won control of the House of Representatives giving the Trump administration a unified government control of both Congress houses increasing the chances of Trump´s campaign promises being implemented.

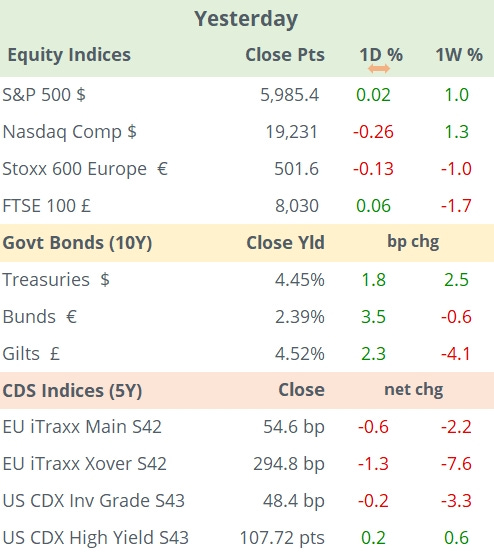

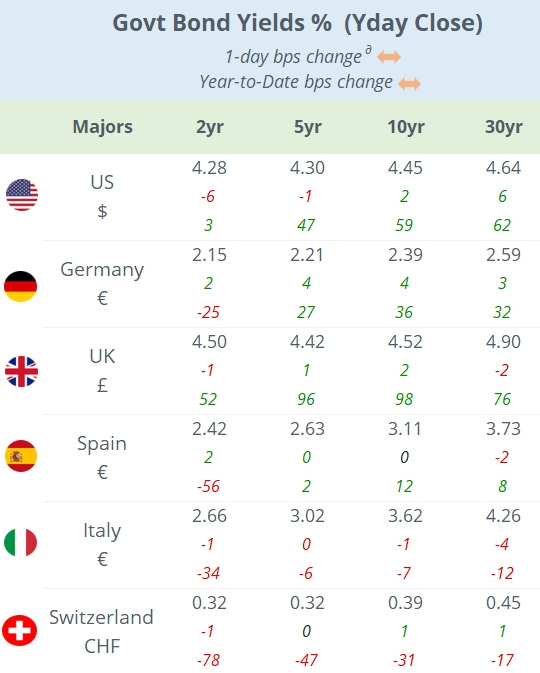

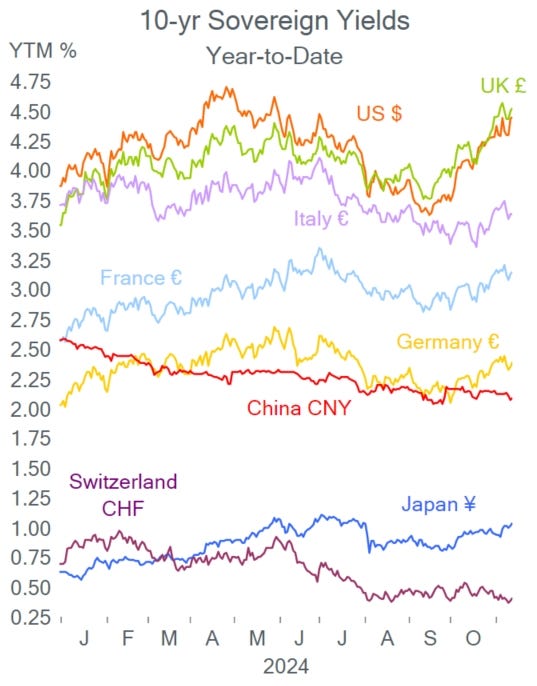

US headline and core CPI inflation in October rose as expected, by 2.6% (vs 2.4% prior) and 3.3% (unch vs Sep). The moderate rise in annual inflation also reflects a low reading of a year ago dropping out of the calculation. US inflation has eased significantly from its peak of >9% in 2022, but the disinflation process has slowed in recent months. As of yesterday´s close, futures markets were pricing in an 83% probability of another 25bp rate cut by the Fed at the December meeting (vs 17% for no chg).

