Morning,

Welcome to the busiest week in global markets this year with tomorrow's US national election and several central bank policy meetings. The latest polls anticipate a tight election as candidates attend their last rallies across swing states. 32% of eligible Americans (77mn) have already cast their vote.

The $ is falling today following a poll that showed Harris winning in Iowa in a reversal to one of the Trump trades that saw a recent recovery for the greenback. The $ index is at 103.70 this morning. Asian equities are mostly higher today with Korea and Taiwan adding 1% while India is dropping by the same amount.

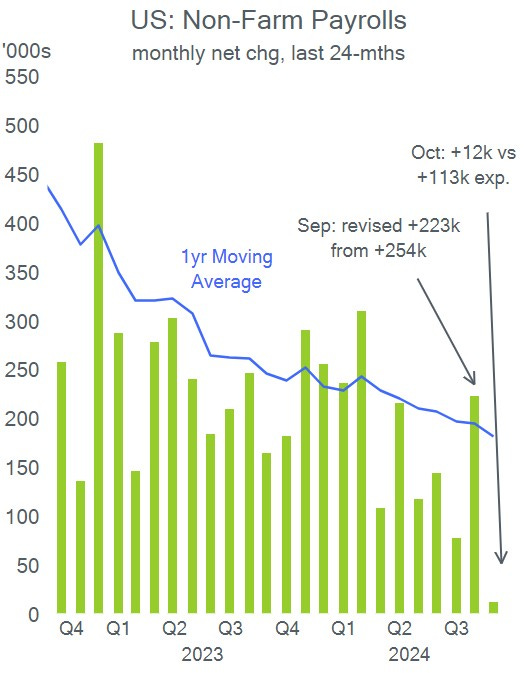

Last week ended with the lowest non-farm payrolls figure since late 2020, with the US economy creating just 12k jobs in October compared to the 113k expected and +223k in September. Private payrolls also came in well below estimates with 28k job losses. The unemployment rate remained steady at 4.1%. The drivers of the weak report were hurricanes (Helene & Milton) and strikes but help Trump on the last day ahead of tomorrow’s election.

