Morning,

Wall Street posted another solid day of gains to accumulate six positive sessions, with all leading indices rising by 1% and the S&P 500 and Nasdaq Composite reaching fresh records. Every sector rose with information technology and materials as the biggest winners. Taiwan’s chip giant TSMC reported strong quarterly revenues ($20.7bn) lifting the semiconductors sector and Nvidia, AMD and Micron added between 3-4%. European stocks reversed Tuesday’s weakness and ended significantly higher with Spanish, Italian and Portuguese indices up by more than 1.30%. Market sentiment is been driven by updates on the French governability situation.

Fed Chair Powell’s second day before Congress was neither dovish nor hawkish but he highlighted that the central bank’s decisions will be purely based on data and not influenced by the presidential election in November. He said that although inflation was decelerating towards the Fed’s 2% target, he was not ready to confirm that a rate cut date was already set but did not rule out a September cut. The Fed meets in late July when no rate cut is expected but futures are pricing in a 73% probability for a reduction at the following meeting.

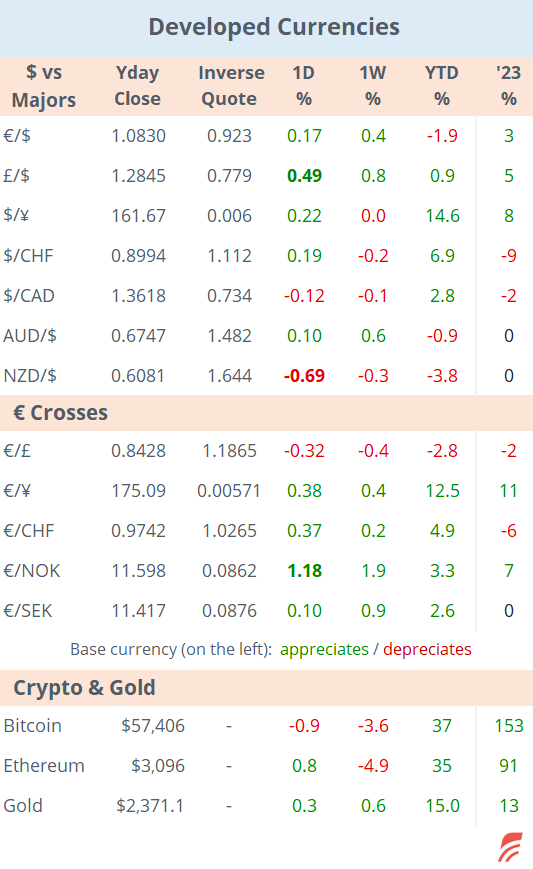

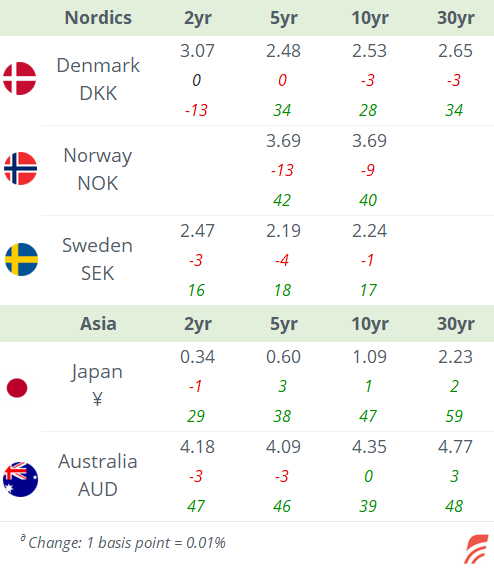

The $ weakened yesterday, mainly against £ following hawkish remarks by Bank of England economist Hill who stated that inflation drivers remained strong. Cable advanced 0.5% to 1.2845 and the pound also appreciated against the €. In bond markets, benchmark yield curves shifted marginally lower with Italian BTPs as the notable movers with 10-yr bond yields down 9bp to 3.86%. US Treasuries closed at 4.28%, Bunds at 2.54% and Gilts at 4.13%.

Today, the Bank of Korea left its policy rate steady at 3.5% for the 12th consecutive meeting as widely anticipated and said it needs more evidence that inflation is shifting down to its 2% target before reducing borrowing costs.

Headlines:

-Biden is facing increasing pressure from party colleagues and celebrities to step down as the chances of beating Trump fell after the first debate. Nancy Pelosi, Democratic Senators and actor George Clooney, a fundraiser for Biden, are among those suggesting he should quit.

-In French politics, Macron is delaying the decision to proceed with a co-habitation procedure and called for a broad governing pact to keep the extremes out of power while the left (NFP), who won the most seats on Sunday, expects to co-govern.

All Asian stock markets are rallying overnight with mainland China, Hong Kong and Taiwan gaining more than 1%. EuroStoxx 50, Dax and FTSE futures are a touch firmer in early trading and crude oil continues to recover and is heading towards $86 after OPEC maintained its forecast for strong growth in global demand and US inventories fell more than expected last week.

There were no significant corporate takeovers to mention but in debt capital markets, Saudi-owned Aramco raised $6bn in three senior bond tranches in dollars rated A1. 10-yr (@ UST +105bp, 5.33% yield), 30-yr (@ +145, 5.93%) and 40-yr (@ +155, 6.03%). The order book was six times oversubscribed in Aramco’s first bond placement in three years.

Today’s key data release will be consumer inflation in the US at 13:30 London time, with headline CPI expected to decelerate to 3.1% YoY. Before the market opens we’ll get Germany’s final inflation reading for June, UK’s GDP, manufacturing and industrial output. Also, Ireland reports inflation figures. Fed officials Cook, Bostic and Musalem will participate in conferences. Biden will hold a press conference at the close of the NATO Summit.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.