fyi- Markets are highly volatile today, text & tables are more updated than the podcast.

Morning,

Let’s get straight into today’s action as Asian markets are selling off sharply following a poor week for risk assets globally and bonds are rallying as investors seek safe havens. The negative sentiment triggered by a weak US PMI reading on Thursday, accelerated on Friday with a lower-than-expected non-farm payrolls print, raising fears about a recession.

Except for mainland China, every equity index across Asia is sinking, with Tokyo’s Topix plunging 10% as the Japanese market enters a bear market, Taiwan (TSMC -6%) and Korea (Samsung -6%) are down 8% and Singapore and Australia are lower by more than 3%. Nasdaq 100 futures are now falling 3.5% into correction territory, and Europe is pointing to a weaker open by around 1.3%. Bund futures are gaining 0.3%.

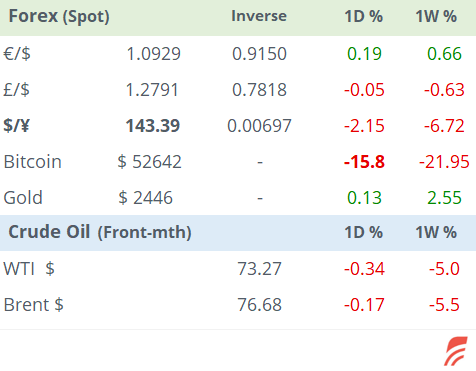

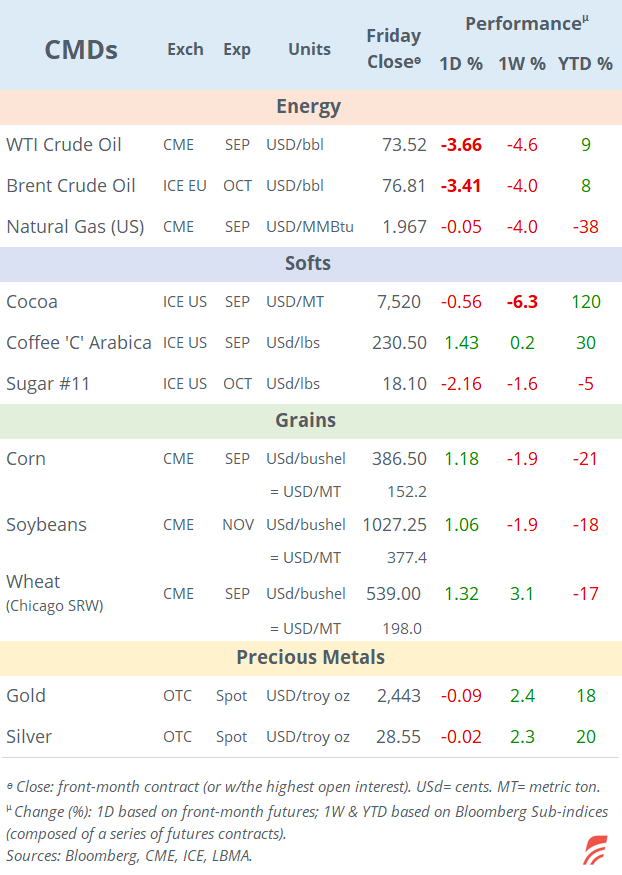

Brent oil is a touch firmer at $77 after a 4% decline last week driven by the weak US data. Bitcoin is collapsing 16% overnight to $52,600 following a 7% decline last week and Ethereum is down 21%. The VIX Volatility index traded as high as 30% on Friday, its highest level in 16 months, before closing at 23.40%.

On Friday, US non-farm payrolls for July came in at +114k, well below estimates, and June’s figure was revised lower to +179k. Overall, the latest figures reflect a deeper than anticipated slowdown in the US economy with some analysts beginning to doubt the soft landing scenario.