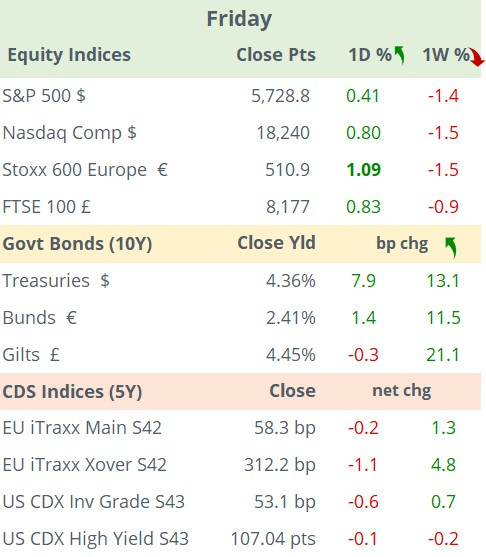

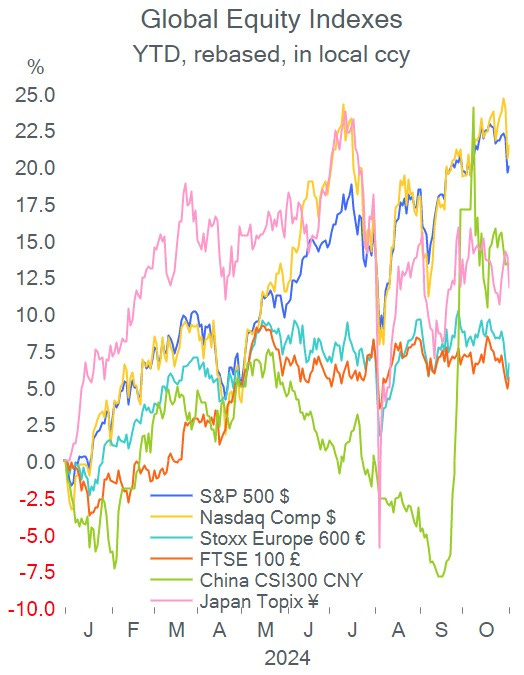

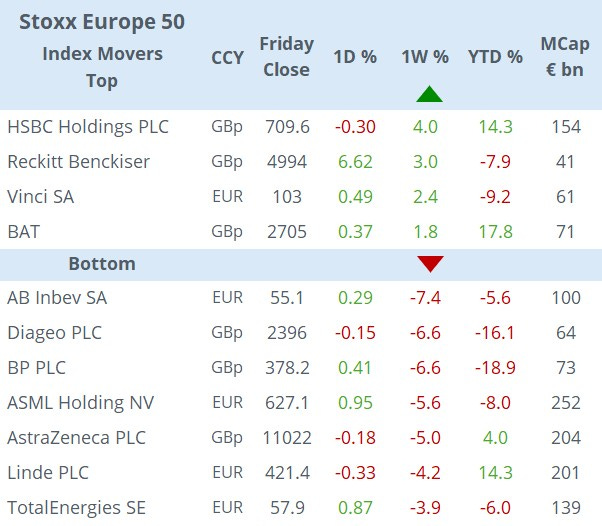

Wall Street stocks finished firmer on Friday following a solid day for European markets which gained more than 1% on the back of a strong performance for financials. Friday’s partial recovery for risk assets was not enough to avoid a negative week-to-date performance as leading indices lost ~1.5%.

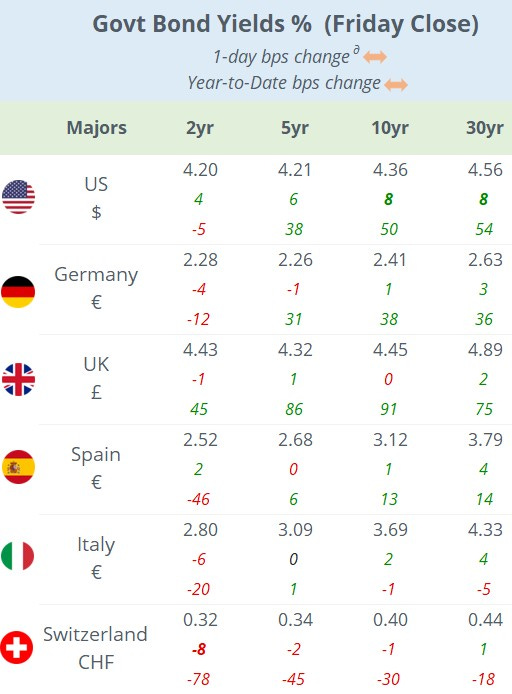

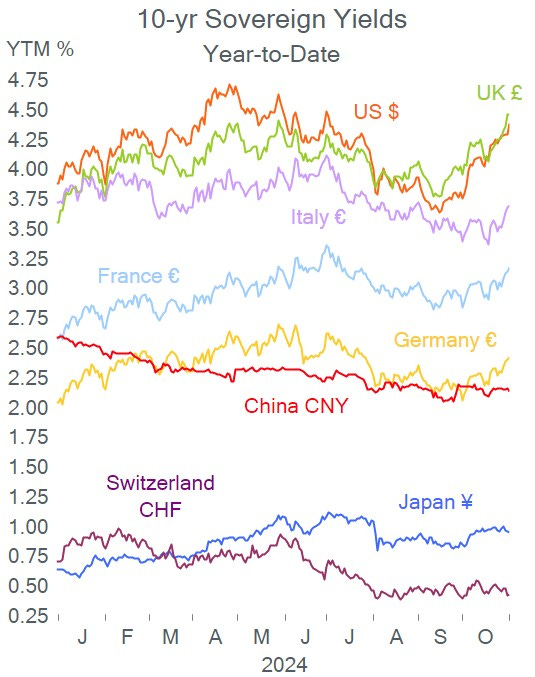

Benchmark bond yields ended sharply higher for a second straight week with 10-yr Gilts as the notable movers with a 21bp jump WTD to 4.45%. Treasuries closed 8bp higher on Friday at 4.36% and Bunds added 12bp on the week to 2.41%.

