Podcast ↑↑↑↑ Scroll down for the script.

Morning,

The highly awaited US CPI inflation for March came in higher than expected and higher than a month ago, showing that inflation is not maintaining a downward trend and adding concerns about whether the Fed will cut rates in June. Stocks and bonds in the US sold off sharply while the dollar rallied.

Both the headline and core CPI readings rose by 0.4% MoM, with the headline up by 3.5% YoY, its largest gain in six months. The core CPI measure, which excludes energy and food items, rose by 3.8% in the past twelve months, the same as in February, also reflecting strong price pressures. The main drivers of a higher cost of living were gasoline and shelter prices.

CPI inflation has fallen significantly from its 9.1% peak in mid-2022 but it hasn’t been below the Fed’s 2% target since early 2021. Governor Powell has warned in the recent past that the last mile to reach the target was going to be the most difficult.

Futures markets sharply repriced traders’ expectations of Fed rate cuts, now pricing in an effective Fed Funds rate above 5% until November.

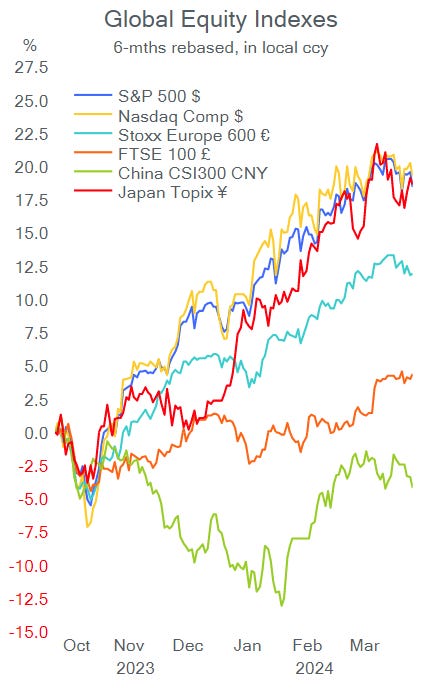

Leading US stock indices fell nearly 1% with every sector except for Energy ending lower and Real Estate experiencing the worst drop. European benchmarks finished modestly firmer on average despite being open during the US inflation data release. Utilities and Real Estate were the weakest sectors. There were no large single-stock moves.

Yesterday’s action was certainly focused on interest rates and currency markets. US Treasuries sold off sharply with 2-year yields jumping 22 bp to nearly 5% and 10-year yields by 19 bp to 4.56%, the highest in five months. It was the largest daily jump for 10-year yields in 18 months. The yield is 70 bp higher year-to-date.

In the credits space, 10-year BBB bonds in the dollar market are yielding 5.87%, or a Z-spread of 181 bp and high-yield bonds yield 6.57% or 257 bp over.

European bond markets also reacted to the news, with every curve shifting marginally higher. Gilt yields added 12 bp to 4.15% and Bunds 6 bp to 2.43%.

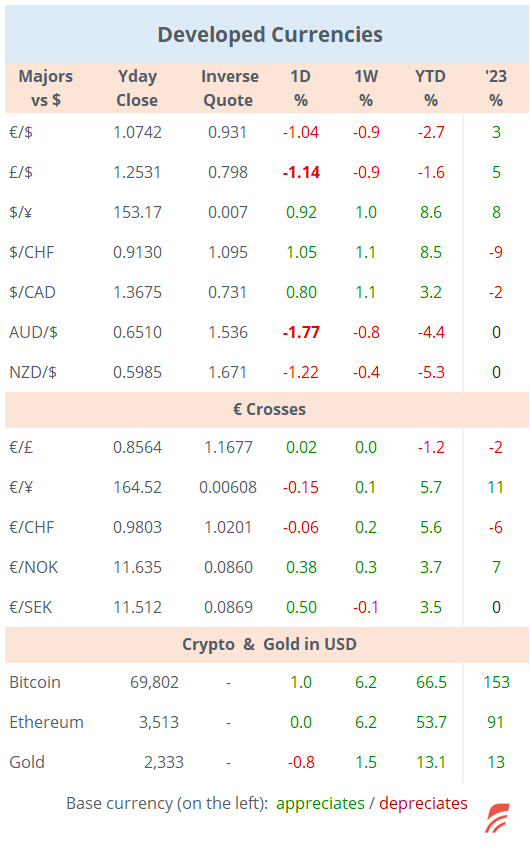

Currencies also experienced significant moves with the DXY $ index gaining 1% yesterday, its best day in 13 months to the highest since November. The € and £ depreciated by more than 1%. The ¥ breached the 153 resistance for the first time, to its weakest level in 34 yrs, prompting Japan’s Finance Minister to warn of possible interventions to reduce market volatility.

China’s latest inflation figures released this morning show that factory gate deflation persists as PPI fell 2.8% YoY. Consumer prices dropped by 1% in March, double the expected, but rose marginally on an annual basis. Stocks are flat on the mainland while Hong Kong is falling 0.75%.

The notable headline today is Washington’s fear of an imminent Iranian missile attack on Israel.

Moving on to updates, the Bank of Canada left rates unchanged at 5%, a 23-year high, as expected and signalled a potential rate cut in June. Economic growth is forecast at 1.5% this year.

European countries that released inflation updates include Norway falling to 3.9%, Portugal steady at 2.3%, Greece rising to 3.2% and Denmark still low at 0.8%.

This afternoon we’ll hear from the ECB with analysts and futures contracts widely anticipating the refinancing and the deposit rates to remain steady at 4.5% and 4%, their highest levels on record.

In corporate deals, Italgas, the Italian gas distributor worth €4bn, has tabled an offer for its smaller domestic rival 2i Rete Gas for around €4.5bn, according to the local press. Italgas shares dropped 3% to a 4-month low. Rete Gas is controlled by an Italian infrastructure fund and has plans to list in the Milan exchange.

Germany’s retailer Galeria Karstadt, Europe’s second-largest department store, which collapsed with its Austrian parent Signa went bankrupt, was acquired by two US and German investors for an undisclosed amount.

Economic data to be released today includes PPI or wholesale inflation in the US, GDP in Norway, CPI inflation in Ireland and industrial production in Italy. The Eurogroup meets today in Luxembourg with inflation developments on the agenda, ahead of next week’s Spring Meetings by the IMF and the World Bank in the US.

Today will be an active day for Fed speakers, including Bostic, Collins, Williams and Barkin.

That’s all for today.