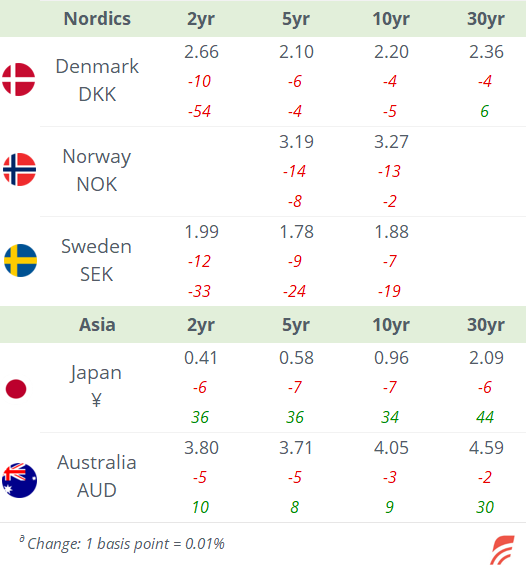

Bond markets rallied sharply last week with benchmark yields plunging and traders pricing in steeper policy rate cuts for this year. Futures markets are now pricing in a 70% chance for a 50bp cut by the Fed in September. 2-yr UST yields plummeted 29bp to 3.87% on Friday, in a bull steepening shift of the curve as 10-yr yields fell 18bp to 3.80%.

In forex: the $ weakened last week with a steep appreciation for the € on Friday. However, the notable mover continues to be the ¥ which rallied nearly 5% last week and is firmer today at 143, its strongest level since early January. The Swiss Franc, another safe-haven currency, gained 3% last week and is also trading up today.

Back to stock markets last week, a notable loser was Intel (mcap $92bn) which sank 26% on Friday, its worst day ever to an 11-year low after missing Wall Street expectations, providing poor guidance as it struggles with a corporate turnaround. The co will cut 15k jobs, suspend a dividend and reduce capex.

On the earnings front, Berkshire Hathaway (mcap $922bn) beat analysts' estimates and increased its cash to a record $277bn after selling half of its stake in Apple in a defensive move. The investment conglomerate posted a record quarterly operating profit (+15% YoY) although net income dropped 15% YoY to $30.3bn. Shares ended flat last week and are 20% higher YTD.

Oil giant ExxonMobil (mcap $524bn) posted one of its strongest quarters in recent years, with revenues ($93bn) and net income ($9.2bn, +17% YoY) above expectations, mainly on higher production in Guyana and the Persian Basin. Shares ended flat WTD but are 17% higher this year.

Chevron (mcap $274bn) beat revenues ($51.2bn, +5% YoY) but missed on earnings ($4.4bn, -26% YoY) on lower refining margins. Chevron’s acquisition of Hess Corp was delayed until next May. Shares ended 6% lower on the week and are flat YTD.

In M&A, British Airways and Iberia owner IAG (mcap £8bn) has terminated its proposed takeover of Air Europa but will retain its 20% stake. IAG also released solid quarterly figures and shares gained 5% on Friday.

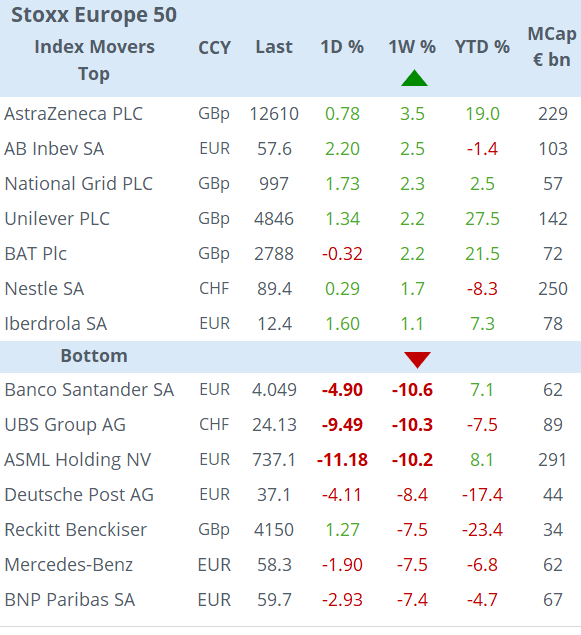

In the utilities sector, Spain’s Iberdrola (mcap €78bn) acquired an 88% stake in British power network Electricity North West (unlisted) for €4.4bn to become the second-largest electricity network operator in the UK.

S&P d/g Ukraine's foreign credit rating to 'SD' (selective default) from CC on Friday after missing a coupon payment in a 2026 €-bond ahead of a restructuring.

Data today: services PMI in developed countries; PPI in the €-zone. The only other relevant release this week will be €-zone retail sales tomorrow and Chinese inflation on Friday.

This week’s monetary policy meetings: Australia tomorrow, Romania on Wednesday, India and Mexico on Thursday and Peru on Friday. Today is a holiday in Canada.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.