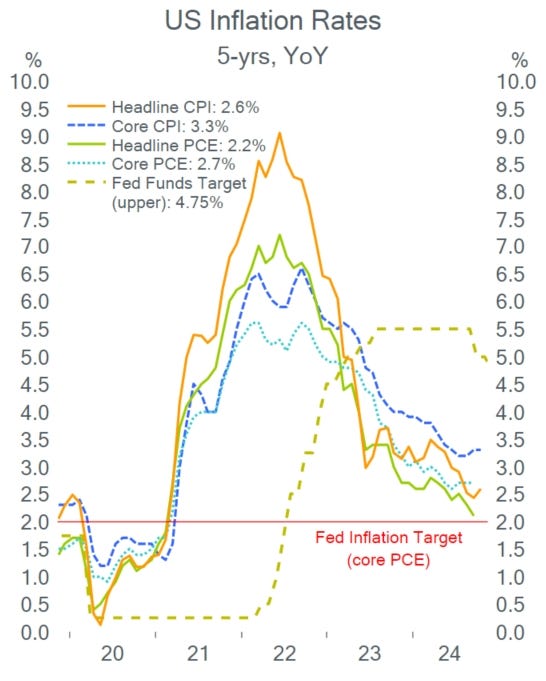

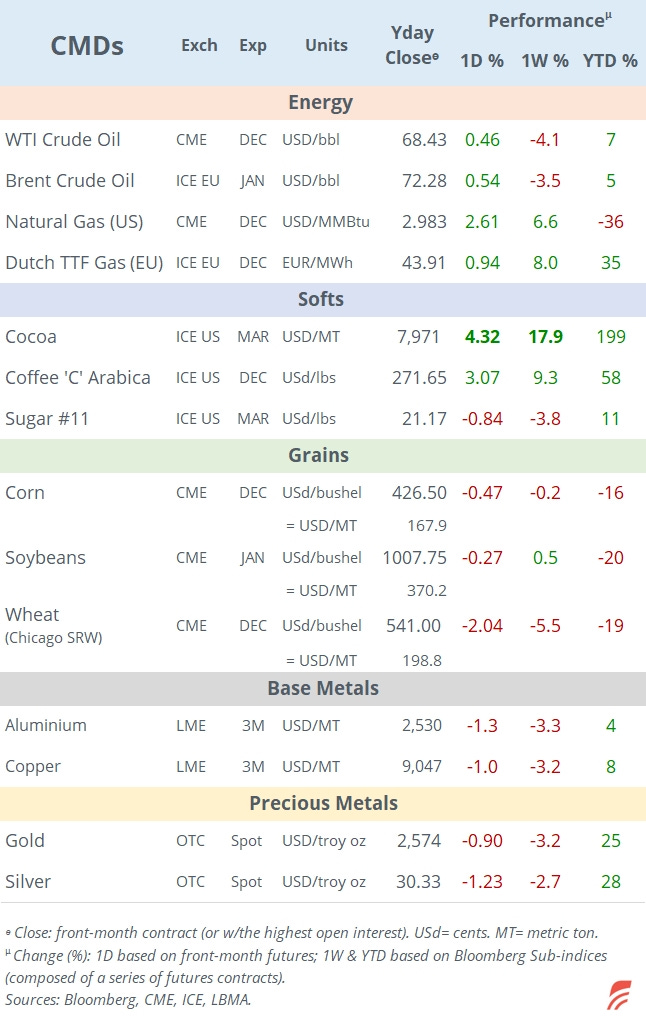

The dollar´s appreciation trend accelerated with the DXY index fast approaching 107 pts, its highest level this year. The € fell to its weakest level in twelve months while £ and ¥ are at a four month low. Gold also suffered a steep reversal from its historic high in late October to $2,555. Bitcoin touched a fresh new record of >$90k and has rallied 32% since the US election day.

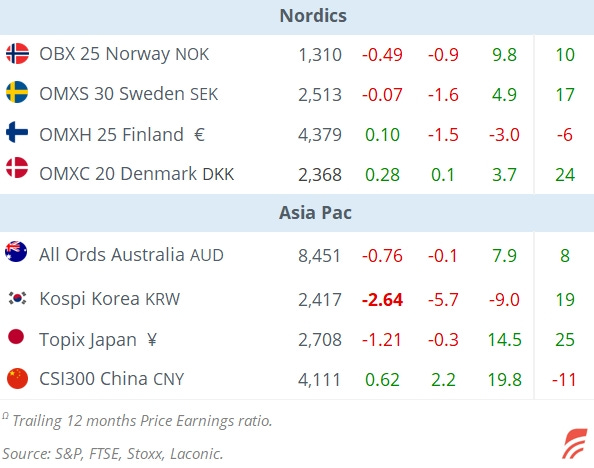

Asian equities are mixed today with mainland China and Hong Kong as the main losers with benchmark index declines of 1.5% following the confirmation of the Republican sweep. European stock futures are flat this morning and Brent oil is a touch lower at <$72.

In corporate deals, Europe´s largest meal delivery app Just Eat Takeaway (mcap €2.7bn) sold its US subsidiary Grubhub for a steep loss ($650mn vs $7.3bn acquisition value in 2020) to a food delivery start-up. Shares gained 15% yesterday but have declined 85% from their all-time high in 2020. (Guardian)

In equity offerings, Swedish fintech Klarna filed for a US IPO and is expected to be worth between 15 and $20bn, less than half its 2021 private round valuation. (Reuters)

In business news, Germany´s utility firm RWE AG (mcap €23bn) plans to reduce its €55bn investment pipeline in renewable energy following Trump´s victory. Shares gained 6% yesterday (-27% YTD) after it announced a €1.5bn share buyback and Elliott disclosed a sizable position. (FT)

In debt capital markets, €-denominated BBB+ senior bonds sold yesterday include Coca-Cola´s 8-yr at 3.25% and Stellantis´ 9-yr at 4%. In $, Gilead Sciences placed 5, 11, 30 and 40-yr bonds.

Day ahead:

Data releases: GDP in the €-zone, Japan and Sweden; producer prices and weekly jobless claims in the US; inflation updates in Sweden and Spain; industrial production in the €-zone.

Mexico holds a monetary policy meeting with rates exp to be cut by 25bp to 10.25%.

Earnings reports: Deutsche Telekom, Siemens AG, E.On, Disney, Applied Materials, Foxconn and Japan´s largest banks.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.