Morning,

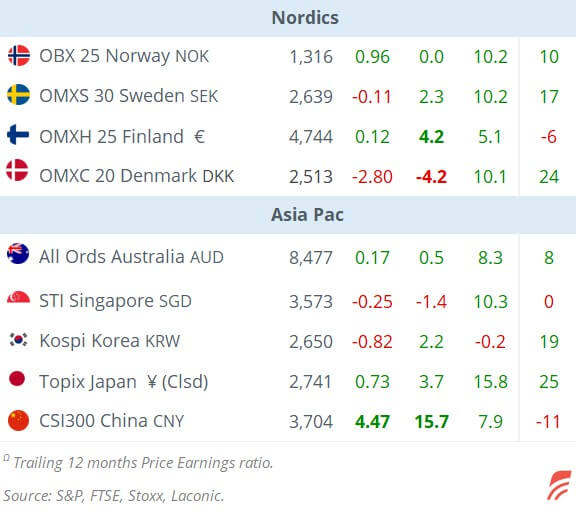

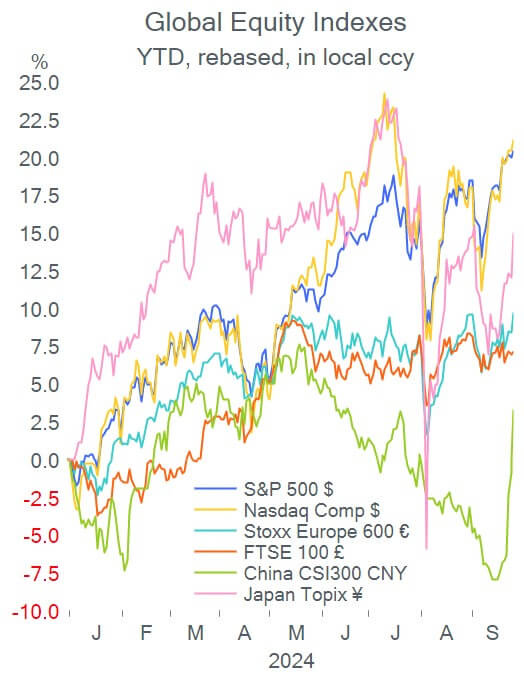

The week began with sharp moves in both directions in Asian markets with Japanese equities selling off while Chinese stocks are rallying significantly. The Nikkei 225 is losing ~5%, the broad Topix index is down 3.3%, the CSI300 is jumping more than 6% and the Hang Seng is gaining 3%. European and U.S. equity futures are showing no reaction and are flat in early morning trading.

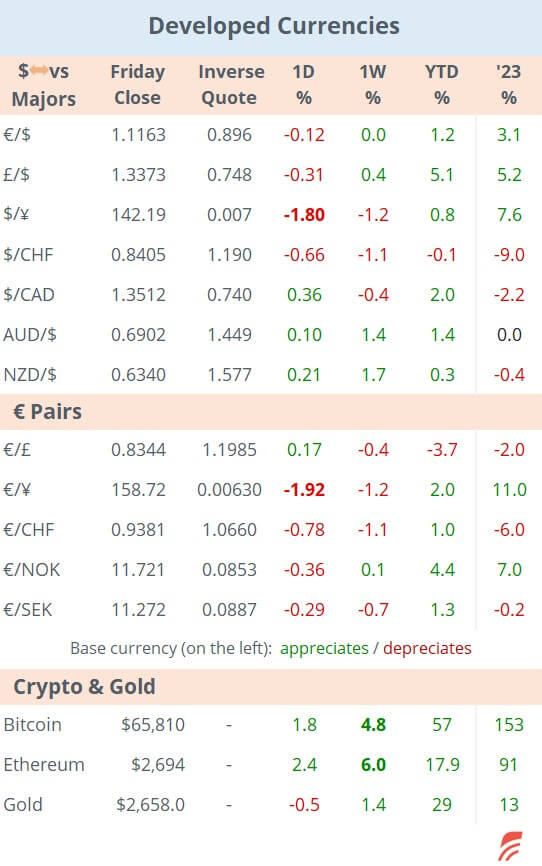

Japanese markets are responding to political news that monetary policy hawk, Shigeru Ishiba, will replace Kishida as the country's prime minister. Also, industrial output for August, released today, surprised analysts with a steep drop of 3.3%, mainly due to disruptions caused by weather conditions (typhoon). The yen appreciated sharply on Friday and is unchanged today while bond yields are rising with the 2-yr JGB yield up by 7bp to 0.385%.

