Morning,

U.S. stocks rallied sharply from their intraday low following the early inflation report and the S&P 500 closed 1% higher while the Nasdaq gained more than 2%, on the back of an 8% jump for Nvidia. The U.S. government said it was considering allowing the chip maker to export advanced semiconductors to Saudi Arabia, triggering a rally in the sector.

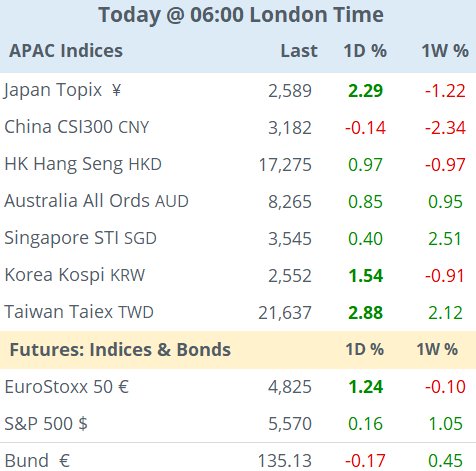

Asian stocks are trading significantly higher today on the back of Wall Street’s positive momentum, with Taiwan’s index gaining 3%, Japan adding 2% and Korea 1.5%. European stock futures are also advancing in early morning trading with the three leading indices firmer by around 1%.

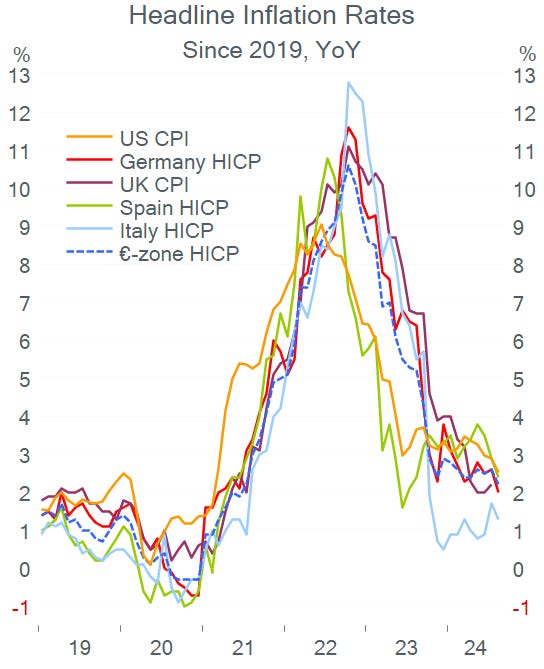

Yesterday’s key data release was the U.S. retail inflation which came in mostly in line with estimates. Headline CPI printed at 0.2% MoM and 2.5% YoY in August, below July’s 2.9%. The Core CPI measure was 3.2% YoY, unchanged on the month. Traders cut their expectations for a jumbo rate cut by the Fed and futures are now pricing in an 85% chance for a 25bp rate cut on September 18.

Also, the British economy failed to grow in July and expanded by 1.2% year-on-year, slower than expected with weak industrial (-1.2%) and manufacturing (-1.3%) readings.

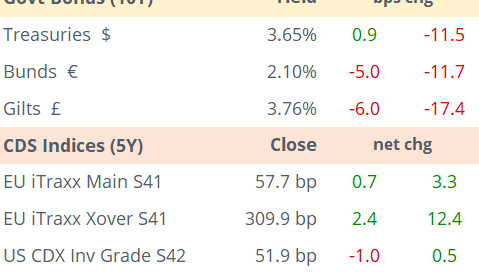

European equities and currencies were little changed on Wednesday ahead of today’s ECB policy meeting. Bund and Gilt yields continue to ease with 10-yr Gilts reaching a seven-month low of 3.76%.

Spanish fashion leader Inditex beat profit (€2.8bn) and sales (€18.1bn) estimates in the first semester and shares advanced 4.5%, their best day in six months and closed near their all-time high for a total market value of €151bn.

In corporate deals, Italian bank Unicredit Spa (mcap €58bn) became the second-largest shareholder in German lender Commerzbank AG (mcap €17bn) after investing €1.4bn in a 9% stake. Commerzbank shares jumped 16% on the back of a potential acquisition.

Putin suggested that Moscow should review some of the country’s commodity exports including uranium, titanium and nickel as a retaliation to the latest Western economic sanctions. The Global X Uranium ETF gained 5% yesterday.

In new bond issues, Dutch chemicals Akzo Nobel placed 10-yr senior bonds rated BBB at Bunds +166bp or a 3.77% yield.

Data to be released today includes producer inflation and jobless claims in the U.S. and retail inflation updates in Spain, Sweden and Ireland.

The ECB meets at 14:15 Frankfurt time and is widely expected to cut the deposit rate by 25bp to 3.50%.

Software giant Adobe (mcap $257bn) reports earnings after the close today.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.