Morning,

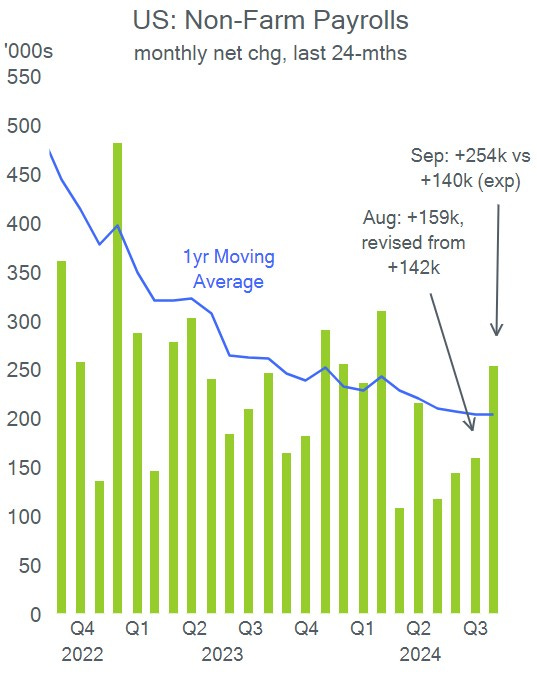

Friday’s robust U.S. employment report (non-farm payrolls at +254k vs +140k exp; unemployment rate at 4.1%) increased the prospects of a “soft-to-no landing” scenario for the economy and reduced the chances for another jumbo rate cut (50bp) by the Fed. In September, the U.S. economy created the highest number of jobs during the past six months and the August figure was revised upwards to +159k. Futures markets are implying a 98% probability of a 25bp cut and a 2% chance of no rate change at the Fed’s Nov 7 meeting, with traders no longer betting for a 50bp cut.

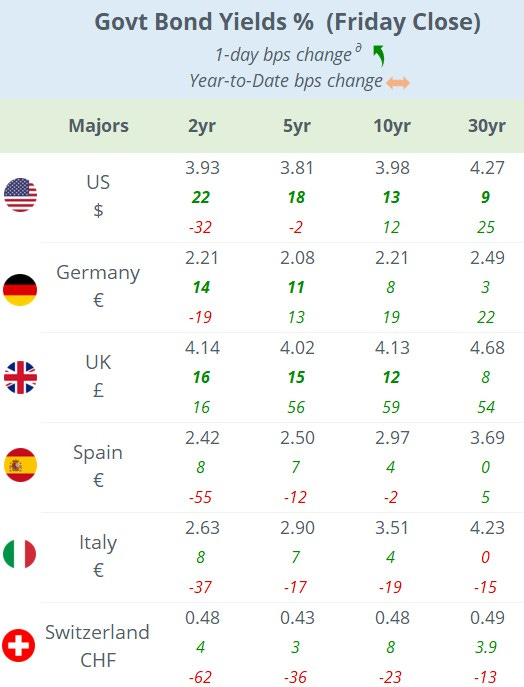

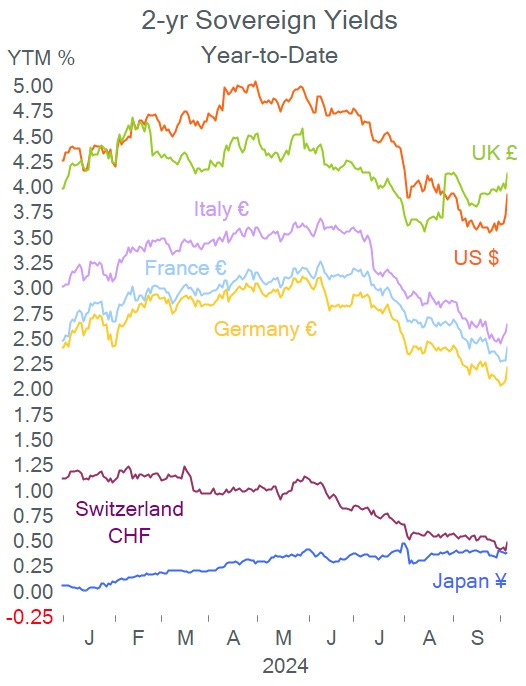

This labour market update reversed the recent trend of a cooling outlook for jobs and the interest rate market reacted with a steep jump in yields, particularly at the short end of the curve. 2-yr Treasury yields added 22bp on Friday and 36bp on the week to close at 3.93%, a one-month high. A similar shift was seen in European bond markets with Bund and Gilts yields shifting upwards by around 15bp on Friday alone.

