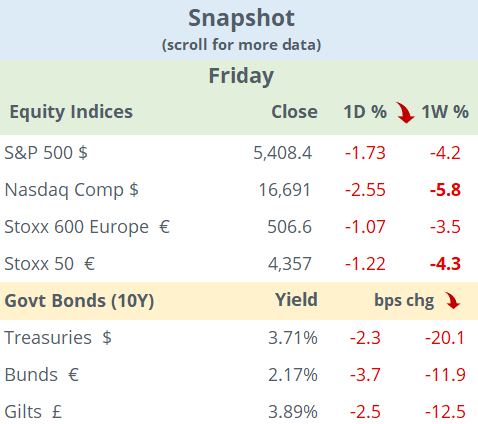

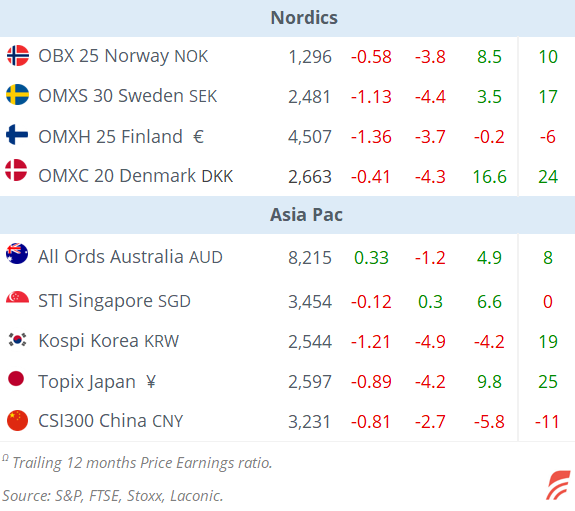

Global equities finished last week on a negative note driven by a mixed reading for U.S. non-farm payrolls that failed to provide a clear picture of the Fed’s next move. The €-Stoxx50 index lost 1.6%, its steepest daily drop in a month to end 4.4% lower on the week following five straight days of decline. The weakness was broad-based across countries and sectors with technology, basic resources and oil & gas as the worst performers.

Stocks on Wall Street did even worse with the Nasdaq Composite posting its worst week since early 2022, down 5.7% and cutting its year-to-date gains to +9%. The information technology sector led the decline with a 7% plunge followed by communication services, energy and materials, down 5%. Semiconductor stocks were the biggest losers of the week with giants Nvidia and Broadcom sinking 14 and 17%. Also, Alphabet had its poorest week in a year, down 7.6% after the U.K. anti-trust regulator said that Google abused its dominant position in online advertising.

U.S. non-farm payrolls for August came in below consensus at +142k and July was revised lower to 89k, the weakest month for job creation since late 2020 (see chart). Private payrolls also printed below estimates (+118k), the unemployment rate fell marginally to 4.2%, and average earnings expanded at a solid 3.8% YoY. All-in-all, these figures reflect a measured deceleration for the labour market and a slowdown of activity. Traders are pricing in a certain policy rate cut by the Fed on September 18, with a 31% chance of a 50bp reduction.

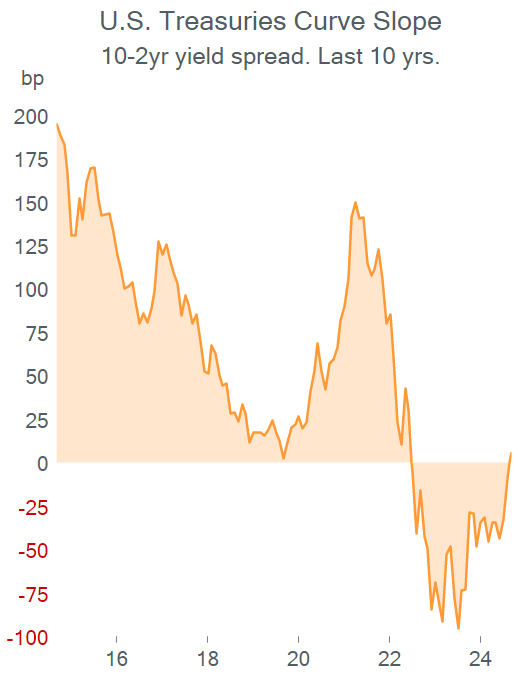

Bond prices continue to move higher and the 2-yr Treasury yield fell 10bp on Friday to 3.65%, its lowest level in 16 months, leading to a positive slope for the yield curve for the first time since mid-2022. The Bund and Gilt yield curves remain inverted up to the 10-yr tenor.

In debt capital markets, American companies issued record amounts of bonds ($82bn last week) as they strengthen their coffers ahead of the November election in case markets become volatile.

Crude oil had its worst week in almost a year with Brent’s November contract down 7.5% to the lowest close since late-2021 on the back of recession fears.

In forex markets, the DXY $ index finished 0.5% lower last week (101.2 pts) with the ¥ appreciating significantly while cryptos remained under pressure with Bitcoin losing 10%.

In data this morning, China’s headline retail inflation for August accelerated to 0.6% YoY but came in just below estimates while producer prices remain in deflationary territory (-1.8%).

Asian markets are falling sharply today following Wall Street’s selloff on Friday with stocks in Tokyo, Shanghai, Hong Kong and Taipei down between 1.5 and 2%. European and U.S. equity futures are gaining up to 0.5% overnight.

In credit rating updates, Virgin Money U.K. Plc (mcap £2.8bn) was u/g by Moody’s to A3.

There are no significant economic releases scheduled for today but it will be an active week for data including U.S. CPI inflation on Wednesday.

The ECB meets on Thursday and analysts and futures markets are anticipating a 25bp deposit rate cut to 3.50%.

Finally, Oracle reports earnings today.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.