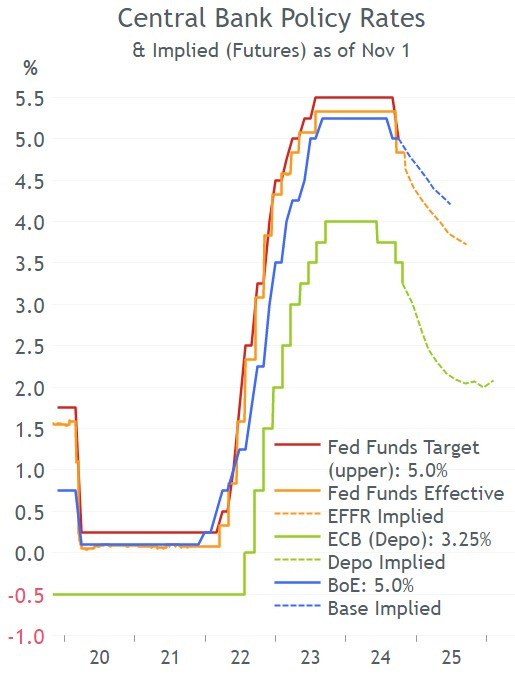

Markets are pricing in an almost certain 25bp rate cut by the Fed (to 4.5-4.75%) and the BoE (to 4.75%) at this week’s meetings, despite the recent bond sell-off and traders’ shift in interest rate expectations.

On the earnings front, oil giants Exxon Mobil and Chevron beat revenues and profit estimates on record oil output but profits fell year-on-year on smaller refining margins. Exxon shares fell 4% last week but remain 15% higher YTD. Berkshire Hathaway continues to reduce its holdings in Apple taking its cash holding to a record $325bn. Berkshire shares are 27% higher YTD.

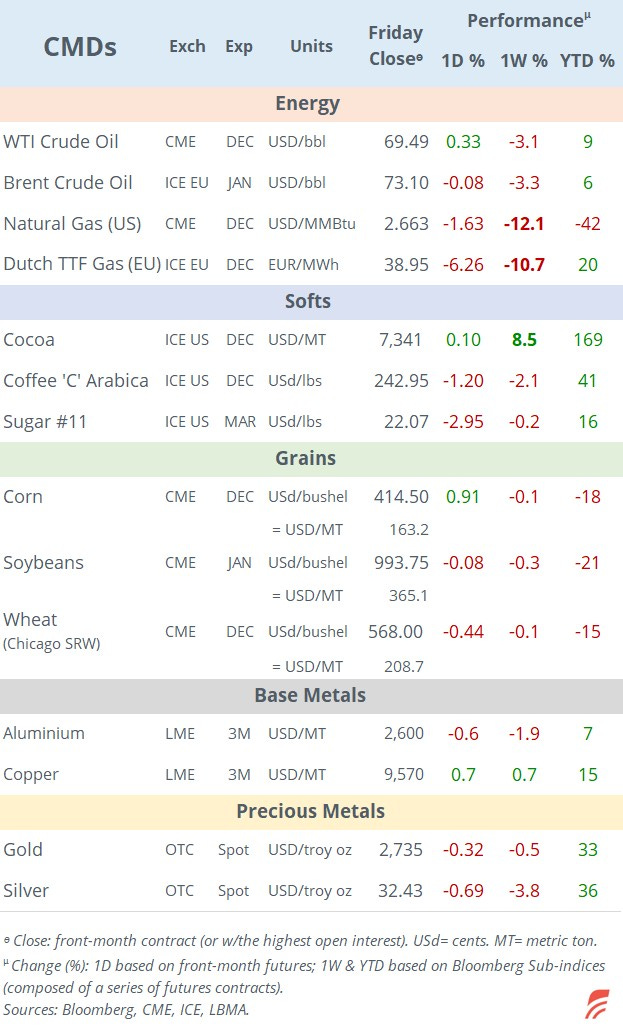

On Sunday, OPEC+ agreed to delay the previously announced December oil output hike by one month, mostly on the back of weak demand in China and non-cartel production keeping prices down. After dropping 3% last week, Brent is recovering 1.6% today at $74.25.

In other data on Friday, Swiss headline inflation eased to 0.6% YoY, below estimates and the lowest reading since April 2021. 2-yr Swiss bond yields fell 8bp on Friday to 0.32% and the Swiss Franc depreciated 0.7% against the $.

In sovereign credit ratings, Turkey and Egypt were u/g one notch to BB- and B.

It will be a busy week for global monetary policy with rate decisions by the Fed (Thu), BoE (Thu), RBA (Tue), Norges (Thu), Riskbank (Thu) and the Central Bank of Brazil (Wed).

Also, China’s National People’s Congress committee meets every day of the week with markets expecting details on the recent stimulus announcements.

Data to be released today: Mfg PMIs in the €-zone, Germany, France. Spain and Italy. Also, US factory orders.

Today’s earnings reports include Ryanair, NXP Semiconductors and Vedanta.

It’s a holiday in Japan, Russia and Colombia.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.