Script: Estimated reading time ⏲ ~6 mins

Good morning,

Equities had a strong end to a volatile week with benchmarks rallying in the US and Europe on Friday driven by solid earnings reports by Alphabet and Microsoft as well as US PCE inflation in line with estimates.

The highly awaited inflation update showed headline and core PCE rose by 0.3% in March, as expected, while moderately higher on an annual basis, with headline at 2.7% and core at 2.8%. Markets feared that Thursday’s PCE price advances during Q1 could anticipate a worse update on Friday, and the marginal increase was well received by investors.

Microsoft beat sales ($61.9bn +17% YoY) and net income ($22bn, +20% YoY) estimates, on strong cloud growth but shares added just 1.8% on the week.

Alphabet also beat on revenue ($80.5bn, +15% YoY) and profit ($23.6bn, +14% YoY) and announced a $70bn stock buyback as well as its first-ever cash dividend. Shares rallied 11% to an all-time high and a $2.1tn market cap.

Leading stock indices gained more than 1% on Friday, and the Nasdaq Composite ended the week firmer by 4%. The FTSE 100 advanced 3% week-to-date while Madrid’s Ibex gained 4% and Lisbon’s PSI rallied 5%. A notable sector mover was the European Bank sector which finished at a 9-year high.

Regarding single stocks, the week’s biggest movers include Galp Energia with a 28% rally, Anglo American up 21%, ASM International up 20% and Volvo down 18%. In the US, Snap added 30%, Nvidia and Tesla gained around 15% and Super Micro Computer, the $50bn computer hardware company, added 20% to accumulate an impressive 200% gain this year.

The notable mover among developed currencies was the yen with a 2.4% depreciation last week against the dollar, accumulating a 12% drop this year compared to a 9% fall versus the euro. Today the yen touched 160, its weakest level since 1990.

In fixed income markets, prices also ended weaker with 10-year Gilt yields accumulating five weeks of gains, closing at 4.33% on Friday. US Treasuries also sold off closing at 4.67% while Bund yields finished higher at 2.57%. The key story in this space is traders’ expectations for a delayed Fed rate cut while the ECB is expected to cut policy rates relatively soon.

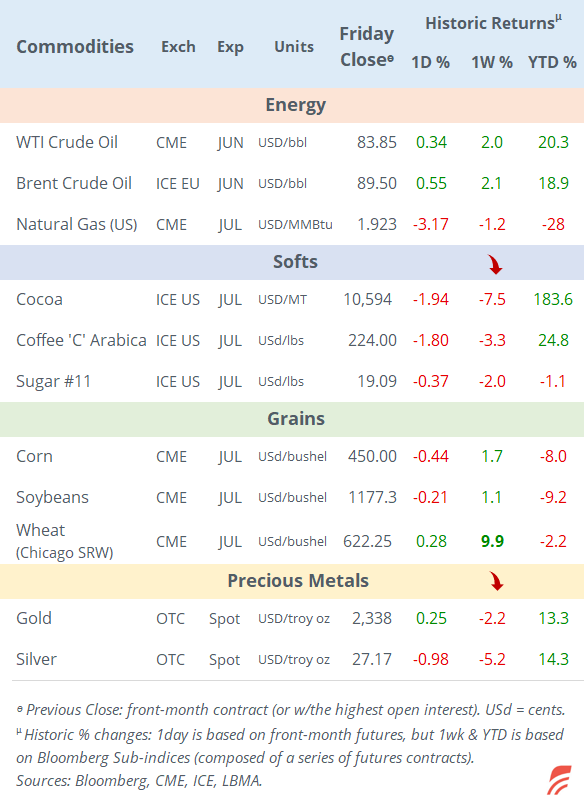

In commodity markets, last week’s highlight was wheat with a 10% rally to the highest in four months, driven by adverse weather in Europe, Russia and the US. The sudden rally triggered stop-loss orders that accelerated the move to $6.22 per bushel.

In corporate deals, US private equity firm Thoma Bravo agreed to acquire UK-based cybersecurity company Darktrace for £4.3bn in cash. Shares jumped 16% on Friday. Darktrace was listed three years ago at a £1.75bn valuation. The company reported £89mn in profits in the LTM.

Also, specialty chemicals company US Silica Holdings is being acquired by Apollo in a deal worth $1.2bn for Silica equity and 1.85bn of enterprise value. Shares jumped 22% on Friday. Silica had earnings of $116mn in the LTM.

The latest regarding BHP’s approach to acquiring Anglo American was the British miner’s rejection of the initial terms as they significantly undervalued the company. Activist hedge funds build stakes in Anglo in anticipation of a higher takeout price. Anglo shares ended 21% higher last week.

The latest in IPOs brought British private equity firm CVC Capital Markets to the Amsterdam exchange on Friday. It was priced at €14, the midpoint of its guidance range, and shares ended 17% higher for a valuation of €16bn. CVC raised €2.3bn in one of Europe’s largest offerings this year.

In US markets, aerospace parts manufacturer Loar Holdings’ IPO was priced at $28 and shares climbed to almost $50 for a $4.3bn valuation. Loar raised $308mn.

Revisiting last week’s update on credit ratings, Peru’s foreign rating was downgraded one notch by S&P to BBB-, as well as several local banks. Bolivia’s rating was cut by two notches to Caa3 by Moody’s. On the corporate side, French Scheiner Electric was upgraded to A.

Companies releasing earnings today include BBVA, Philips and NXP Semiconductors.

On today’s data front, we’ll get inflation in Germany and Belgium, GDP in Sweden and Sentiment indices for the €-zone. On Wednesday, the Fed will hold its policy meeting with futures anticipating an almost certain chance of no change in interest rates, and on Friday we’ll hear from Norway’s central bank.

This will be a broken week as Wednesday is May 1st and most European markets will be closed as well as China, Mexico and Brazil among others. Markets in the US and UK will be open.

Asian markets are trading firmer today with China, Hong Kong and Taiwan up by nearly 1.5%, the yen is volatile on intervention rumours. European futures are pointing to a positive open, Brent is now at $88.70, and Bitcoin is lower at $62,500.

That’s all for today, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. It is prohibited to copy and paste, forward, or set up auto email forwarding rules to give access to others. Please share the publication using the button below, as access is free to all.