Est reading time: 6 min

Market sentiment ended on a positive note last week with the latest inflation updates for the €-zone and the US.

The €-block’s HICP (flash) headline (2.6% YoY) and core (2.9%) inflation rose by more than expected in May and were higher than in April. In dovish remarks, ECB policymaker and governor of the Bank of Italy, Fabio Panetta, reaffirmed his view that the central bank can begin to cut policy rates, that these figures were neither good nor bad, and that the ECB needed a series of rate cuts to reach neutral stance. The ECB meets on Thursday and markets are pricing in a 92% chance for a 25bp cut to 3.75%.

PCE inflation in the US for April, the Fed’s preferred inflation measure, came in mostly in line with estimates and unchanged from the previous month. Headline PCE was 2.7% YoY while core was 2.8%, and the positive reading was the monthly print for core PCE at 0.2%, a touch lower than expected. Consumption grew by 0.2% MoM, below estimates and March was downgraded to 0.7% MoM, a sign that consumer spending (which accounts for 2/3 of US GDP) is moderating.

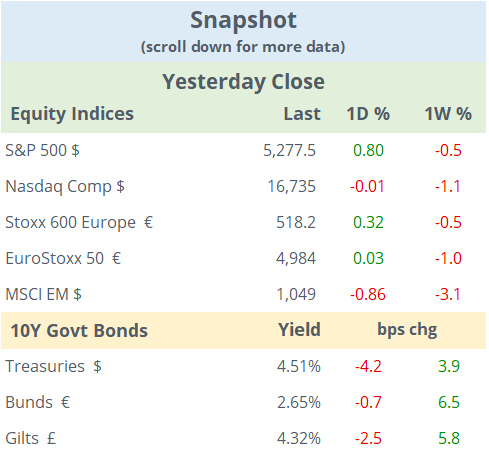

Most European equity benchmarks finished moderately firmer on Friday but ended lower for the week, with the Eurostoxx 50, Dax, and CAC lower by around 1%. In the US, the Dow Jones advanced 1.5% on Friday but finished the week lower by 1%, while the S&P 500 lost 0.5% and the Nasdaq 100 fell 1.4% WTD. On the forex front, it was a quiet week with the DXY dollar index, the € and £ ending flat WTD.

A few performance highlights for May. The $ index had its first negative month of the year, down 1.4%. The S&P 500 advanced 4.8% and the Stoxx 600 by 2.6%, their fourth positive month YTD. On the 10-year bond space, Treasury yields fell 17bp (4.51%) in May while Bund yields (2.65%) added 7bp and Gilts 3bp (4.32%).

In single stock names last week, the two large-cap notable movers were German software giant SAP (mcap €194bn) and US computer hardware Dell Technologies (mcap $99bn).

SAP had its worst week in more than two years, falling 7.8% from its all-time high after peer Salesforce disappointed with its sales guidance for the current quarter. Dell reported quarterly results that beat sales and profit estimates but signalled higher-than-expected costs for its A.I.-servers and lower margins for this quarter, and traders took profits on a stock that was trading at a record high and has rallied 122% YTD. It plunged 18% on Friday to finish its worst week in 5 years (-13%).

On to today’s markets: except for mainland Chinese stocks, which are marginally weaker, all other Asian stock markets are rallying. Hong Kong is gaining 2.3%, Korea 2%, Taiwan 1.8% and Japan 1%. European futures are pointing to a strong open, up nearly 1%. China’s manufacturing PMI was slightly better than anticipated and continues to expand. Korea’s government announced a potential vast oil and gas offshore discovery.

Headlines,

-Yesterday, OPEC+ agreed to extend most of its deep oil production cuts well into next year to prop up the price of crude oil. On aggregate, all OPEC+ members are currently reducing oil output by a total of 5.86mn bpd, or around 5.7% of global demand. 62% of those cuts will be extended until the end of 2025, and the balance will begin to phase out from September of this year. The cartel’s next meeting is scheduled for December 1. Brent futures are trading unchanged at $81 this morning despite the announcement.

-Moscow and Beijing disagree over the price of Russian gas via the new pipeline that Gazprom is completing to increase its energy exports.

-Mexico held general elections yesterday and exit polls show that frontrunner Claudia Sheinbaum, the former mayor of Mexico City and candidate of incumbent president Lopez Obrador, got 56% of the vote and will become the country's first woman president.

-South Africa’s ANC party ended up winning slightly less than 40% of the seats in the National Assembly, its worst election in three decades and parties must now agree on a coalition within 14 days. The biggest opposition party, the white-led (Steenhuisen) and pro-business Democratic Alliance, got nearly 22%, Jacob Zuma’s MK party 14% and the far-left Economic Freedom Fighters (Malema) won 9.9%.

-Exit polls in India, which take weeks to vote and count, suggest a significant victory for Modi. India’s Nifty Fifty stock index hit a record high today, up 3.6%.

-In the Middle East, Biden presented a peace plan that was accepted by Hamas and is being considered by Israel, in a move that could begin to de-escalate the conflict.

-Nvidia announced details for its next generation of A.I. chips, called Rubin, only a few months after launching its predecessor line of processors Blackwell. Taiwan’s TSMC shares are rallying 3.8% today.

The Saudi government launched a follow-on share placement of Aramco (mcap $1.83tn) shares on Sunday, worth $12bn or 0.64% of the total outstanding. Bankers say they have received demand for all the shares. The government owns 98% of the stock, directly (82%) or through its SWF (16%). The guidance price is SAR 26.7-29 range.

France’s credit rating was downgraded one notch by S&P to AA-, 10-yr OATs closed at 3.15% or 50bp over Bunds. Ireland’s rating was upgraded one notch by Fitch to AA, outlook stable (10-yr yield 3.06%).

Today’s economic data highlight will be manufacturing PMIs for developed countries. In monetary policy decisions this week, we’ll hear from the Bank of Canada and Poland on Wednesday, the ECB on Thursday and Russia’s and India’s central banks on Friday.

That’s all for today, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Please share using the button below, as access is free to all.