Morning,

Let’s cover today’s events before reviewing last week’s market performance. Japan’s ruling Liberal Democratic Party coalition lost the parliamentary majority yesterday for the first time since 2009 in a surprising result that triggered political instability. Voters rejected the incumbent government of Prime Minister Ishiba mostly on the loss of wages’ purchasing power as salary improvement has not matched inflation and recent scandals. The Constitutional Democratic Party of Japan was the election’s biggest winner adding 50% of its seats in parliament. Smaller parties (Democratic Party for the People and the Japan Innovation Party) also added seats and will prove key in negotiations to form a new government.

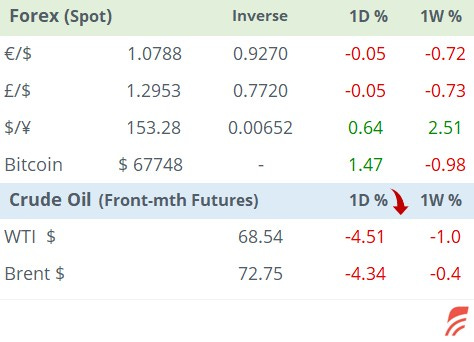

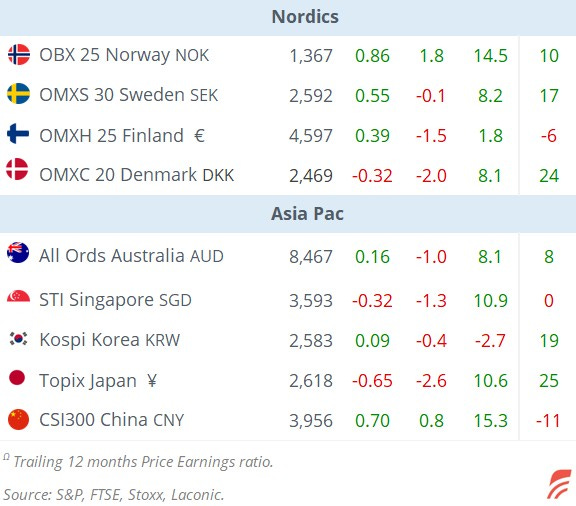

The ¥ is dropping 1% today to a three-month low of 153.70 while stocks are rallying 2% following last week’s 2.6% decline and bond yields are little changed with 10-yr JGB yields just 1.5bp higher at 0.965%. Other Asian markets are mixed with stocks in China, Hong Kong and Taiwan a touch weaker while Korea is firmer by 1%.

The other notable event this morning is crude oil’s sell-off with Brent and WTI plunging 4.5%, reversing all of last week’s gains, after Tehran downplayed the impact of Israel’s retaliation on Saturday. Israel avoided hitting nuclear and oil facilities and focused on military facilities in its response to Iran’s recent air strike. The geopolitical risk in the Middle East perceived by traders came off following Iran’s statement that only limited damage was caused. Brent is now trading at $72.60. €-zone equity futures are pointing to a strong opening of nearly 0.5% while US futures are even firmer in overnight trading.

