Morning,

During the weekend, Trump nominated Wall Street financier, Scott Bessent, as US Treasury Secretary, a move welcomed by markets. Bessent supports an extension of tax cuts, the implementation of trade tariffs and deregulation.

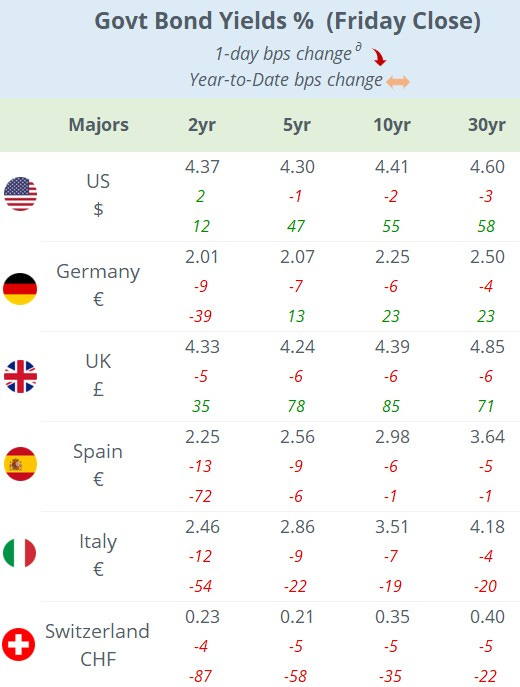

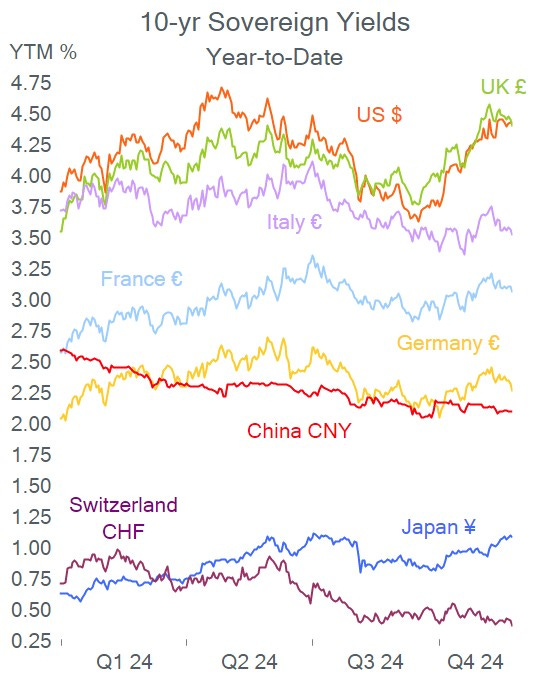

Equity futures in the US and Europe are gaining between 0.5% - 1% in overnight trading, Asian stocks are mostly firmer except for China which is 0.5% weaker. US bond futures are rallying as 10-yr Treasury yields ease following a two-month sell-off and drop to 4.35%.

