Est reading time: 5 min

Good morning,

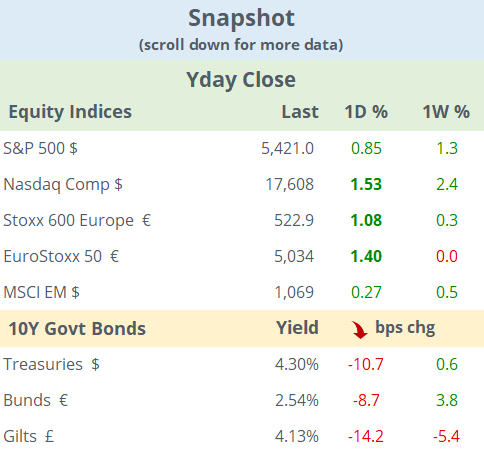

Wall Street closed at another record high last night with the information technology sector as the biggest winner. The S&P 500 added 0.85% and the Nasdaq 100 index gained 1.3%. Mega-caps continue to drive indices higher as Apple rose 3% and accumulated a 10% gain in the past two days following the announcement of its A.I. strategy, while Nvidia and Tesla also added more than 3% yday.

The catalyst for the risk on sentiment was lower-than-expected inflation in the US in May. Headline CPI came in flat for the month and 3.3% YoY, slightly below forecast and below the previous month (3.4%). The core CPI reading rose by 0.2% MoM and 3.4% YoY, also marginally lower than analysts' expectations. Cheaper gasoline (-3.6% MoM) helped price pressures to remain under control.

The other key event of the day was the Fed’s meeting, which ended in a widely anticipated decision to maintain rates unchanged at the highest level in 23 years, a 5.25-5.5% range. But the focus was on the hawkish signal sent by Fed President Powell, with the expectation of just one interest rate cut this year instead of the three cuts estimated a few months ago. The Fed still considers that inflation is too high and that policy rates need to remain at restrictive levels to weaken the economy and reach the central bank’s 2% inflation target. However, Powell did not rule out a potential second rate cut during the next six months as the Fed remains data-dependent. Fed officials lifted their projection for PCE inflation, their preferred inflation measure, to 2.6% for 2024, from 2.4% in March.

Futures markets are pricing in a 61% probability of a rate cut in September and almost ruling out any action in the next meeting in July.

Bond markets reacted to the inflation update and rallied. Yields fell across tenors on both sides of the Atlantic. 2-year US notes fell 8bp to 4.75% while the 10-year bond closed 11bp lower at 4.30% The British Gilts curve shifted sharply lower, 14bp across maturities with the 10-yr ending at 4.13%.

Onto today’s markets, Asia is trading mixed with Japan and mainland China a touch lower (-0.5%) while all other stock markets are firmer with Korea and Taiwan gaining around 1.5%. European equity futures are weaker this morning (-0.1%) while S&P 500 futures are higher (+0.25%). Brent oil is marginally lower at $82.30 and Bitcoin is little changed at $67,300.

Headlines:

-The political turmoil in France is deepening. Eric Ciotti, the leader of The Republicans, the Conservative (centre-right) party that holds a clear majority in the upper house (Senators), was ousted from the party for suggesting an alliance with Marine Le Pen’s Rassemblement National. Macron urges other parties to battle the right extremists while his colleagues demand he step down from the campaign for the legislative election.

-Brussels is imposing additional steep import tariffs on Chinese-made electric vehicles to nearly 50% but exempts European brands produced in China. Tariffs are implemented on a company-to-company basis and cover EV and battery manufacturing. However, EV stock prices are rising ~5% today.

