Morning,

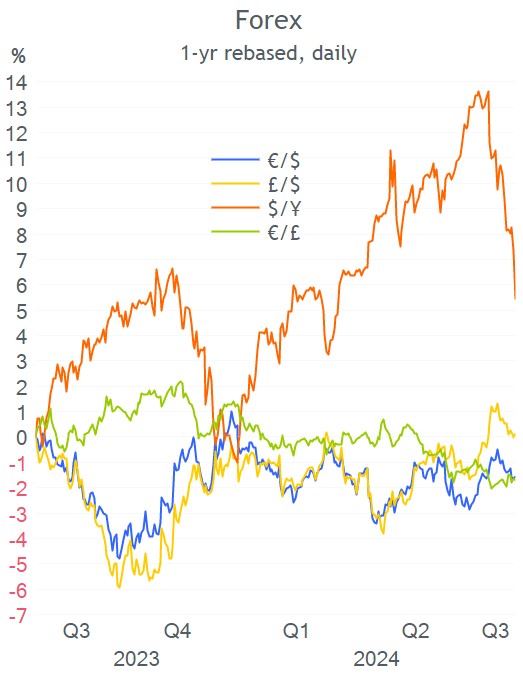

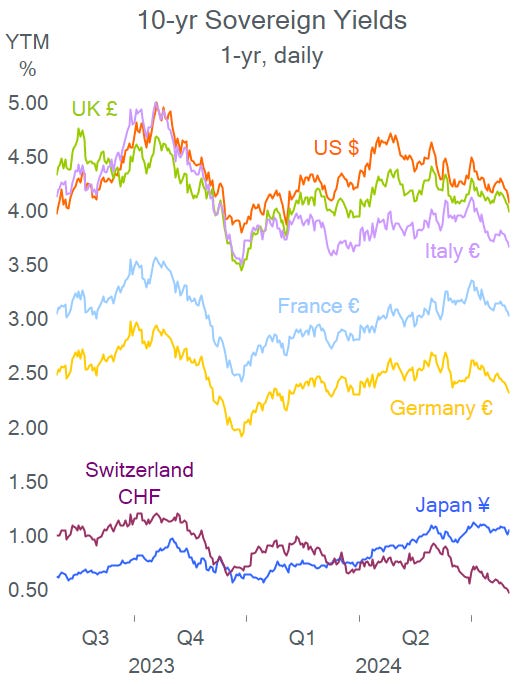

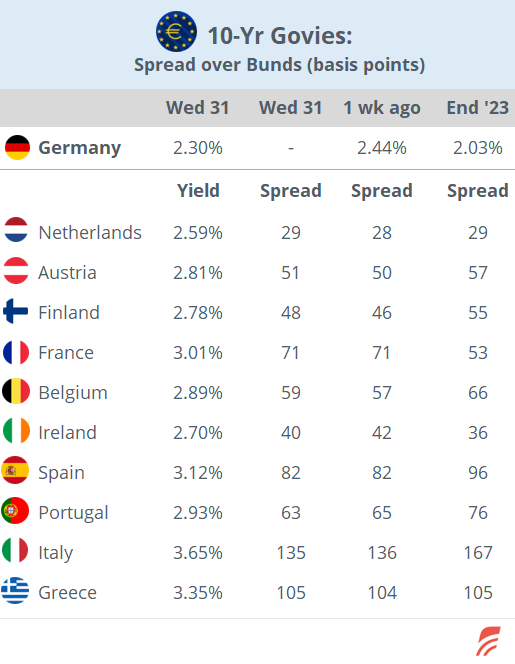

Wednesday was an active and volatile day for global markets. Equities rallied sharply, interest rates continued their decline across developed countries, the $ weakened and crude oil advanced. There were several catalysts for these moves.

The Fed’s monetary policy meeting took place after the European close and the FOMC left its Funds target rate steady at a 5.25-5.50% range, as widely anticipated. However, Jerome Powell made dovish remarks during the press conference and signalled high chances for a rate cut at the next meeting in September, always subject to data. He described the latest data as ‘quality disinflation’, which increases confidence that the central bank’s goal will be achieved.

