Hi, Markets Dawn Europe is ads-free. To survive, it needs to grow its audience, more feedback and support. 🙏 share it, like it and email us with suggestions so we can improve.

Morning,

The weekend's headlines featured a shooting incident at a Florida golf course, which appeared to be another assassination attempt on Trump. (BBC NYT WSJ FT).

Risk assets ended last week on a positive note driven by traders’ increasing bet on the Fed delivering a larger-than-usual policy rate cut on Wednesday. Also, former NY Fed President Dudley said there was a strong case for a 50bp cut and the central bank’s decision will be this week’s key event in global markets.

As of Friday’s close, futures contracts implied a 45% chance of a 50bp cut versus a 55% probability of a 25bp reduction. The Bank of England and the Bank of Japan will also hold policy meetings this week.

Stocks on Wall Street posted their best week this year with the S&P 500 advancing 4% and the Nasdaq 100 rallying 6% with the information technology and consumer discretionary sectors as the clear outperformers. The S&P 500 is now 18% higher YTD compared to an 8% gain by the Stoxx 600 and 12% by the Dax, in the same currency terms as the € is flat against the $ in 2024.

Among I.T. names, the notable winners include chip makers with giant Nvidia rallying 16% last week while Broadcom gained 22% and AMD added 13%. Other technology companies to perform well were Oracle up 14% to a record high and Tesla +9%.

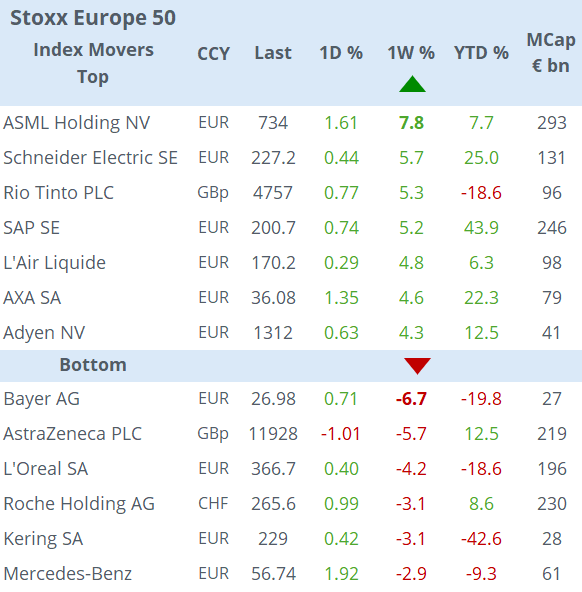

European equities also had a strong week with the blue-chip EuroStoxx 50 index ending 2.2% higher, in line with the Dax, while Madrid’s Ibex 35 was the outperformer with a 3.3% gain on the back of Inditex’s 8% rally.

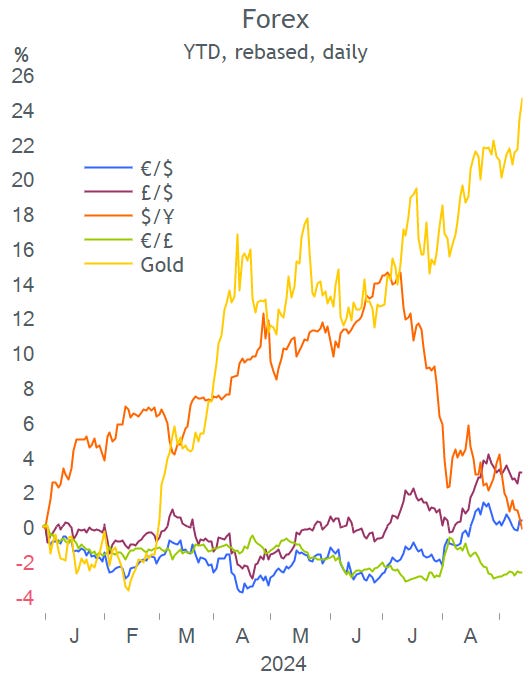

Friday was a quiet day in forex markets and major pairs ended mostly unchanged on the week except for the ¥ which maintained its appreciation trend, closing firmer by 1% against both the $ and the €. Gold extended its recent gains and broke another all-time high after advancing 3.2% last week to $2,576 and accumulated a 25% rally YTD. In cryptos, Bitcoin and Ethereum climbed more than 12%.