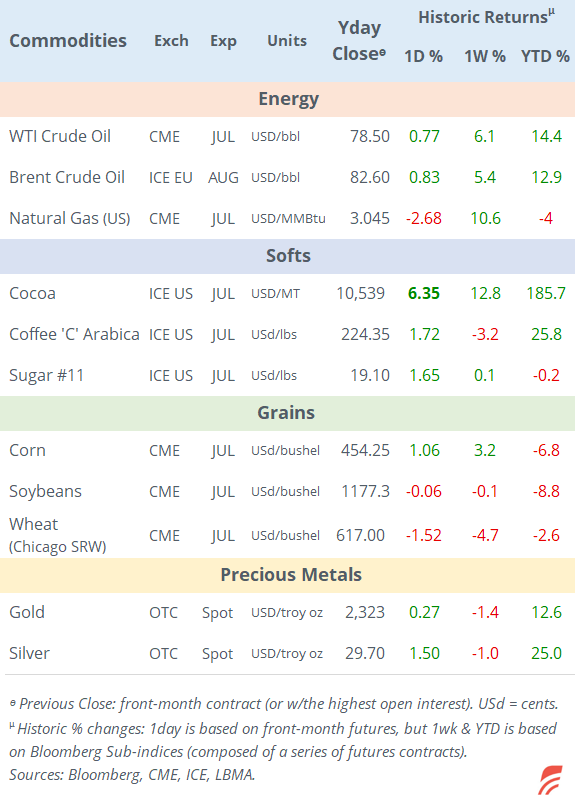

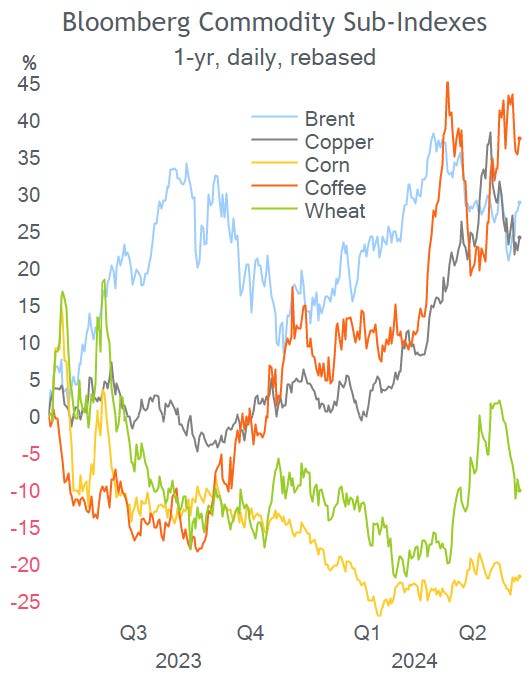

-In commodities, the International Energy Agency warned of a massive global surplus of crude by 2030, as the Middle East and the US continue to pump oil, which should drive prices down. Investments in the sector have reached the highest in five years to nearly $540bn in ’23. OPEC+ production accounts for 48.5% of global crude supplies after it extended voluntary cuts. The IEA projects demand to weaken towards the end of this decade driven by a slowdown in China. Oil futures did not react to this update and prices rose nearly 1% to $82.60 yday.

In M&A, National Bank of Canada (mcap $29bn) is acquiring smaller rival Canadian Western Bank (mcap $1.75bn) for $3.68bn in an all-share deal that will combine the 6th and 8th largest banks in the country. Terms: 110% premium to CWB’s undisturbed price, CAD 54.24 at the time of the announcement. CWB shares jumped 70% while NBC’s dropped ~6%. Canada’s banking sector continues to consolidate as this transaction follows RBC’s takeover of HSBC’s local business.

In IPOs, Italian luxury footwear maker Golden Goose aims to raise €560mn at a €1.86bn valuation by selling 30% of its shares in the Milan exchange. The price guidance range is €9.5-10.5 and the offer begins today and runs for 5 days. Private equity firm Permira acquired Golden Goose four years ago for €1.3bn.

In bond issuance, ITV Plc (UK, broadcasting, mcap £3.1bn) and K+S AG (Germany, chems, mcap €2.2bn) raised 8 (ms+145bp) and 5-year (ms+155) senior notes.

In data today, we’ll get producer prices and jobless claims in the US, inflation in Ireland and industrial production in the €-zone. Adobe, the US software co (mcap $207bn), reports earnings after the market close. The two-day G7 Summit starts today in Italy.

That’s all for today, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Please share using the button below, as access is free to all.