Morning,

Hurricane Milton, forecasted as the most destructive in a century, made landfall as a Cat 3 near Tampa on the west coast of Florida last night and is now travelling across the state towards the Atlantic as a Cat 2.

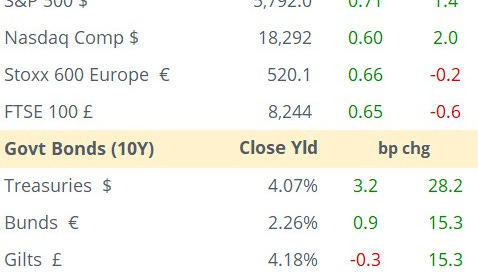

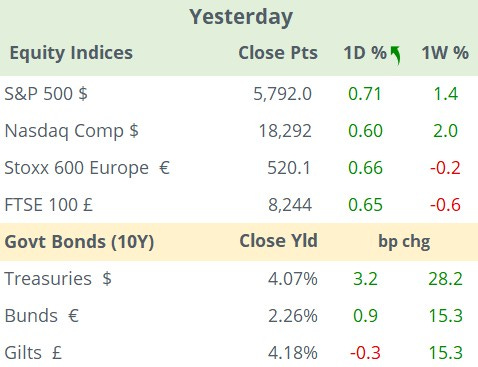

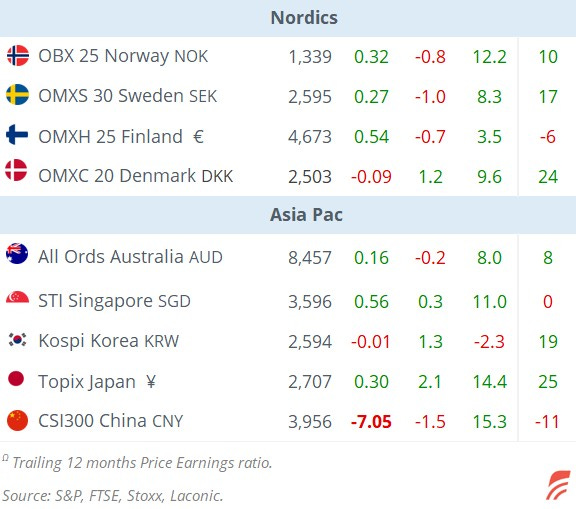

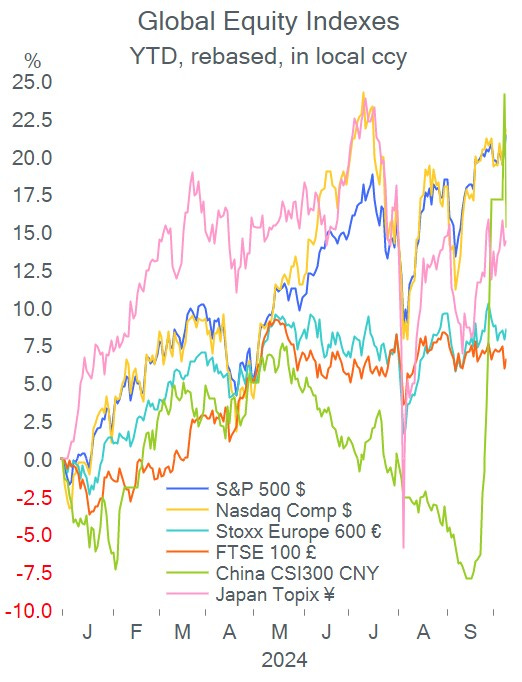

Developed equities traded firmer yesterday with Wall Street indices advancing 0.7% and the S&P 500 reaching a fresh record high (5,792 pts), ahead of today’s inflation report and tomorrow's bank earnings releases. Both the S&P 500 and Nasdaq Comp accumulated a ~21% YTD rally compared to a 9% gain by the Stoxx 600, in local currency terms.

One notable mover in Europe was Bayer AG (mcap €27bn) with a 7% (-19% YTD) drop after a U.S. court agreed to review a case related to Monsanto’s toxic chemical PCB.

