Script: Estimated reading time ⏲ ~6 mins

Good morning, it’s Monday 6th of May,

A reminder that today is a holiday in the UK, Ireland, Japan and Korea.

US markets ended sharply higher on Friday after a cooler-than-anticipated employment report and helped by Apple’s rally. Non-farm payrolls increased by 175k in April, the lowest in six months and well below analysts’ expectations of 243k and March’s 315k revised figure. The rise in annual wages was less than 4% for the first time in three years.

These signs of labour market cooling support a lower inflation scenario and consequently a sooner Fed rate cut. Futures markets are now pricing in a 78% chance of a rate cut in September.

The three US leading stock indices gained between 1 and 2% to finish the week 0.5 to 1.5% firmer. Apple rallied 6% on Friday, 8.3% higher week-to-date, its best week in two years following its earnings beat and a record buyback announcement after the market close on Thursday.

Sector-wise, European real estate was the best performer last week (+4%) while autos and retailers were the worst (-3%). In the US, utilities (+3.4%) were the outperforming sector while energy (-3.4%) underperformed.

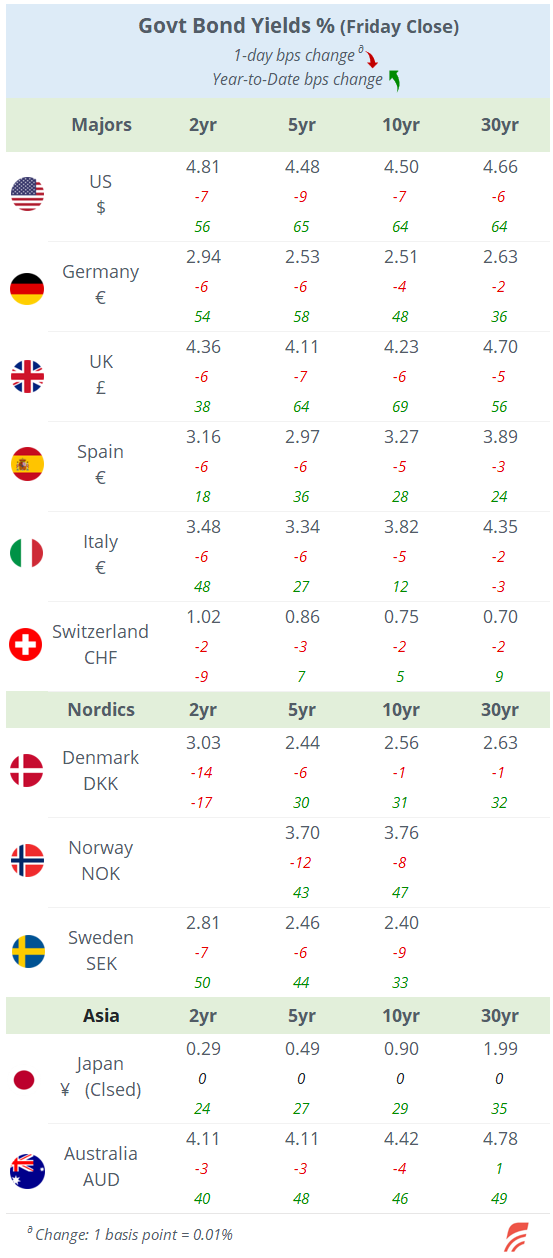

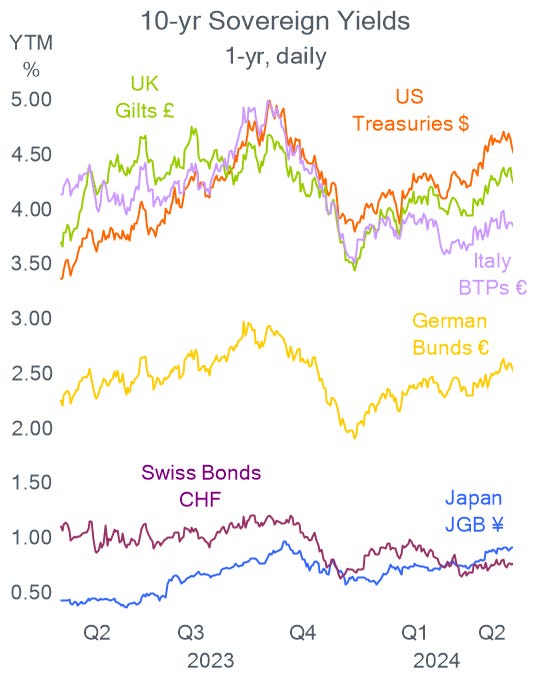

Benchmark yields across markets also dropped last week with 10-year Treasuries down by 17bp to 4.50%, Bunds down 6bp to 2.51% and Gilts yields lower by 10bp to 4.23%.