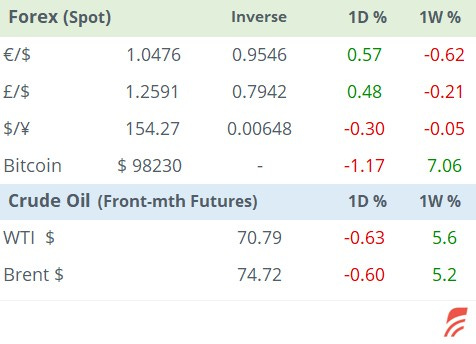

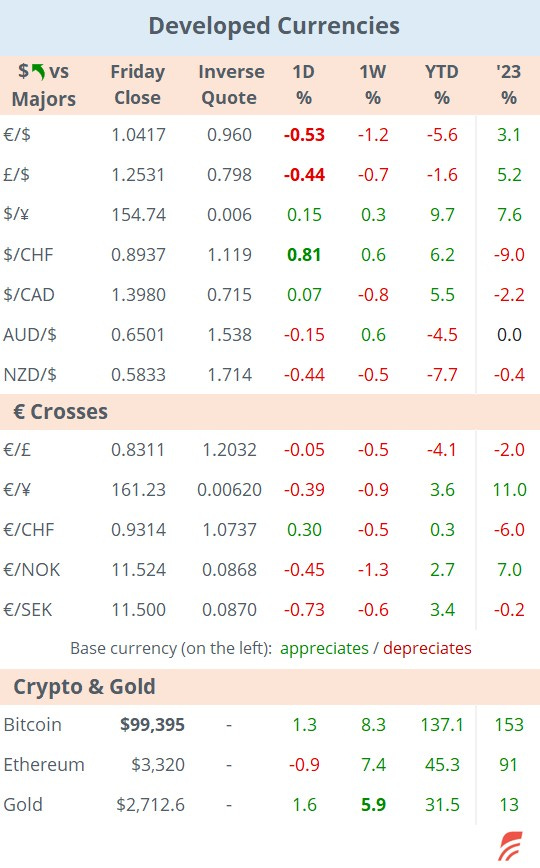

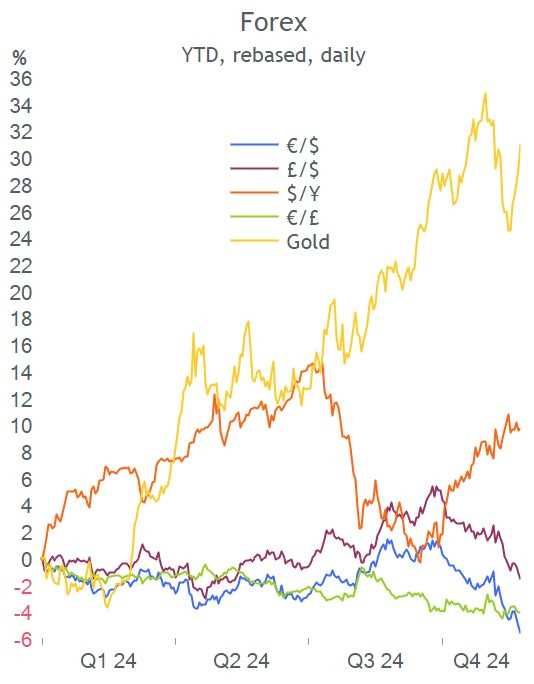

The $ index is partially reversing the strong gains on Friday and dropped <107 pts this morning. The € traded as low as 1.033 on Friday, its weakest level in two years and has depreciated 5% in 2024. Gold is losing 1.5% today to $2,672.

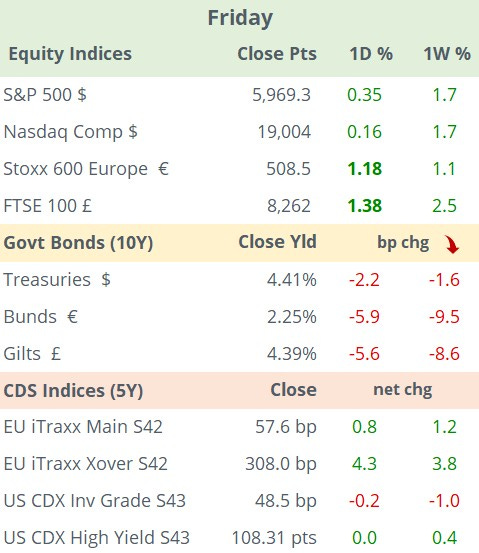

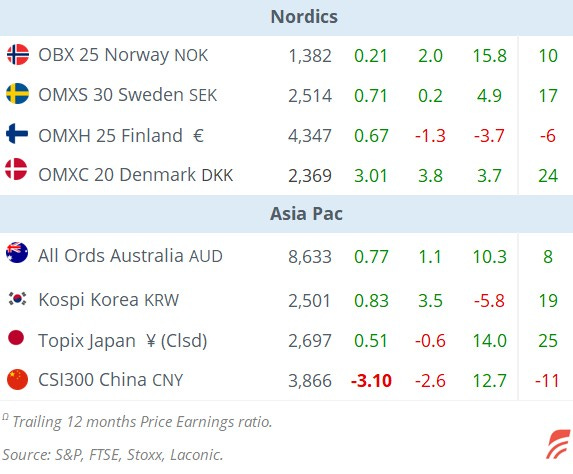

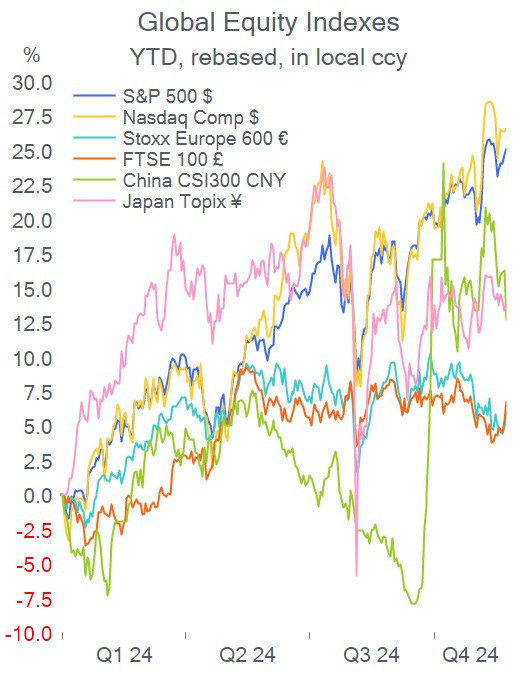

On a week-to-date basis, Europe’s Stoxx 600 gained ~1%, the FTSE 100 advanced 2.5% and outperformed its continental counterparts while US benchmarks ended ~2% higher. The US stock market continues to significantly outperform all other indices globally by a wide margin.