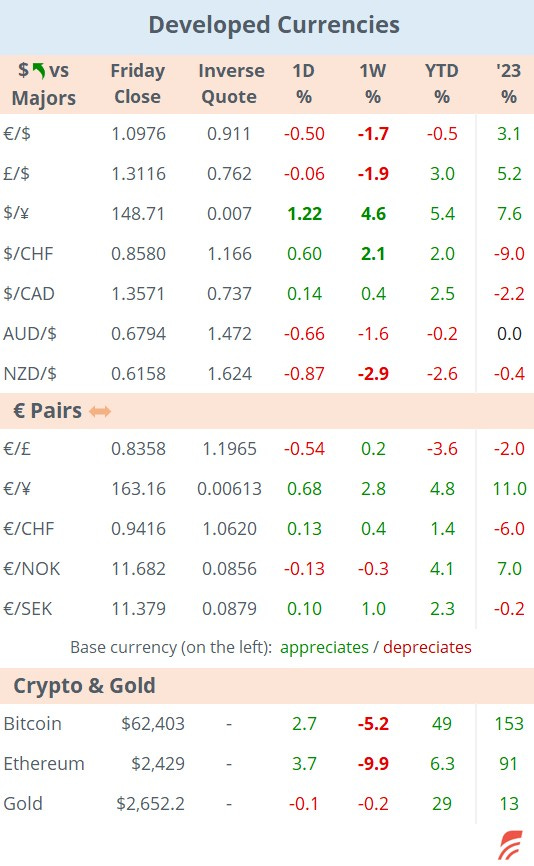

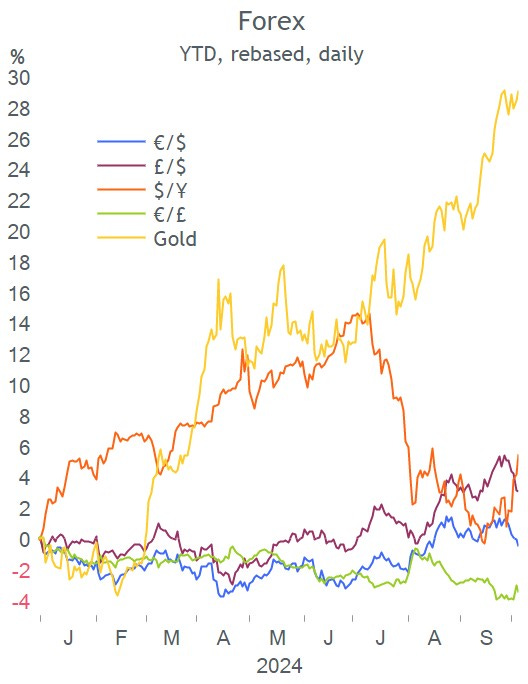

The $ continues to recover and appreciated to finish the week nearly 5% stronger against the ¥ and 2% versus the Sterling, Euro and Swiss franc, sending the DXY index to a 7-week high.

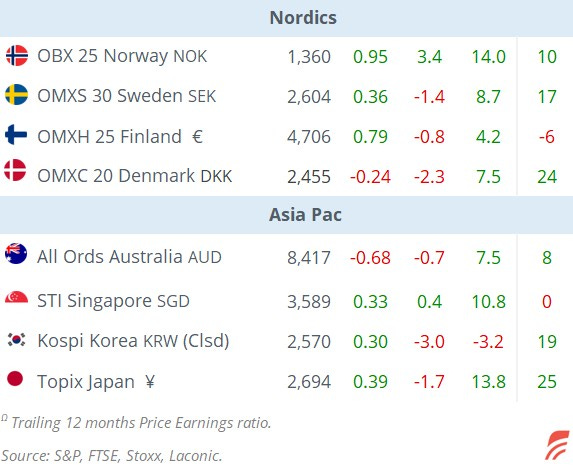

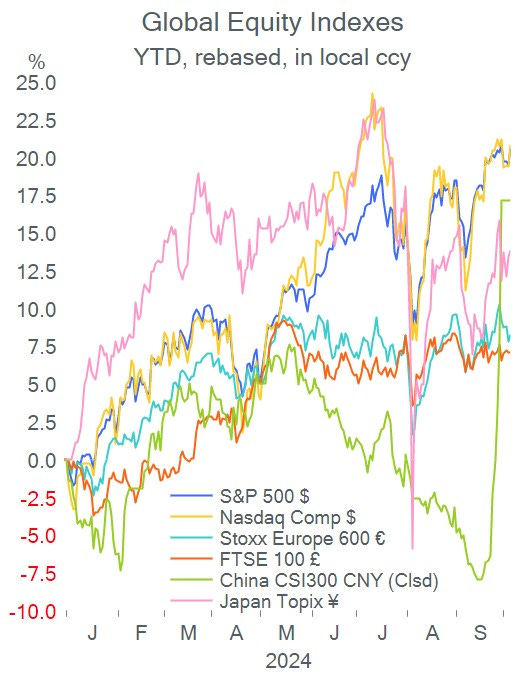

U.S. equity markets ended on a positive note on Friday, gaining >1% to close the week mostly unchanged while European benchmarks finished between 2 and 3% lower for the week with Irish, Italian and French indices as the weakest.