Most currencies were little changed on the week with the dollar index depreciating nearly 1% mostly due to the yen’s sudden recovery, up by 3.4%, its best week in 18 months on intervention speculation. The yen is at 153.9 this morning.

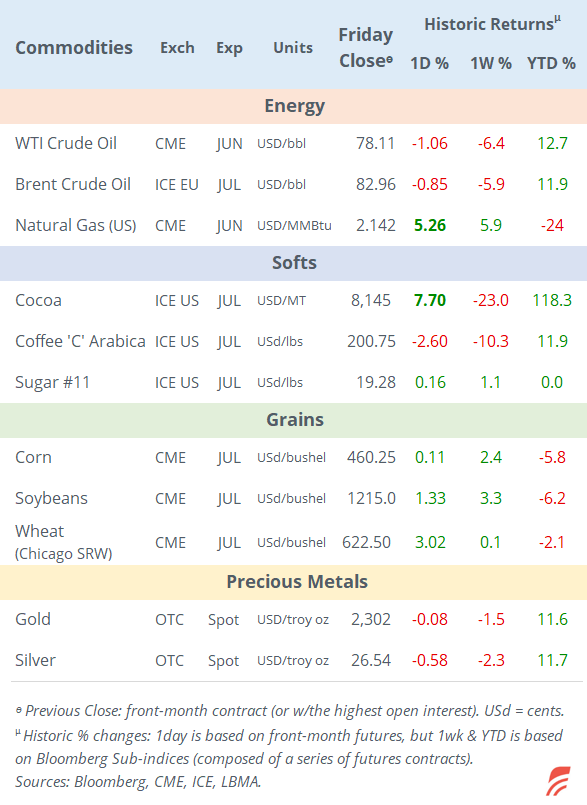

Crude oil had its worst week in three months, down 6% on a weaker US jobs market and a possible extension of supply cuts by OPEC+ beyond June. Brent is now at 83.20.

Headlines,

-Tensions in Gaza escalated this weekend after a Hamas rocket killed three Israeli soldiers in a key crossing used for humanitarian aid near Egypt. Netanyahu rejects demands of a permanent ceasefire and orders to shut down Al Jazeera’s media offices in Israel.

-Southern Brazil is facing one of its worst floods in history with 75 dead, at least 100 people missing and 80,000 people displaced, as more than 300 cities are flooded following the collapse of a hydroelectric dam.

-Chinese President Xi Jinping visits Paris today on a trip that will include Serbia and Hungary. President Macron’s focus will be on Chinese weapons ending under Putin’s control.

-Moscow’s trade with its key partners, China and Turkey, has fallen sharply in Q1 after the US targeted intermediary banks with sanctions, further complicating the access of goods into Russia.

-By-elections in England and Wales resulted in a significant defeat of the Conservative Party and Prime Minister Sunak receives internal pressure to revive the party’s performance.

In corporate deals, private equity firm L Catterton, backed by French luxury group LVMH, secured enough shares of Italian shoemaker Tod’s to unlist the company from the Milan exchange at a €1.4bn valuation.

In the US oil and gas sector, regulators approved Exxon’s acquisition of Pioneer Natural Resources for $60bn announced last October.

In equity capital markets, Chinese electric vehicle brand Zeekr Intelligent Technology seeks to raise $368mn in its IPO in a New York exchange at a $5bn valuation.

In credit markets, Turkey’s rating was upgraded one notch by S&P to B+, and now matches the B+ by Fitch and B3 by Moody’s. Turkey’s 10-year dollar bonds trade at 315 basis points over Treasuries for a 7.66% yield.

The main data today will be Services PMIs for European countries and producer prices for the €-zone. The Milken Institute Conference continues today in Beverly Hills with speeches by Fed officials and the head of the IMF. On the earnings front, Berkshire Hathaway reports today.

In monetary policy meetings this week, Australia’s central bank meets tomorrow, Sweden’s and Brazil’s on Wednesday, the Bank of England, Poland’s and Mexico’s on Thursday.

Asian markets are firmer today with mainland Chinese stocks up by 1.5%, Taiwan +1% and Australia +0.7%. European futures are indicating a positive open. Bitcoin is now at 64,200.

That’s all for today, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. It is prohibited to copy and paste, forward, or set up auto email forwarding rules to give access to others. Please share the publication using the button below, as access is free to all.