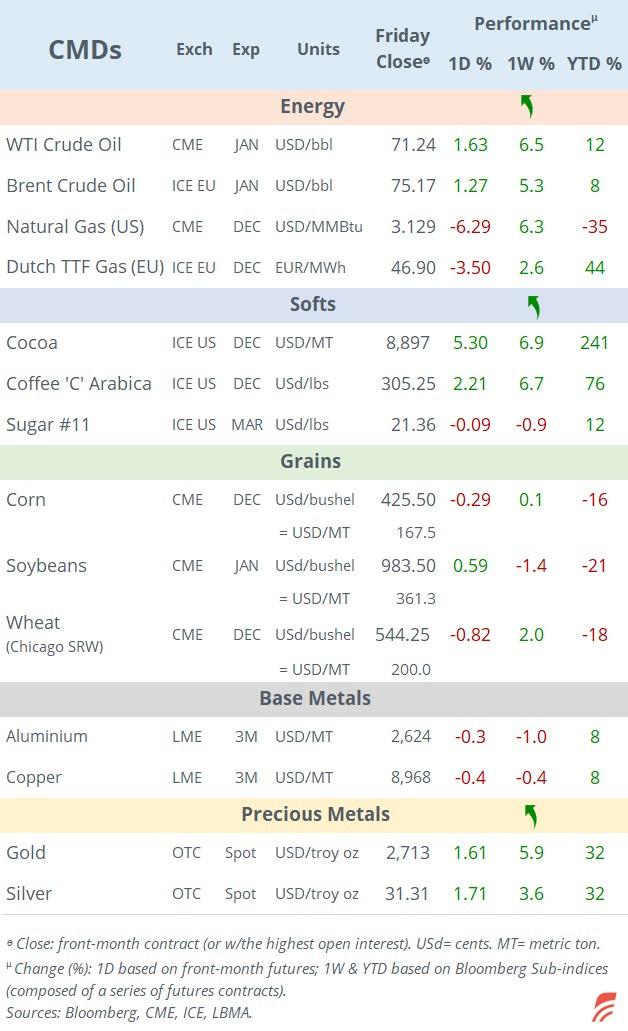

Commodities were a notable mover last week with the Bloomberg BCOM index rallying 3%, its best week since mid-2023, on strong gains for oil (+5%), natural gas (+6%), soft agricultural (+7%) and gold (+6%).

Preliminary PMI data on Friday showed the €-zone’s business activity took a surprisingly sharp downturn in November (Composite PMI 48.1 pts), reflecting contractions in the services industry and the manufacturing sector which sank deeper into recession. The UK also showed weaker PMIs as well as a decelerating retail sales update. On the contrary, US PMI data reflect a positive picture, particularly strong growth in the services sector (57 pts).

In politics, the result of yesterday’s first-round election in Romania shows a surprise lead for far-right, pro-Russia and ultranationalist candidate Calin Georgescu followed by his pro-Europe rival Marcel Ciolacu. In Uruguay, the left-wing opposition candidate, Yamandu Orsi, won the presidential run-off election, will take office in March and anticipated no major policy shifts.

In equity capital markets, the controlling shareholders of Swiss personal care co Galderma Group AG (mcap $23bn) sold shares worth $1.4bn representing ~7% of the total outstanding. Galderma has rallied 65% since its listing last March.

Credit rating changes last Friday: Burberry Plc was d/g to Baa3; Nykredit Bank A/S (Denmark) was u/g to A+; Cyprus was u/g two notches to A3 and Saudi Arabia was u/g to Aa3.

Today will be light on the data front with German Ifo indicators but it gets busier from Wednesday with inflation updates in the US (PCE), the €-zone and Japan.

The Central Bank of Israel meets today with policy rates expected to remain steady at 4.5%.

It will be a short trading week due to Thanksgiving in the US with markets closed on Thursday and partially closed on Friday, which is also ‘Black Friday’ for retailers. Also on Friday, Ireland holds a general election.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.