In China, the central bank announced new stimulus measures last night to revive the property market including a 50bp reduction (on average) to all existing mortgages, a cut in down payments, and easing restrictions for home buyers. These measures follow data earlier this month that showed new home prices dropped at the fastest pace in nearly a decade and that real estate sales plunged 18% year-to-date. The CSI300 Real Estate index is rallying 7% today.

Both Manufacturing PMI indicators, the official NBS and private Caixin surveys, released today reflect that factory activity remains in contraction territory for a fifth consecutive month while the Services sector slowed sharply. Chinese markets will be closed on holidays from tomorrow until next Monday inclusive.

In other Asian markets, stocks in Taiwan are losing 1.5% while Australian equities are advancing nearly 1% to an all-time high.

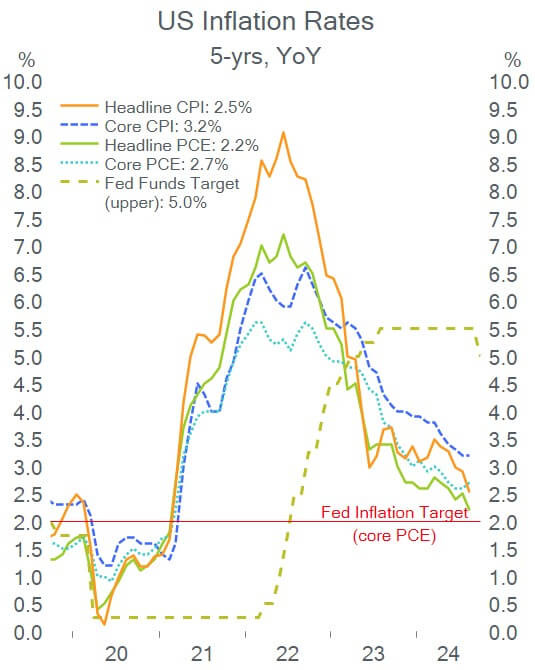

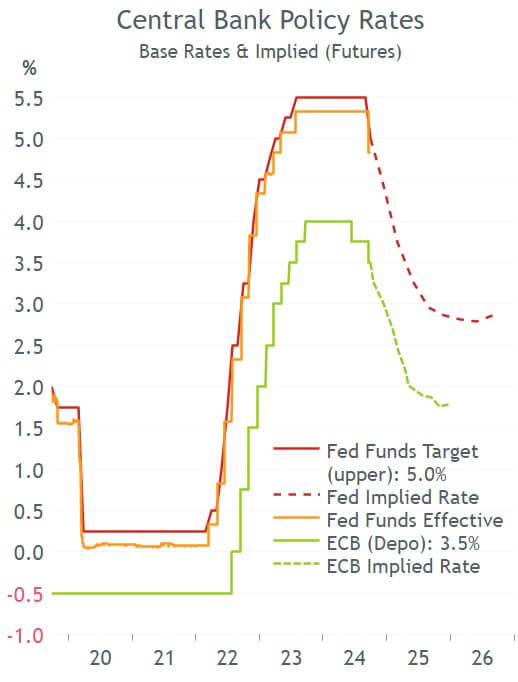

The key economic release on Friday was U.S. PCE inflation, the Fed’s preferred inflation measure, which slowed to 2.2% YoY, slightly below estimates and significantly lower than the 2.5% recorded a month earlier. The core PCE measure was 2.7%, in line with consensus and a touch higher on the month (see chart). Markets are pricing in a slightly higher chance for a 50bp rate cut versus a 25bp cut by the Fed in November (see chart).

Headlines:

-Austria’s far-right Freedom Party (Herbert Kickl) is set to win yesterday’s legislative elections with 29% (followed by the People’s Party OVP with 26.5% and the Social Dems with 21%), as the pro-Russian and anti-establishment party gets closer to ruling the country. (BBC)

-Israel widens its offensive against terrorist groups and launches air strikes against Houthi rebels in Yemen only days after the attacks in Beirut to kill Hizbollah leaders. Tel Aviv defences have intercepted missiles launched from Yemen for the third time this month. (FT)

-In the U.S., Hurricane Helene caused at least 100 casualties, severe floods and damage in its path through North and South Carolina after making landfall in Florida on Friday. (CNN)

Data to be released today: GDP, mortgage figures and house prices in the UK; retail inflation in Germany and Italy; GDP and unemployment in Denmark.

Credit Ratings: Israel was d/g two notches by Moody’s on Friday to Baa1.

Monetary Policy meetings this week: quiet in developed countries and Colombia (today, -75bp to 10% exp), Poland (tomorrow) and Romania (Friday) in emerging countries.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.