Markets in China remain highly volatile with the CSI300 blue-chip index plunging 7% on Wednesday, driven by unconvinced traders regarding the government’s stimulus measures as the monetary announcement was not complemented with a fiscal plan. Beijing officials are expected to issue an update on Saturday. Today, mainland and Hong Kong benchmarks are recovering ~4%.

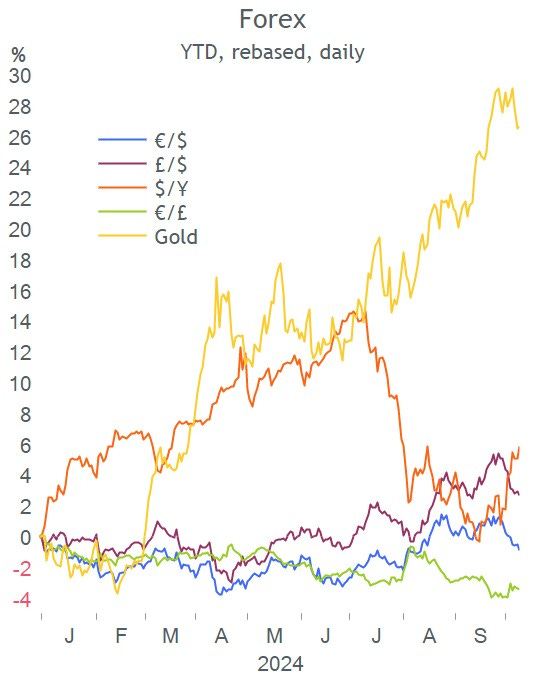

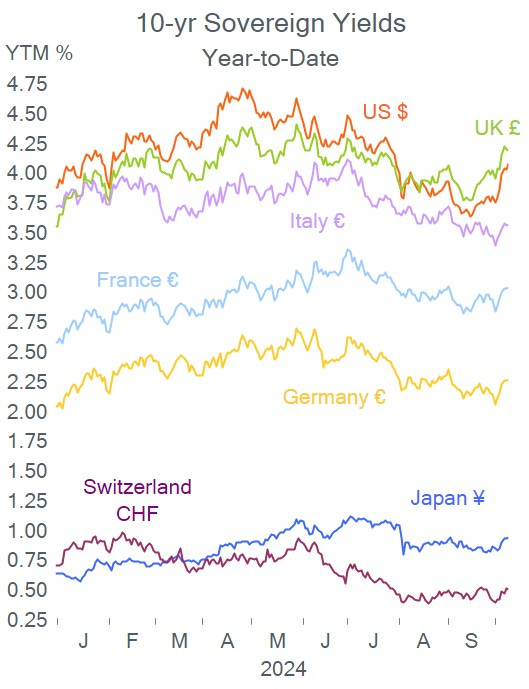

The Fed’s minutes from its September meeting showed that a substantial majority of voters favoured the 50bp rate cut to begin easing monetary policy but made it clear it did not mean that future cuts should be the same size. The $ index advanced almost 0.5% and benchmark yields were little changed yesterday.

In economic news, Berlin is predicting another year of negative growth (-0.2% YoY) leading to the first 2-year recession in more than two decades. Germany’s main challenges for growth have been inflation, high energy costs, a shortage of skilled workers and excessive red tape. Still, the Dax is one of the best-performing indices in Europe this year with a 15% gain.

In business news, the U.S. government said it may request a judge to force Google to divest parts of its businesses, including the Chrome browser and mobile operating system Android, which the government claims are used to maintain an illegal monopoly in online search.

In corporate deals, Canada's Alimentation Couche-Tard (mcap $51bn) has improved its takeover bid for Japanese retail giant Seven & i Holdings (mcap $41bn) by 22% to a total of $47bn.

