Morning,

It’s a negative start to the week as most Asian markets are falling today with Taiwan and Hong Kong stocks down by more than 1%. Tokyo is the only market in green after the Bank of Japan's last meeting minutes showed discussions about intervention and rate hikes to support the ¥. Today, stocks are trading firmer (+0.8%) and the ¥ is weakening towards 160 again.

European and US equity futures are also pointing to a weaker open with the Eurostoxx 50 and FTSE lower by 0.3%. Bund futures are a touch firmer and Brent oil is unchanged at $85.20 while Bitcoin is down 2% at $62,700.

Friday was a poor day for European markets with leading stocks dropping 0.7% on average and several country benchmarks ending lower by more than 1%. The catalyst was weaker than expected PMIs and softer than a month ago in the UK (51.7 pts), Germany (50.6) and France (48.2). As a whole, €-zone business growth slowed sharply in June with the manufacturing sector worsening (45.6). In other economic data, British retail sales rebounded in May (+2.9% MoM, +1.3% YoY) following the poor reading in April (-1.8% MoM) due to weather conditions.

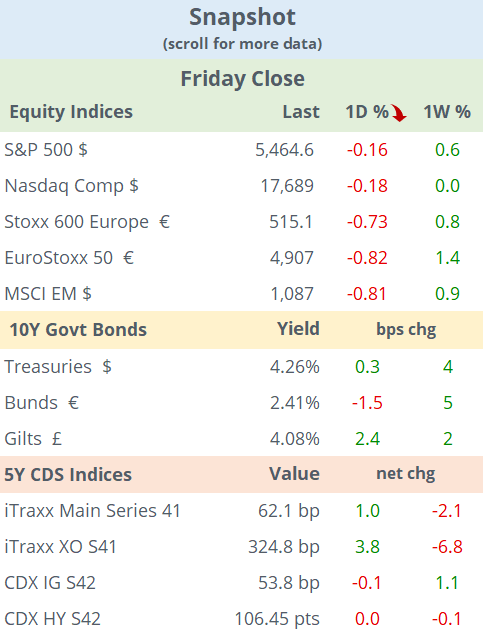

Equities still managed to finish higher for the week on both sides of the Atlantic with the S&P 500 advancing 0.6% and the Eurostoxx 50 gaining 1.4% WTD. US stocks continue to outperform their European counterparts this year with the Nasdaq 100 index up by 17% YTD.

In forex, the ¥ was the notable loser last week, depreciating 1.5% against the $ and €. The Japanese currency is lower by 13% YTD against the $, the weakest among major pairs.

It was a quiet week for bond markets as benchmark yields added around 4-5bp with 10-year Treasury yields closing at 4.26%, Bunds at 2.41% and Gilts at 4.08%. French OATs remain at 76bp over Bunds for a 3.16% yield, a basis point above Portugal’s PGBs.

Headlines:

-In French politics, Macron’s gamble on calling for snap legislative elections may backfire according to polls that show a lead for Le Pen’s far-right RN party one week ahead of the election. The RN party and its allies lead with 35% of voting intentions followed by the newly formed large left alliance with 27% and Macron’s centrist Ensemble party barely reaches 20%.

-Israel intensified its air strikes in Gaza City this weekend killing dozens while Netanyahu said that the current "intense phase" of fighting in Rafah is nearly over but that the battle to eliminate Hamas continues.

This week’s key economic release will be PCE inflation and GDP figures in the US on Thursday and Friday. Also, the first US presidential debate takes place on Thursday and at least five Fed officials will speak at conferences during the week.

We’ll also get French, Italian and Spanish preliminary inflation for June. Sweden’s Riksbank meets on Wednesday and announces its policy decision on Thursday with markets anticipating rates to remain at 3.75%.

Today will be light with Germany releasing Ifo indicators. On Sunday, France holds the first round of parliamentary elections.

That’s all for today, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.