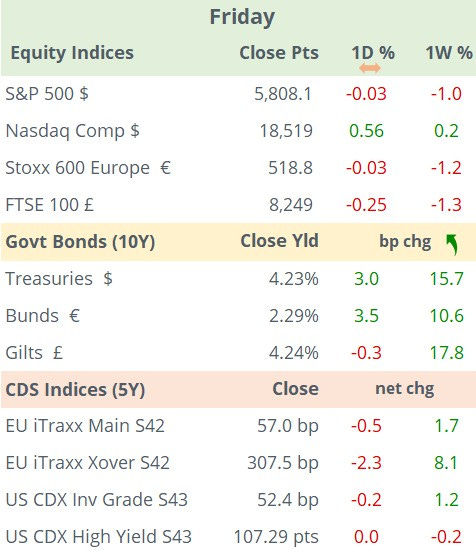

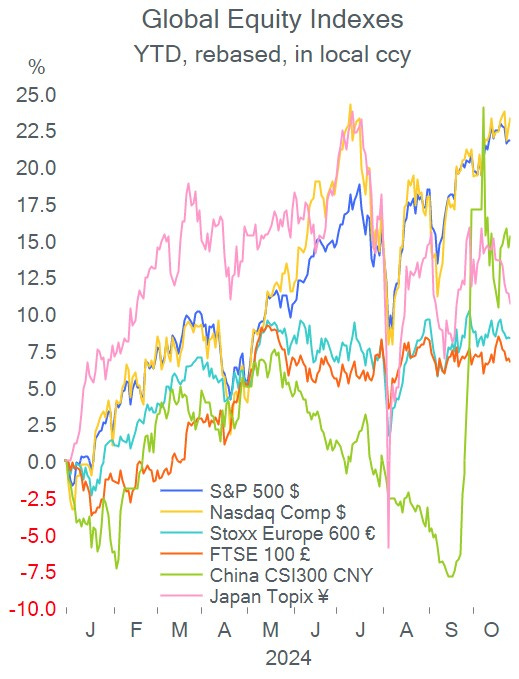

Last week’s highlights in global markets include a steep bond sell-off, Nasdaq indices reaching a fresh record high, Nvidia (mcap $3.47tn) briefly becoming the world’s largest co and European corporate earnings disappointing.

