Podcast ↑↑↑↑ Scroll down for the script.

Morning, it’s Monday the 8th of April,

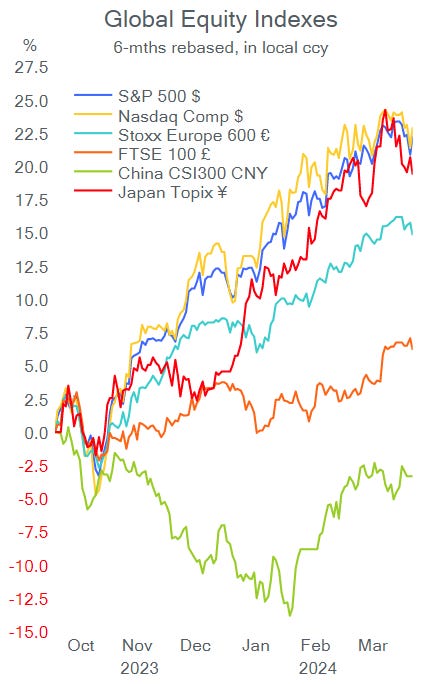

Last week ended on a positive note with US stocks recovering more than 1% on Friday although they finished the week lower by 1% on average. European markets fell on Friday, following the late steep drop in the US a day earlier driven by hawkish comments by Fed policymakers. The Stoxx 600 fell 1.2% on the week with Italian and Swiss markets as the weakest.

The key data on Friday was non-farm payrolls in the US, which showed 303,000 new jobs were created in March, far exceeding the 200,000 expected, and accumulating 39 straight months of job growth. The US economy generated 828,000 posts during Q1, 30% more than in Q4. The reading reflects the strength of the labour market with the unemployment rate easing to 3.8% and average hourly earnings growing by 4.1% YoY.

The high payroll print supports the scenario of a Fed waiting to cut policy rates, but it also confirms that there’s a low to no recession risk in the short term. At the start of the year, markets were pricing in up to seven interest rate cuts, with traders now turning less dovish, to around two cuts as of Friday. The next key data release will be CPI inflation on Wednesday.

In currency markets last week, the dollar index ended modestly lower, while the notable mover was gold with a 4.4% gain to a record high of $2,330, extending its YTD rally to 13%, on the back of the employment update and tensions in the Middle East. Silver rallied 10% on the week.

Bond yields jumped last week, up 18 bps for US Treasuries to 4.38%, up 11 bps for Bunds to 2.40% and 13 bps for Gilts to 4.07%. The yield curves of the US, Germany and Britain remain inverted.

In single equities, last week’s movers worth highlighting in the US are Meta Platforms advancing 9% to an all-time high, it is now worth $1.3tn. Spotify gained 17%, Dell Technologies 16% and General Electric 12%. Intel, on the other hand, dropped 12%. Most sectors fell in the US last week with energy as the best performer.

In Europe, the retail and utilities sectors fell the most. In single names, Norsk Hydro added 12%, miners Anglo American and Antofagasta were up by 7%. In red, Spanish Cellnex Telco fell 9%, and Germany’s Vonovia and Merck lost more than 7%.

Asian markets are mixed this morning, with stocks in Japan rallying 1.5% at one point, now 0.8% higher, while China is dropping 0.5%. European equity futures are pointing to a flat opening, gold is firmer again at $2,340 and Bitcoin is at 69,500.

The week starts with few headlines,

Tensions in the Middle East eased after Israel withdrew soldiers from Southern Gaza following Washington’s warning about protecting civilians. This sent crude oil prices down by 1.5% to below 90 bucks today.

A drone attack on a Ukraine power plant has increased the risk of a "major nuclear accident", the International Atomic Energy Agency warned.

Presidential elections in Slovakia on Saturday saw nationalist-left candidate Peter Pellegrini win with 53% of the votes, supporting pro-Russian Prime Minister Robert Fico, who assumed power recently. Presidents in Slovakia do not hold many executive powers.

There will be a total solar eclipse today that will be seen across North America. A total eclipse occurs when the moon perfectly positions between the sun and the earth.

In corporate deals, pharma giant Johnson & Johnson agreed to acquire US heart equipment producer Shockwave Medical for $12.5bn in cash, a 17% premium to its undisturbed price. Shockwave gained 2% on Friday to its all-time high of $326. It was listed in 2019 at $17 per share. The deal follows J&J’s acquisition of heart pump company Abiomed in 2022 for $16bn.

In the insurance industry, US Arch Capital bought the US mid-market and entertainment insurance unit of Allianz for $450mn.

In IPOs, US biotech Contineum Therapeutics raised $110mn on the 9th biotech IPO of the year. It was priced at $16 and shares dropped 4% on their debut on Friday, to a market value of $415mn.

Monetary policy meetings this week: Israel today, Canada and New Zealand on Wednesday, the ECB and Denmark on Thursday and Korea on Friday. In economic data today, we’ll get industrial production in Germany, Norway and Denmark, as well as housing prices in Sweden.

That’s all for today.