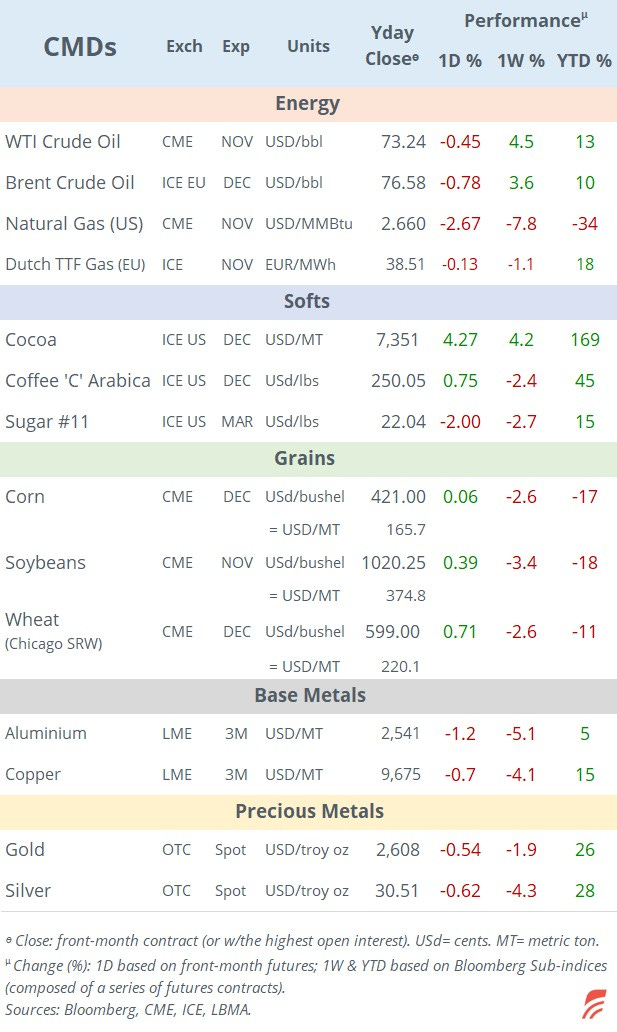

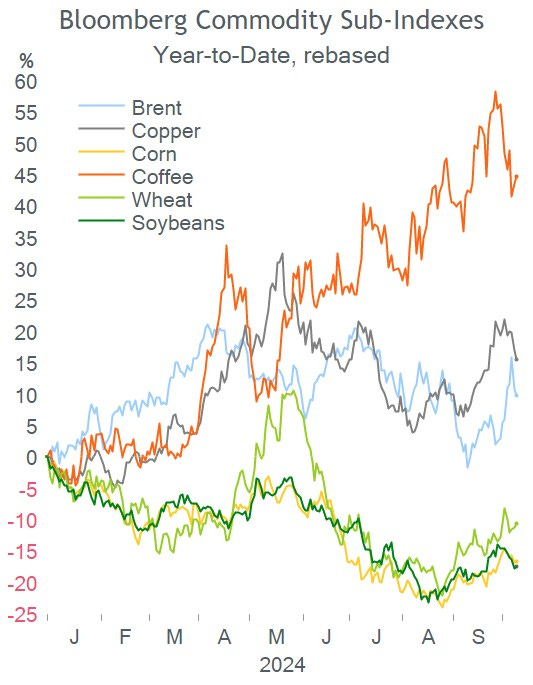

In the mining sector, Anglo-Australian group Rio Tinto (mcap $112bn) is buying Arcadium Lithium (mcap $6bn) of the U.S. for $6.7bn in cash, to become the world’s third-largest lithium producer. Arcadium shares rallied 31% yesterday.

The German state is planning the sale of 20-30% of its 99% stake in bailed-out utility Uniper (mcap €19bn) for the first half of 2025.

In IPOs, KinderCare Learning Companies (KLC), a U.S. childcare services company backed by Partners Group, was listed on the NYSE at a $3.1bn valuation. It raised $576mn and shares gained 9% on their debut.

Also, Spanish frozen pastry company Europastry, which was due to begin trading in Madrid today, postponed its debut for the second time in four months, citing global geopolitical risks and unstable markets.

CeriBell (CBLL), an A.I. healthcare company backed by TPG, will be priced today (guidance $16-17) and expects to raise $580mn.

In credit ratings, Moody’s d/g Israeli banks by one notch to BBB+. Israel’s central bank left its policy rate unch as expected at 4.5%.

There were no significant corporate bond issues yesterday but in the sovereign space, the Republic of Ghana raised $7bn in 5 and 7-yr bonds rated Ca.

In data today: U.S. CPI inflation and weekly jobless claims; retail inflation in Ireland, Portugal, Greece, Denmark and Norway; Japan’s wholesale prices.

It’s a holiday in Taiwan.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.