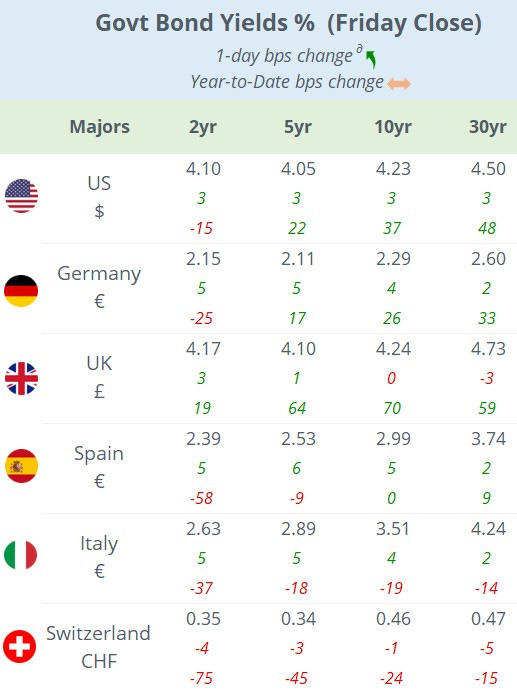

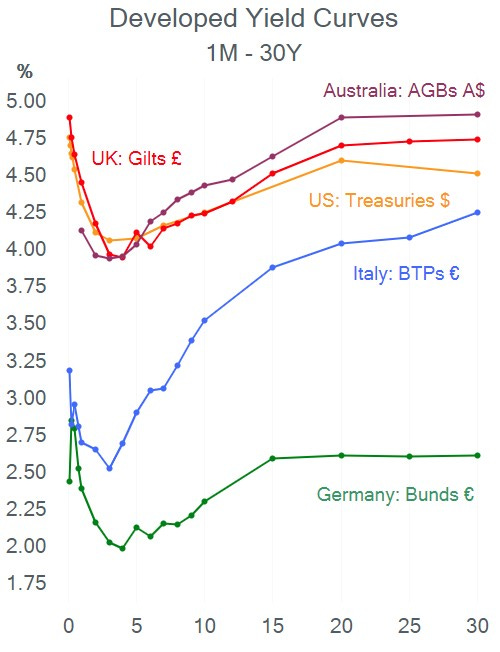

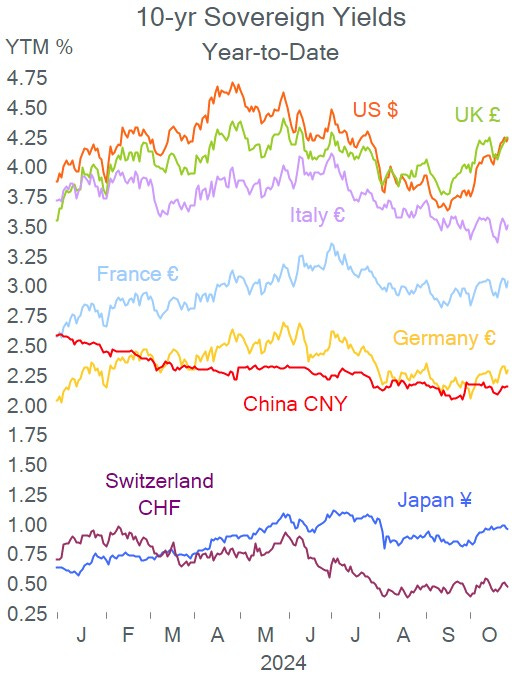

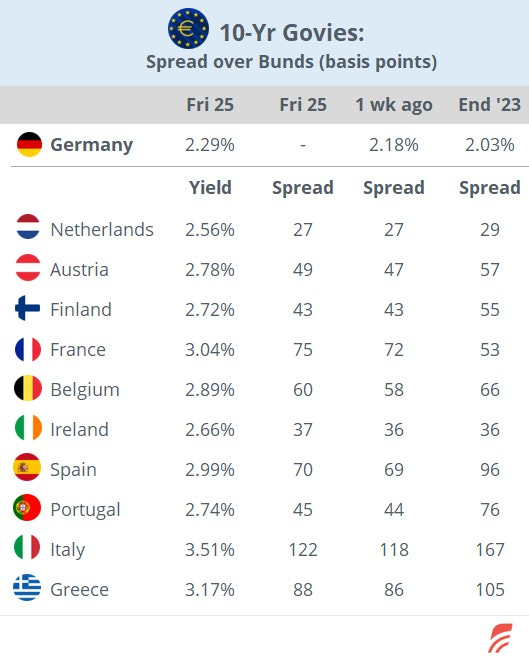

Bond prices have fallen for seven straight weeks with yields on 10-yr UST adding 16bp last week to 4.23% on Friday and are moving higher this morning, hitting a 3-month high. Bund yields also added 10bp to 2.29% while Gilts added 18bp to 4.24%. Traders have become less dovish in recent weeks following the latest data.

US stock indices finished in red last week with the price-weighted Dow Jones Industrials index losing nearly 3% on the back of falls in IBM, McDonald’s and Travelers. The S&P 500 ended 1% lower while Nasdaq indices finished flat on the week. In Europe, all country benchmarks fell ~1% WTD.

The Auto & Parts sector in the €-zone continues to struggle with Chinese competition at home and China’s demand for its vehicles. Autos are this year’s worst sector with a 10% decline after Mercedes Benz, Porsche and Valeo (-9.5% on Fri) reported weak results or provided poor outlooks (for sales and margins).

In IPOs, US clinical-stage biotech Septerna Inc (SEPN) raised $290mn on Nasdaq at a $970mn valuation and was priced at $18. It rallied 19% on its debut.

In credit ratings, Italy’s Monte dei Paschi di Siena bank (mcap €6.4bn) was u/g one notch by Fitch to BB+.

Today’s economic data will bring Spain’s retail sales. In monetary policy this week, the Bank of Japan meets on Thursday (unch at 0.25% exp).

On the earnings front, Philips NV, Ford and Waste Mgt will announce today but it gets busy later in the week with US mega-caps Apple, Microsoft, Alphabet, Amazon and Meta reporting.

It’s a holiday in New Zealand, Greece, the Czech Rep and an early close for markets in Turkey.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.