Morning,

Global equities ended a volatile week on a positive note with the S&P 500, Nasdaq 100, FTSE and €-Stoxx 50 indices, advancing more than 1% on Friday on the back of a good reading for US inflation and solid earnings reports in Europe. The US technology sector posted a steep weekly loss (-2.6%) while the small-cap Russell 2000 had its second-best week this year with a 3.5% rally, benefiting from the portfolio rotation process.

European stock benchmarks had a positive week with the Dax, FTSE and Belgium’s Bel 20 indices adding well over 1%. Japanese (-5.6%) and Chinese (-3.7%) indicators were the weakest ones with steep weekly loses.

Headline PCE inflation rose moderately in June, up 2.5% YoY in line with estimates and a touch lower than the 2.6% increase in May. The core PCE reading, the Fed’s preferred inflation measure, added 2.6% YoY, unchanged from a month earlier, showing that price pressures remain under control driven by a cooler economy that expanded a half the pace in H1’24 (+2.1% annualised) compared to H2’23 (+4.2%). Although this inflation update supports the disinflation trend, the Fed is expected to hold rates steady this week.

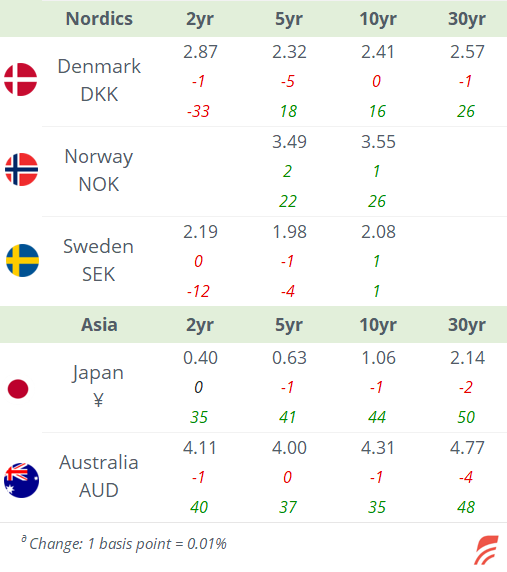

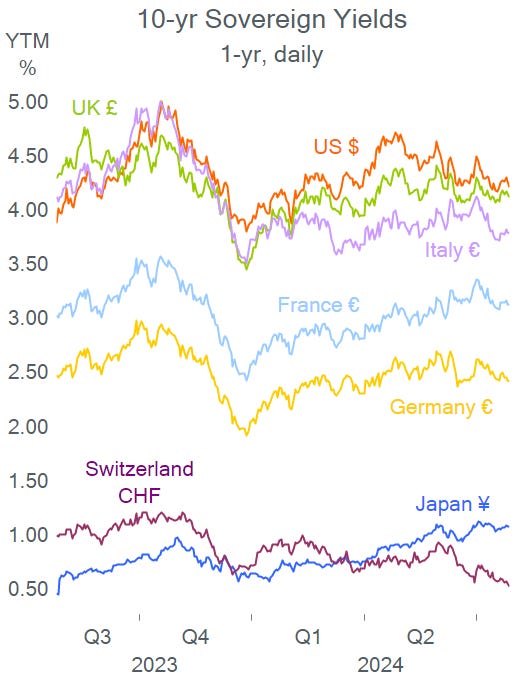

Interest rate markets benefited from the inflation update with US Treasury yields shifting lower by 5 to 6bp across tenors on Friday. However, on a week-to-week basis, benchmark yields barely changed with Bunds as the only notable movers, accumulating three weeks of declines in yield, to close at 2.40%. The French OAT spread over Bunds widened last week to +71bp and a 3.11% yield, above Portugal’s 3.05%.

Today, European and US equity futures are extending Friday’s sentiment with gains of around 0.5% and stocks in Asia are firmer with Japan, Hong Kong and Korea gaining over 1.5%. One big mover in Tokyo is pharmaceutical Eisai Co (mcap $11bn) which plummeted 12% following a rejection of its Alzheimer's drug by the EU regulator.

The ¥ maintains its recent recovery trend and appreciates to 153.30 against the $, its strongest level since early May. Brent oil is little changed this morning at $81.25 and Bitcoin is up 3% at $69.5k.

Headlines:

-Tensions in the Middle East rose following a rocket strike against Israel, attributed to the Lebanese terrorist group Hezbollah that killed 12 and retaliation is expected.

-Kamala Harris gets closer to being nominated as the Democratic presidential candidate after receiving support from the Obamas and raising $200mn in her first week of campaign.

-In Venezuela, incumbent President Maduro was declared winner of yday’s general election with 51.2% of the votes while the opposition claims fraud.

In IPOs, US hedge fund Pershing Square Capital postponed the listing of its Pershing Square USA fund after reducing the target of the expected fundraising from $25bn to around $5bn.

In credit rating updates, the notable changes were the upgrades of Munich Re to AA, AstraZeneca to A+ by S&P and KBC Groep to A3 by Moody’s.

This will be a busy week in monetary policy action with the central banks of the US, Japan and Brazil meeting on Wednesday followed by the Bank of England on Thursday.

It will also be an active week for corporate earnings. Notable blue chips reporting today include Heineken, Philips and McDonald's. Mega-caps Microsoft, Apple, Amazon, Meta, Mastercard, HSBC and Toyota will report during the week.

Today will be light on economic data with Sweden’s GDP and retail sales updates. Later in the week, the key data release will be inflation and GDP in several €-zone countries (€-block on Wed) and the monthly labour report in the US (NFP on Fri).

That’s all for today, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.