"If we were to see inflation moving down ... more or less in line with expectations, growth remains reasonably strong, and the labour market remains consistent with current conditions, then I think a rate cut could be on the table at the September meeting," Powell said.

Also supporting a rate cut scenario, was the US ADP employment report for July which came in below estimates (+122k) and lower than a month earlier, reflecting a weakening in labour conditions, ahead of tomorrow's non-farm payrolls (+175k exp) and unemployment update (4.1% exp).

Traders have increased bets that the interest rate cuts will be more aggressive than previously anticipated, with a total reduction of 75bp by year-end. Moreover, futures are pricing in an 11% probability of a 50bp cut at the September meeting despite Powell’s comment that they were not considering such a move.

The Nasdaq Composite posted its second-best day this year with a 2.6% gain and the S&P 500 ended 1.6% higher. Information technology was by far the best sector and the Philly Semiconductors index posted its best day since Nov ‘22, driven by Nvidia and Broadcom's 12% rally after Microsoft announced a massive rise in expenditures on A.I. chips. For context, Nvidia’s stock recovered from a 23% correction in the past two weeks and is still 136% higher YTD.

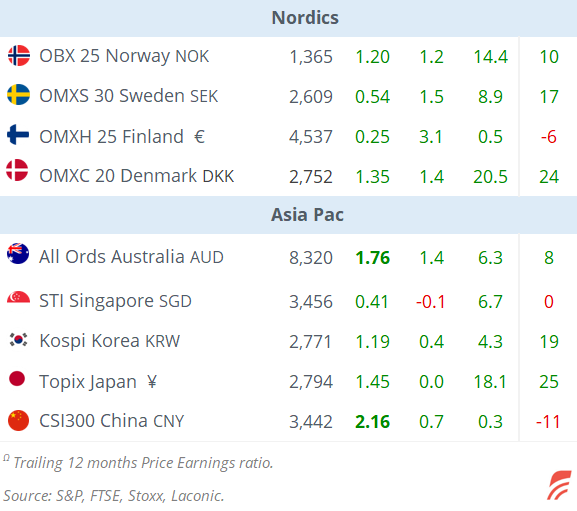

In Europe, stocks rose on the back of earnings updates by HSBC and Airbus while ASML climbed with the chip sector as well as specific company news regarding US trade rules. Madrid’s Ibex was the only notable loser with BBVA as the main dragger, down 4.6% after it paused the share buyback plan.

Today, Asian markets are trading mixed and with large variations. Japan’s Topix index is plunging 3.5% while Taiwan is rallying 2%. The ¥ continues to appreciate after the Bank of Japan hiked its policy rate to the highest level in 15 years (0.25%), triggering an unwind of the popular carry trade.

Headlines:

-Iran plans a retaliation against Israel for the killing of the Hamas leader in Tehran, as tensions in the Middle East increase leading to a recovery in oil prices.

-The race for the White House becomes tighter as Kamala Harris has seen a notable improvement according to the latest polls.

In new € bond issues, French materials company Saint Gobain (mcap €40bn) was the notable issuer with 5-yr (at 3.33%) and 12-yr (at 3.72%) senior notes, rated Baa1/BBB+.

In IPOs, US hedge fund Pershing Capital run by Bill Ackman withdrew its plan to list a new US fund on the NYSE after investor interest diluted rapidly in the past few days.

The key event today will be the Bank of England’s policy meeting at midday London time. Markets are not convinced of a rate cut from the actual 5.25% as there’s a 58% chance for a cut against 42% for no action. The Gilts yield curve was among the most active yday with an 8bp parallel downward shift and the 2-yr closed at 3.81%.

In data, we’ll get the final manufacturing PMI for July for most developed nations.

It’s another busy day for earnings reports. In Europe: Shell, Inbev, Ferrari, the LSE, BMW, Volkswagen, Barclays and Credit Agricole. In Japan: Mitsubishi UFJ, Mitsubishi Corp and Toyota. In the US: Apple, Amazon and Intel after the market close.

OPEC+ panel meets to review oil policy. The Swiss stock exchange will be closed on holiday today.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.