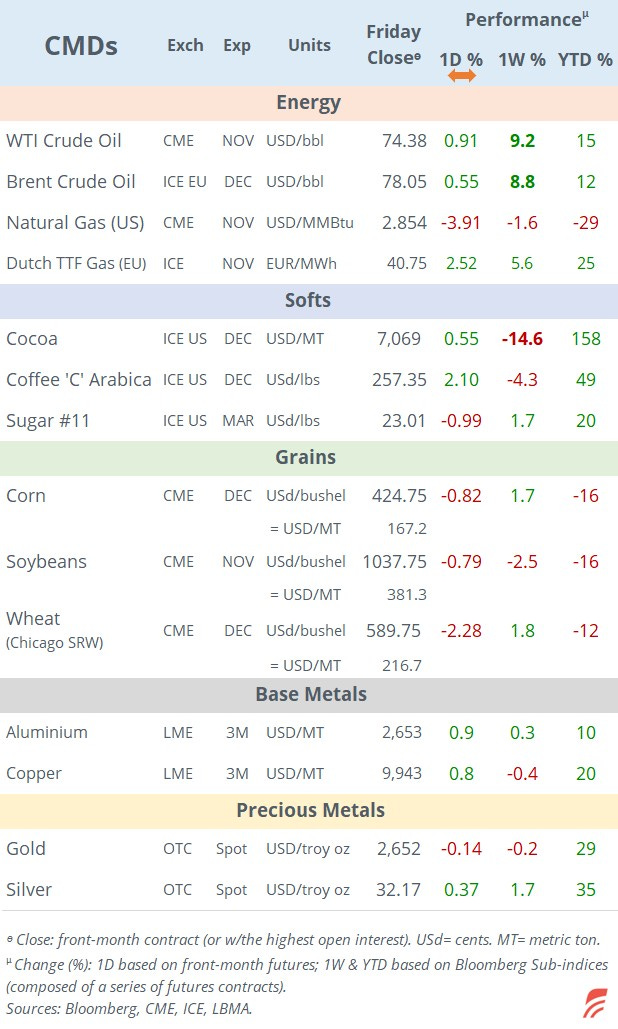

Crude oil advanced 9% last week to a six-week high as traders anticipate Israel’s expected retaliation plans against Iran. The Middle East conflict continues to escalate with Israel bombarding southern Beirut and Gaza yesterday ahead of today’s first anniversary of the Hamas attack. Brent is at $77.8 this morning.

Asia today: stocks are rallying with Japan, Korea, Taiwan and Hong Kong gaining between 1.5 and 2% driven by Friday’s positive sentiment in the U.S. Markets in mainland China will reopen tomorrow after a week-long holiday. European stock futures are 0.4% firmer in early morning trading.

In business news, Brussels agreed to increase tariffs on imports of Chinese electric vehicles by up to an additional 35%. The autos sector was by far the worst-performing sector in Europe last week with a 6.2% drop.

In weather updates, only 10 days after Hurricane Helene made landfall in Florida, the U.S. South faces another threat from tropical storm Milton which formed on Saturday in the Gulf of Mexico.

In corporate deals, the Italian government announced plans to sell ~15% of Monte dei Paschi di Siena (€6.2bn) by year-end to reduce its stake in the bailed-out bank to 12%.

Italian gas distributor, Italgas Spa (mcap €4.4bn) is closer to acquiring its domestic rival 2i Rete Gas (private) for ~€5bn of enterprise value.

In frontier markets sovereign credit ratings, Serbia and Mongolia were u/p by S&P and Senegal was d/g by Moody’s on Friday.

Data today: retail sales in the €-zone; industrial orders and mfg output in Germany; house prices in the UK. The key update this week will be U.S. CPI inflation on Thursday.

In central bank action this week, we’ll hear from New Zealand, India and Israel on Wednesday and Peru on Friday.

The US Q3 earnings season kicks off on Friday with JP Morgan, Wells Fargo, Blackrock and Bank of New York Mellon.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.