Good morning,

Legislative elections in France and general elections in the UK as well as the timing for the Fed’s rate cut, continue to dominate market sentiment. The anti-far-right initiative in France, between Macron’s centrist party and the new left (NFP) to stop Le Pen’s National Rally party from obtaining a majority, has proven successful. The new left-wing coalition (NFP) surprised by winning the most seats (31%) followed by Macron’s centrist alliance (27%) while the far-right (24.8%) came in third, a sharp turnaround from the results of the first round a week ago. No party has obtained a majority (289 seats) and a fragmented parliament is the base scenario with negotiations leading to weeks of political uncertainty. The Republicans, the liberal and centre-right party founded by former president Nicolas Sarkozy, is the fourth largest party and won 6.5% of the votes.

The € initially dropped following the results but is now recovering and is little changed from Friday's close.

Asian stock markets are trading mostly weaker today with Hong Kong leading the fall, down 1.3% and Taiwan as the exception with a 1.7% gain. European equity futures are firmer while bond futures are down with French OATs lower by 0.2%. Brent oil is a touch weaker at $86.41 after ending 2% firmer last week. Bitcoin maintains a bearish trend despite the dovish data for interest rates and is now at $55,000, the lowest level since late February.

On Friday, US non-farm payrolls for June came in at +206k, higher than expectations but in a clear downward trend after May’s figure was revised sharply lower to +218k, a sign that the labour market is cooling which boosted the chances for a Fed rate cut in September to 77%. The unemployment rate rose to 4.1%, a 2.5-year high, while average earnings decelerated to +3.9% YoY.

Stocks in Wall Street rose on Friday to a fresh record high with the S&P 500 advancing 2% week-to-date and the Nasdaq 100 index gaining 3.6%. The notable large-cap mover was Tesla (mcap $802bn) which rallied 27%, its best week in 18 months, to the highest level this year following the upbeat deliveries reported a week ago. Apple and Meta also posted significant gains last week advancing 7%. European indexes traded weaker on Friday but still managed to finish the week in positive territory with French stocks adding 2.6% on average.

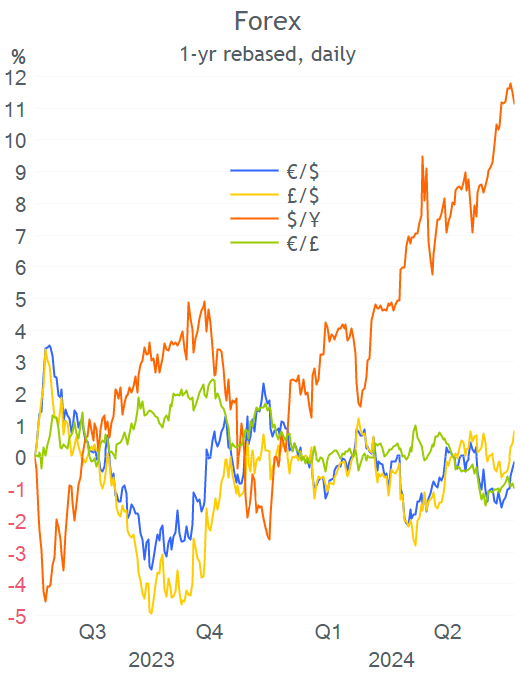

In FX markets, the $ weakened more than 1% against £, € and Aussie and Kiwi dollars last week with cable reaching its strongest level (1.2808) in four months and the € appreciating to a four-week high.

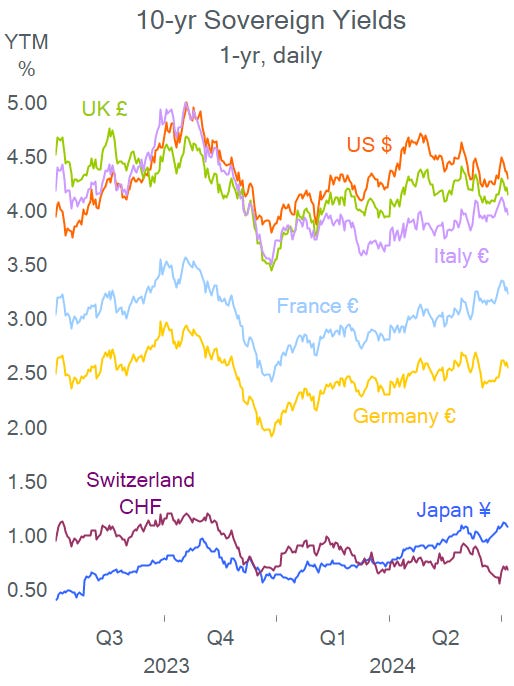

Friday’s labour data in the US pulled benchmark yields lower with 10-year Treasuries closing at 4.27%, Bunds at 2.53% and Gilts at 4.13%. The French OATs yield spread to Bunds narrowed to +68bp for a 3.21% yield ahead of Sunday’s election.

In monetary policy action, Israel’s central bank meets today (unch at 4.5% exp), the Reserve Bank of New Zealand meets tomorrow (unch at 5.5% exp); the Bank of Korea on Wednesday; and Peru’s and Malaysia’s central banks on Thursday.

In economics, China’s CPI and PPI inflation will be released tomorrow; US CPI on Thursday and PPI on Friday will be the most relevant data updates.

On the earnings front, JP Morgan, Citigroup and Wells Fargo will kick off the releases for Q2 on Friday.

See you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.