Podcast script: Estimated reading time ⏲ ~4 mins

Good morning,

Today is a Bank Holiday in the UK and Memorial Day in the US. Markets are expected to remain calm with both countries on holiday.

-On the geopolitical front, the International Court of Justice, the United Nation’s top court, issued a dramatic ruling on Saturday, ordering Israel to immediately halt its military offensive in Rafah in southern Gaza. The ruling also requested Tel Aviv to allow basic services and humanitarian aid for Palestinians. Yesterday, Hamas launched a big rocket attack at the capital of Israel which was intercepted by Israel's air defence system as sirens sounded in Tel Aviv for the first time in four months. Last night, Netanyahu responded with an airstrike in Rafah ignoring the UN’s ruling, further escalating tensions.

-Macron became the first French president to visit Germany since the year 2000 ahead of next week’s EU parliament in most member countries, where the right is expected to gain more control.

A quick review of global markets last week. European stocks finished mostly lower with the Stoxx 600 down by 0.5% with the Utilities sector being the key loser. Italy’s benchmark was the underperformer with a 2.6% drop, mostly on Enel, Eni and Intesa’s weaknesses.

US indices ended mixed, with a 2.3% decline for the Dow Jones Industrials and a 1.4% gain for the Nasdaq 100 while the S&P 500 finished flat. The main Dow losers were Home Depot, McDonald’s, Boeing and Johnson & Johnson, all losing more than 5% on the week.

Sovereign bond yields ended several basis points higher, mostly on hawkish remarks by Fed officials with US Treasuries closing at 4.47%, Bunds at 2.58% and Gilts at 4.26%.

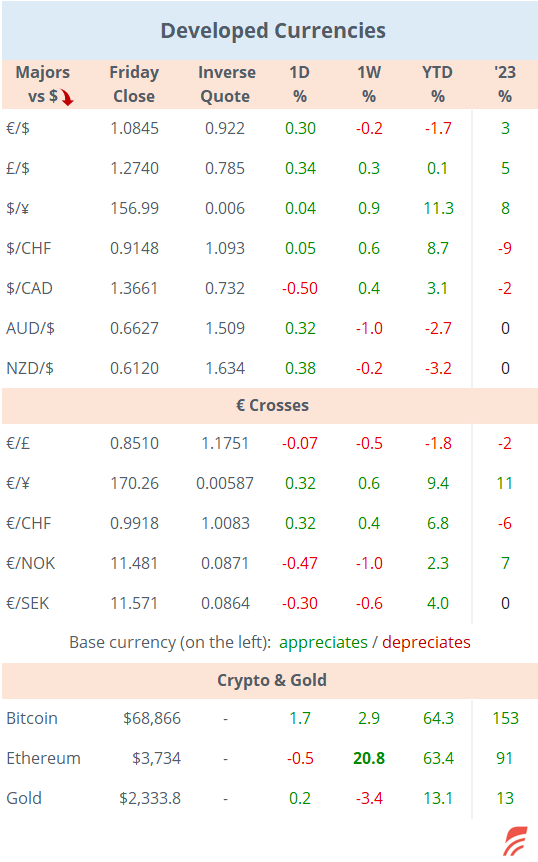

In FX, the dollar was little changed and the yen fell nearly 1% to 157, and accumulated an 11% drop YTD, the worst performer among developed currencies, on renewed speculation of a central bank intervention.

Brent and WTI oil dropped 2% last week on higher inventories and prospects of an interest rate cut delay. OPEC+ will hold a virtual meeting next Sunday.

Asian markets are trading a touch firmer today with Taiwan as the outperformer with equities up by more than 1%. Eurostoxx and Dax futures are marginally weaker on light volumes while the FTSE is closed.

The latest in corporate deals includes KKR getting closer to gaining approval to finally acquire Telecom Italia’s fixed-line network business for €22bn, which would become the first large European operator to divest its landline unit. The deal was first announced more than a year ago.

Also, Britain’s oilfield services company John Wood Group (mcap £1.33bn), has rejected a third takeover proposal from Sidara of Dubai for GBp220, 16% above Wood’s closing price on Friday.

In credit ratings, Moody's raised Saudi Arabia's domestic and foreign rating by one notch to Aa1 on Friday.

In economics this week, we’ll get Germany’s Ifo indicators today, Ireland’s retail sales and Germany’s wholesale prices tomorrow. On Wednesday, Germany’s inflation. US GDP on Thursday and Friday will be the most active on the data front with US PCE inflation, €-zone inflation, German retail sales and GDP updates in France, Italy, Portugal and Canada.

In monetary policy, only South Africa’s Reserve Bank meets on Thursday.

That’s all for today, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Please share using the button below, as access is free to all.