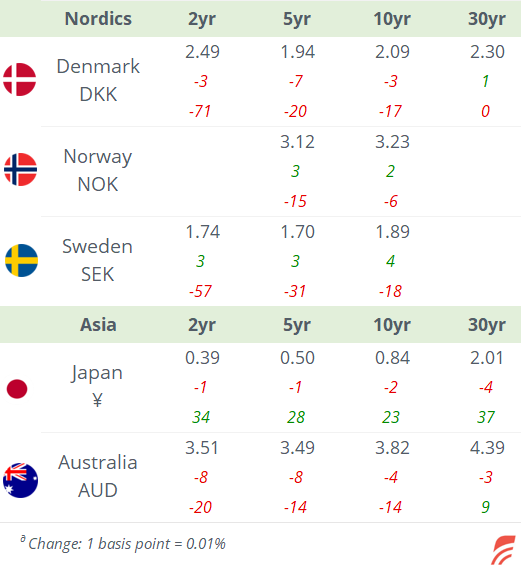

Benchmark bond yields continue to shift lower as traders anticipate interest rate cuts by central banks, with the short-end of yield curves as the most volatile.

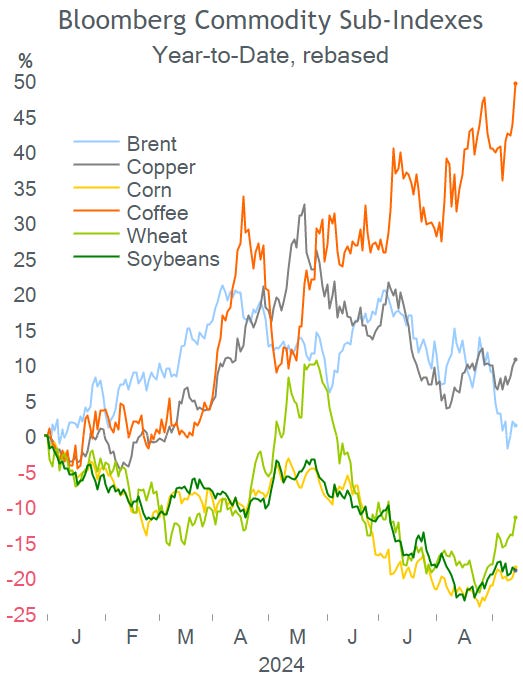

Commodities posted a solid recovery last week from their 3-year low with the Bloomberg broad commodity index adding 2.6%. Cocoa, coffee and silver were the main winners (see table).

In earnings reports, Adobe beat revenue ($5.4bn, +11% YoY) and earnings ($1.68bn, +20% YoY) estimates but missed on guidance for the next quarter and shares dropped 8.5% on Friday, their worst day since March.

In M&A, Danish logistics co DSV (mcap $43bn) is acquiring Schenker, the logistics arm of Deutsche Bahn for €14bn to create a world leader.

In private markets, Nvidia-backed cloud services company CoreWeave of the U.S. plans a sale of employee-held shares valuing it at $23bn, 20% more than at its Series C funding round last May.

In IPOs in the U.S., there were three listings by biotech companies on Nasdaq, MBX Biosciences, Bicara Therapeutics and Zenos BioPharma, raising between $160-300mn.

Asian markets are calm today as it’s a holiday in Japan, mainland China, Korea and Indonesia. It is also a holiday in Mexico. European and U.S. equity futures are mostly flat overnight.

In monetary policy action this week, besides the Fed, we’ll also hear from the central banks of Brazil and Indonesia on Wednesday; of the U.K., Norway, Turkey and South Africa on Thursday; and of Japan and China on Friday.

In economic data releases today, we’ll get Germany’s wholesale prices; Italian retail inflation; and New York’s Fed manufacturing index.

It will be a light week on the corporate earnings front with Fedex (mcap $70bn) reporting on Thursday.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.